Stock Analysis

- South Korea

- /

- Communications

- /

- KOSDAQ:A178320

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to reach new highs, with the Dow Jones Industrial Average and S&P 500 Index hitting record intraday levels, small-cap stocks like those in the Russell 2000 Index are also capturing attention by joining their peers in record territory. This positive momentum, alongside geopolitical developments and economic indicators such as robust consumer spending despite a manufacturing slump, sets an intriguing backdrop for evaluating high-growth tech stocks. In this environment, a good stock is often characterized by its ability to leverage technological innovation and adapt to changing market dynamics while maintaining strong financial health.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

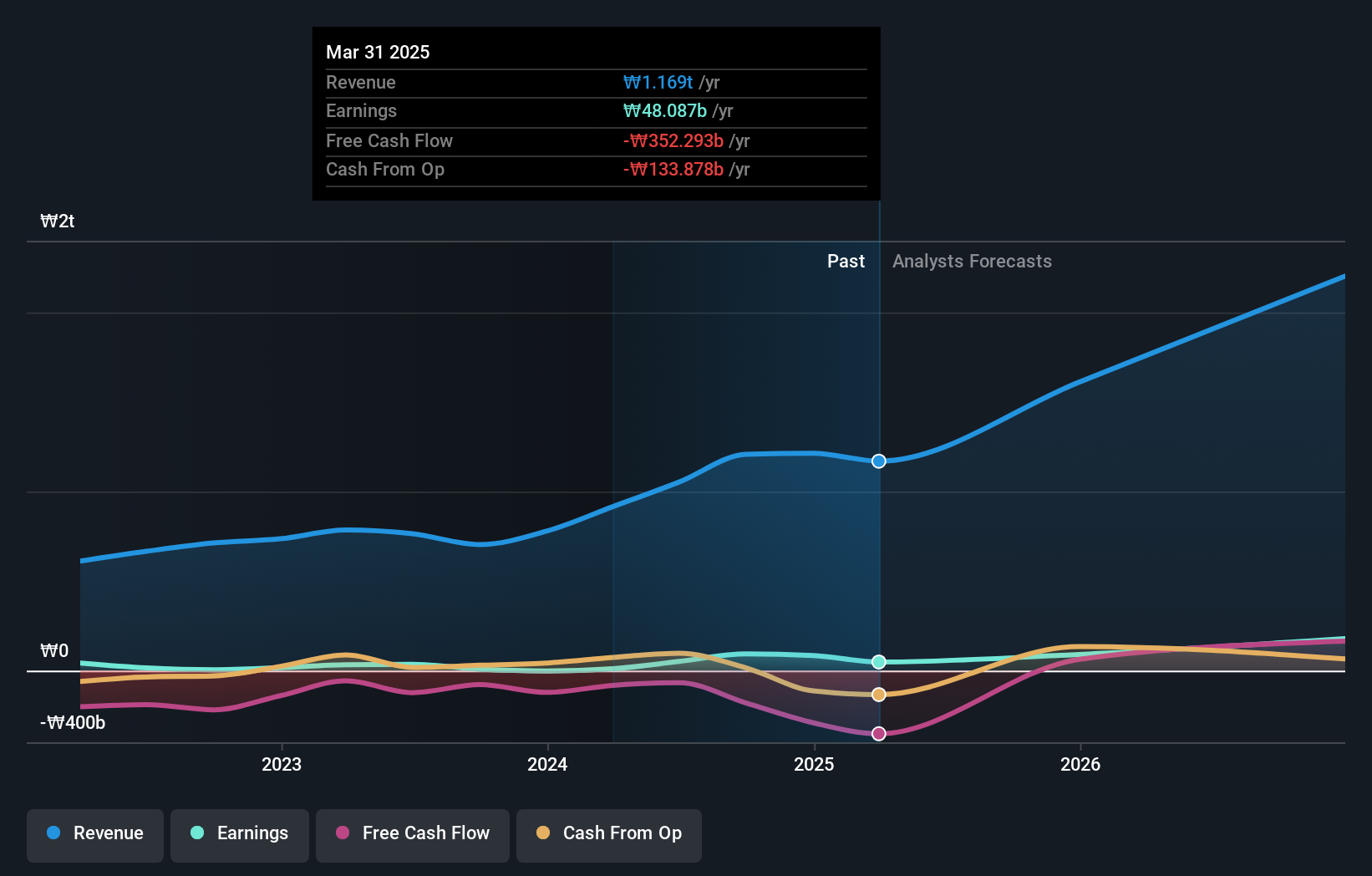

Overview: Seojin System Co., Ltd is engaged in the production of telecom equipment, repeaters, mechanical products, and LED and other equipment with a market capitalization of ₩1.45 trillion.

Operations: Seojin System Co., Ltd generates revenue primarily from its EMS Sector, contributing ₩1.79 trillion, and the Semiconductor Sector, adding ₩187.83 billion. The company's operations focus on producing telecom equipment and related products.

Seojin SystemLtd, amid a dynamic tech landscape, is poised with a robust growth trajectory, evidenced by its staggering 1063% earnings increase over the past year and an anticipated annual profit surge of 39.9%. This performance starkly outpaces the broader Communications industry's decline of 15.1%. Despite challenges in debt coverage by operating cash flow, Seojin's commitment to innovation is clear from its R&D investments, crucial for sustaining its competitive edge in technology development. With revenue expected to climb at 35.4% annually—surpassing the market average—Seojin is strategically positioned to leverage sector advancements and expand its market footprint effectively.

- Click here and access our complete health analysis report to understand the dynamics of Seojin SystemLtd.

Examine Seojin SystemLtd's past performance report to understand how it has performed in the past.

Guangzhou Fangbang ElectronicsLtd (SHSE:688020)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Fangbang Electronics Co., Ltd focuses on the research, development, production, sale, and service of electronic materials in China with a market cap of CN¥3.02 billion.

Operations: Guangzhou Fangbang Electronics Co., Ltd generates revenue primarily through the sale of electronic materials, leveraging its research and development capabilities. The company operates within China, focusing on production and service offerings to support its product sales.

Guangzhou Fangbang Electronics is navigating a challenging tech landscape, yet shows potential with projected revenue growth at 60.9% annually, significantly outpacing the CN market's 13.9%. Despite recent setbacks including a net loss reduction to CNY 39.63 million from CNY 52.46 million year-over-year, the company's focus on R&D could catalyze future profitability, with earnings expected to surge by an impressive 237.8%. This investment in innovation might be pivotal as it transitions towards profitability in the coming years, reflecting a proactive approach amidst industry volatility.

PCL Technologies (TWSE:4977)

Simply Wall St Growth Rating: ★★★★★☆

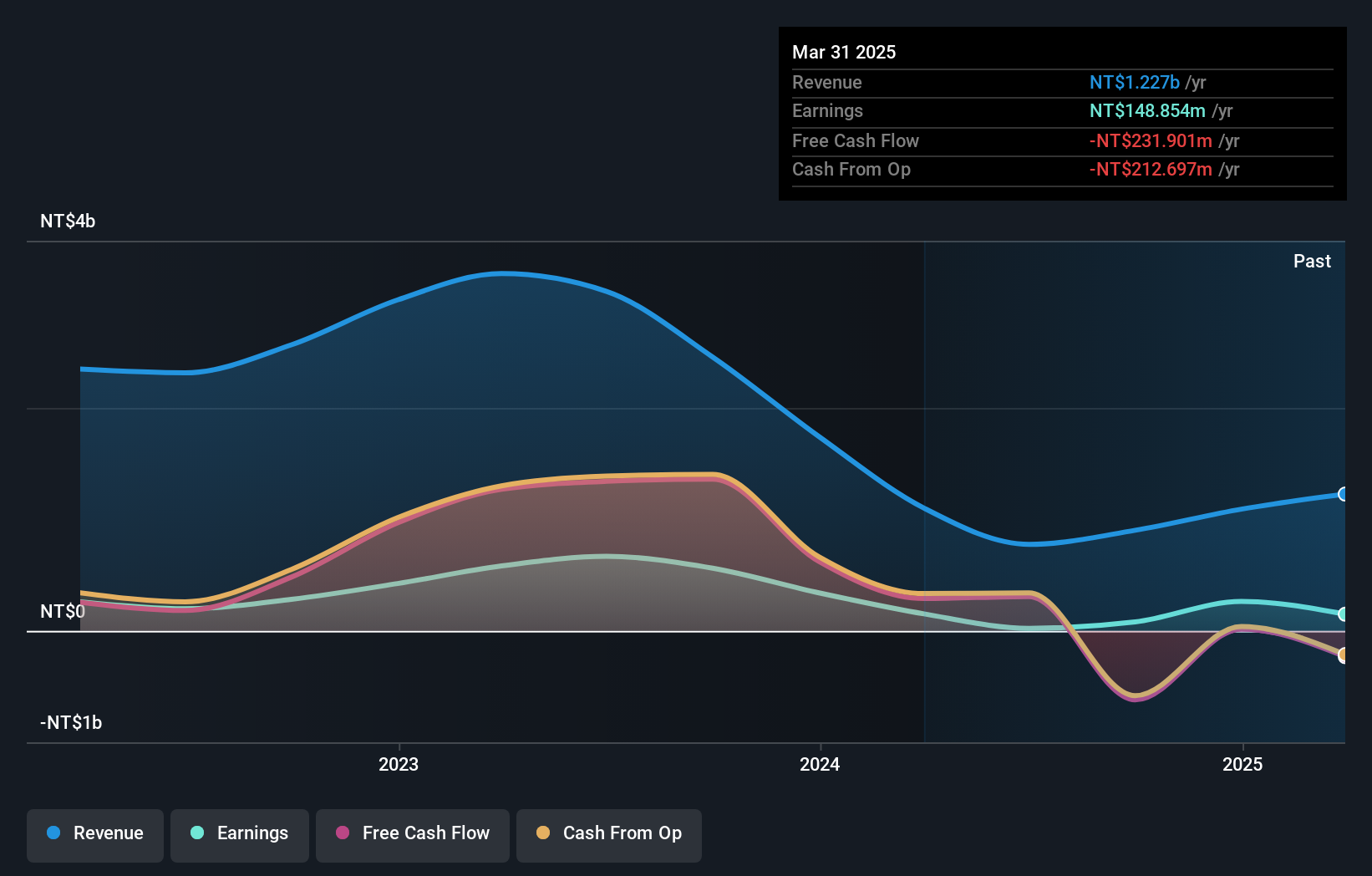

Overview: PCL Technologies, Inc. and its subsidiaries focus on the research, manufacturing, and sale of optical transceiver products both in Taiwan and internationally, with a market cap of NT$10.38 billion.

Operations: The company generates revenue primarily from the research, development, production, and sales of light mine devices, amounting to NT$902.33 million. With a market cap of NT$10.38 billion, it operates in Taiwan and internationally within the optical transceiver sector.

PCL Technologies has demonstrated a robust growth trajectory, with recent earnings showing a significant uptick: Q3 sales surged to TWD 357.64 million from TWD 231.02 million year-over-year, and net income rose to TWD 89.18 million from TWD 32.4 million in the same period. This performance is underscored by an aggressive R&D investment strategy, aligning with industry trends where tech firms increasingly prioritize innovation to drive growth. The company's commitment is evident as it outpaces general market trends, projecting annual revenue and earnings growth rates of 47.1% and 90.5%, respectively—far exceeding the broader Taiwanese market's averages.

- Click here to discover the nuances of PCL Technologies with our detailed analytical health report.

Gain insights into PCL Technologies' past trends and performance with our Past report.

Where To Now?

- Click here to access our complete index of 1284 High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A178320

Seojin SystemLtd

Provides telecom equipment, repeaters, mechanical products, and LED and other equipment.