- South Korea

- /

- Communications

- /

- KOSDAQ:A178320

Even though Seojin SystemLtd (KOSDAQ:178320) has lost ₩138b market cap in last 7 days, shareholders are still up 41% over 3 years

Low-cost index funds make it easy to achieve average market returns. But across the board there are plenty of stocks that underperform the market. That's what has happened with the Seojin System Co.,Ltd (KOSDAQ:178320) share price. It's up 41% over three years, but that is below the market return. Unfortunately, the share price has fallen 22% over twelve months.

In light of the stock dropping 9.8% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

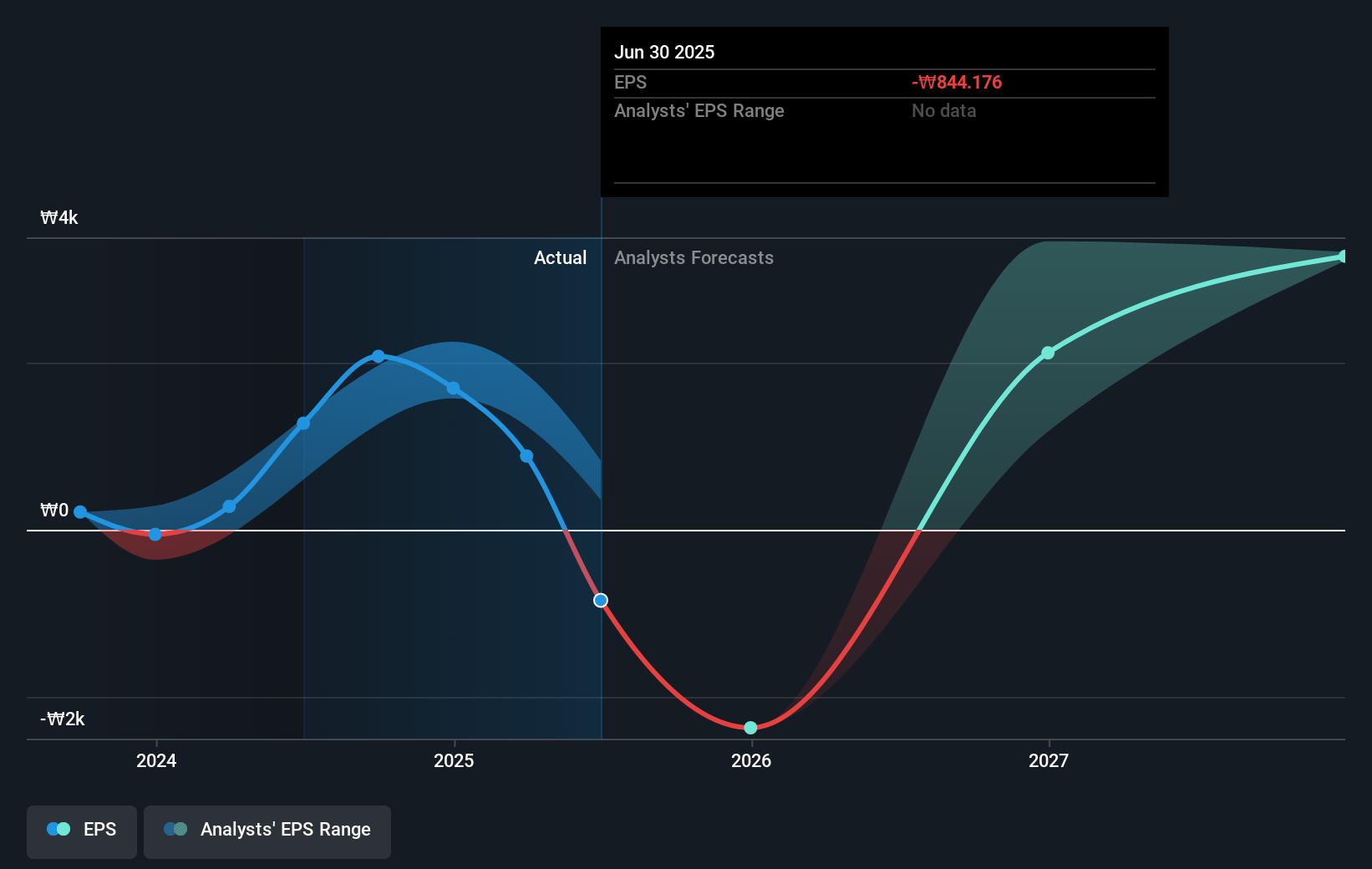

Seojin SystemLtd was able to grow its EPS at 16% per year over three years, sending the share price higher. This EPS growth is higher than the 12% average annual increase in the share price. So one could reasonably conclude that the market has cooled on the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Seojin SystemLtd's key metrics by checking this interactive graph of Seojin SystemLtd's earnings, revenue and cash flow.

A Different Perspective

Investors in Seojin SystemLtd had a tough year, with a total loss of 22%, against a market gain of about 65%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Seojin SystemLtd you should know about.

Of course Seojin SystemLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A178320

Seojin SystemLtd

Provides telecom equipment, repeaters, mechanical products, and LED and other equipment.

Undervalued with high growth potential.

Market Insights

Community Narratives