- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A148150

Se Gyung Hi Tech Co., Ltd. (KOSDAQ:148150) Held Back By Insufficient Growth Even After Shares Climb 33%

Se Gyung Hi Tech Co., Ltd. (KOSDAQ:148150) shares have had a really impressive month, gaining 33% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.8% over the last year.

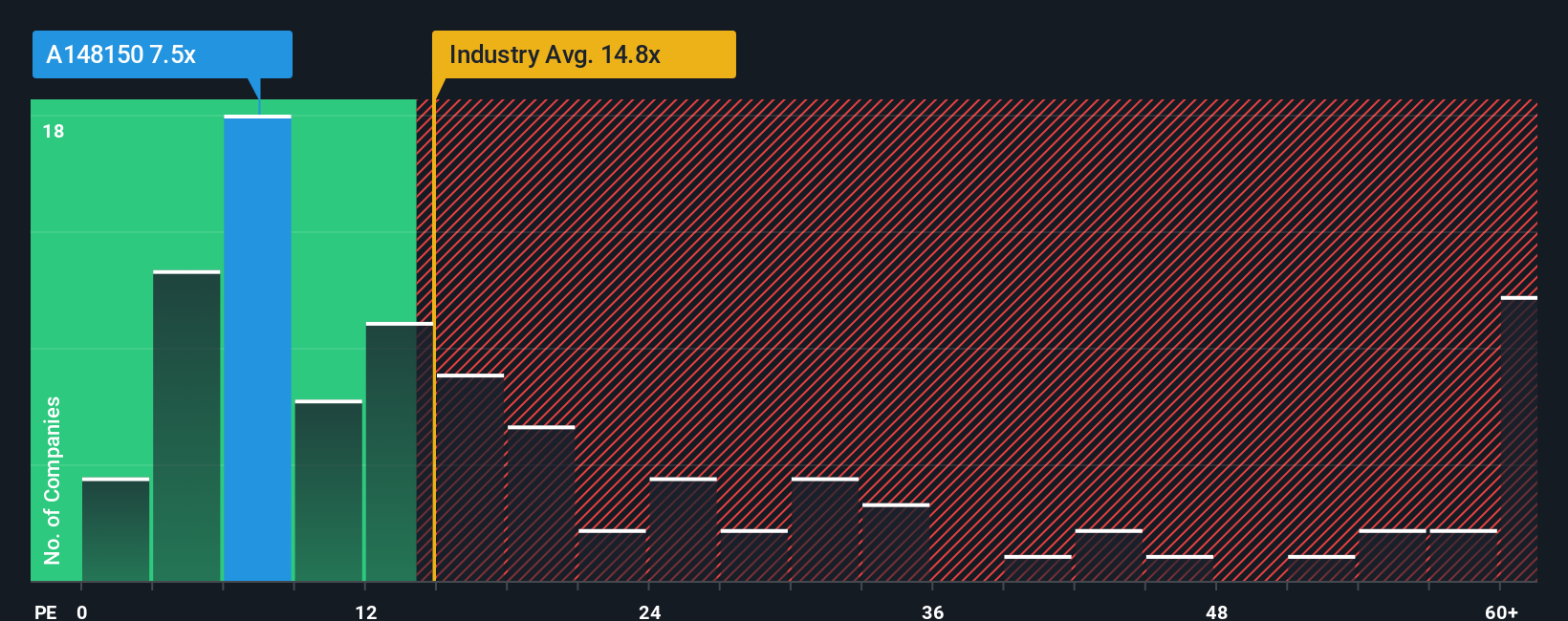

Although its price has surged higher, Se Gyung Hi Tech may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.5x, since almost half of all companies in Korea have P/E ratios greater than 14x and even P/E's higher than 29x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

There hasn't been much to differentiate Se Gyung Hi Tech's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Check out our latest analysis for Se Gyung Hi Tech

Is There Any Growth For Se Gyung Hi Tech?

There's an inherent assumption that a company should underperform the market for P/E ratios like Se Gyung Hi Tech's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Although pleasingly EPS has lifted 67% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 1.8% per year over the next three years. With the market predicted to deliver 18% growth each year, the company is positioned for a weaker earnings result.

With this information, we can see why Se Gyung Hi Tech is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The latest share price surge wasn't enough to lift Se Gyung Hi Tech's P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Se Gyung Hi Tech maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Se Gyung Hi Tech has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A148150

Se Gyung Hi Tech

Engages in the manufacture and sale of electronic equipment parts.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026