- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A148150

After Leaping 33% Se Gyung Hi Tech Co., Ltd. (KOSDAQ:148150) Shares Are Not Flying Under The Radar

Despite an already strong run, Se Gyung Hi Tech Co., Ltd. (KOSDAQ:148150) shares have been powering on, with a gain of 33% in the last thirty days. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

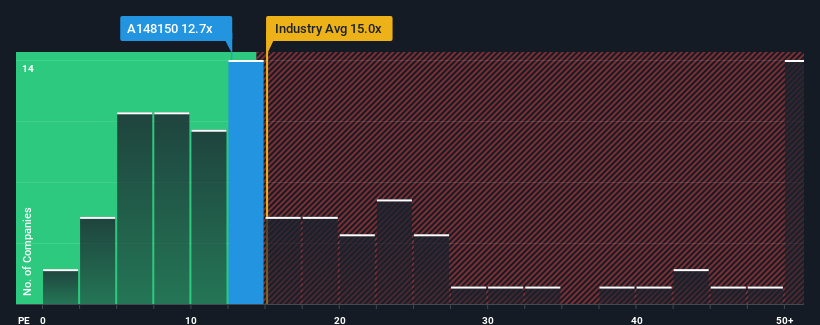

Although its price has surged higher, you could still be forgiven for feeling indifferent about Se Gyung Hi Tech's P/E ratio of 12.7x, since the median price-to-earnings (or "P/E") ratio in Korea is also close to 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Se Gyung Hi Tech certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Se Gyung Hi Tech

Is There Some Growth For Se Gyung Hi Tech?

Se Gyung Hi Tech's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 112%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 19% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 19% per annum, which is not materially different.

With this information, we can see why Se Gyung Hi Tech is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Se Gyung Hi Tech's P/E

Se Gyung Hi Tech's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Se Gyung Hi Tech's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Se Gyung Hi Tech, and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A148150

Se Gyung Hi Tech

Engages in the manufacture and sale of electronic equipment parts.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives