- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A092460

Does Hanla IMS (KOSDAQ:092460) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Hanla IMS Co., Ltd. (KOSDAQ:092460) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Hanla IMS

What Is Hanla IMS's Net Debt?

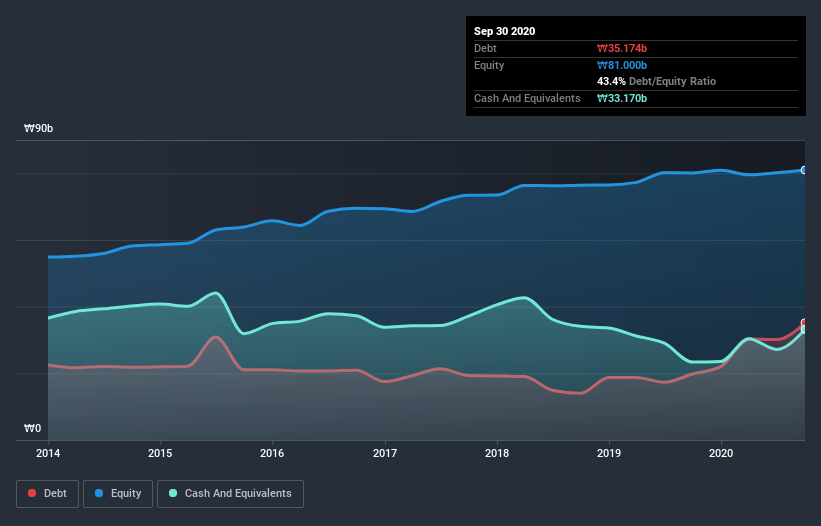

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Hanla IMS had ₩35.2b of debt, an increase on ₩19.8b, over one year. However, it also had ₩33.2b in cash, and so its net debt is ₩2.00b.

How Strong Is Hanla IMS's Balance Sheet?

The latest balance sheet data shows that Hanla IMS had liabilities of ₩43.2b due within a year, and liabilities of ₩5.54b falling due after that. Offsetting this, it had ₩33.2b in cash and ₩3.78b in receivables that were due within 12 months. So it has liabilities totalling ₩11.8b more than its cash and near-term receivables, combined.

Given Hanla IMS has a market capitalization of ₩69.5b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hanla IMS has net debt of just 0.73 times EBITDA, suggesting it could ramp leverage without breaking a sweat. But the really cool thing is that it actually managed to receive more interest than it paid, over the last year. So there's no doubt this company can take on debt while staying cool as a cucumber. Fortunately, Hanla IMS grew its EBIT by 3.4% in the last year, making that debt load look even more manageable. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Hanla IMS will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last two years, Hanla IMS burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Based on what we've seen Hanla IMS is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. When we consider all the factors mentioned above, we do feel a bit cautious about Hanla IMS's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Hanla IMS (of which 2 are a bit concerning!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Hanla IMS, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hanla IMS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A092460

Hanla IMS

Provides integrated systems in South Korea, Singapore, China, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives