- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A085670

NewFlex Technology Co., Ltd. (KOSDAQ:085670) Shares May Have Slumped 32% But Getting In Cheap Is Still Unlikely

The NewFlex Technology Co., Ltd. (KOSDAQ:085670) share price has softened a substantial 32% over the previous 30 days, handing back much of the gains the stock has made lately. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 11%.

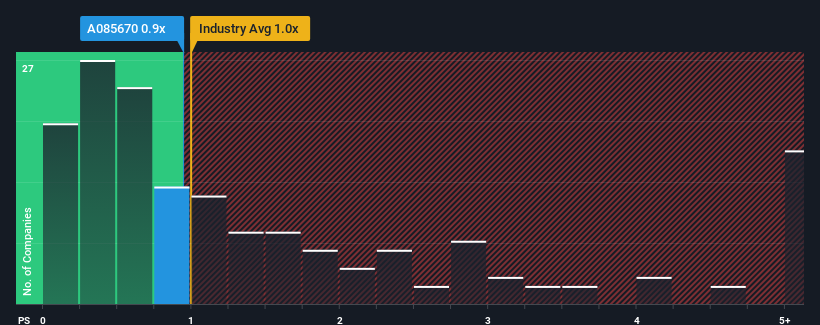

Although its price has dipped substantially, it's still not a stretch to say that NewFlex Technology's price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Electronic industry in Korea, where the median P/S ratio is around 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for NewFlex Technology

How NewFlex Technology Has Been Performing

While the industry has experienced revenue growth lately, NewFlex Technology's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think NewFlex Technology's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like NewFlex Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Still, the latest three year period has seen an excellent 50% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 4.5% during the coming year according to the sole analyst following the company. That's shaping up to be materially lower than the 13% growth forecast for the broader industry.

With this information, we find it interesting that NewFlex Technology is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does NewFlex Technology's P/S Mean For Investors?

Following NewFlex Technology's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that NewFlex Technology's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Having said that, be aware NewFlex Technology is showing 2 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if NewFlex Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A085670

NewFlex Technology

Engages in the manufacture and sale of flexible printed circuit boards products in South Korea.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives