- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A080420

How Much Did Moda-InnoChips'(KOSDAQ:080420) Shareholders Earn From Share Price Movements Over The Last Three Years?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Moda-InnoChips Co., Ltd. (KOSDAQ:080420) shareholders have had that experience, with the share price dropping 35% in three years, versus a market return of about 34%. Even worse, it's down 16% in about a month, which isn't fun at all.

View our latest analysis for Moda-InnoChips

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

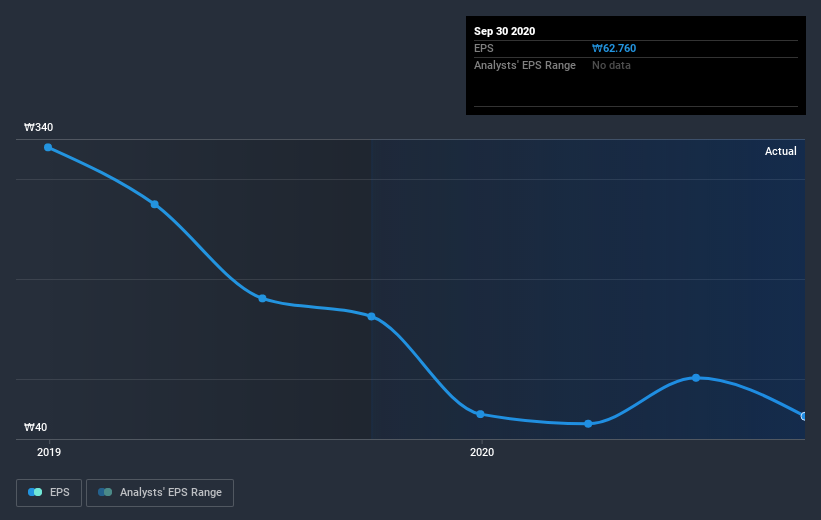

Moda-InnoChips saw its EPS decline at a compound rate of 55% per year, over the last three years. This fall in the EPS is worse than the 13% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. With a P/E ratio of 57.20, it's fair to say the market sees a brighter future for the business.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Moda-InnoChips' key metrics by checking this interactive graph of Moda-InnoChips's earnings, revenue and cash flow.

A Different Perspective

Moda-InnoChips shareholders are down 6.8% for the year, but the broader market is up 48%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Moda-InnoChips (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Moda-InnoChips, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A080420

Moda-InnoChips

Manufactures and sells ceramic-based core electronic components.

Slight risk with poor track record.

Market Insights

Community Narratives