- South Korea

- /

- Communications

- /

- KOSDAQ:A078890

Investors Don't See Light At End Of KAON Group Co., Ltd.'s (KOSDAQ:078890) Tunnel And Push Stock Down 27%

KAON Group Co., Ltd. (KOSDAQ:078890) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

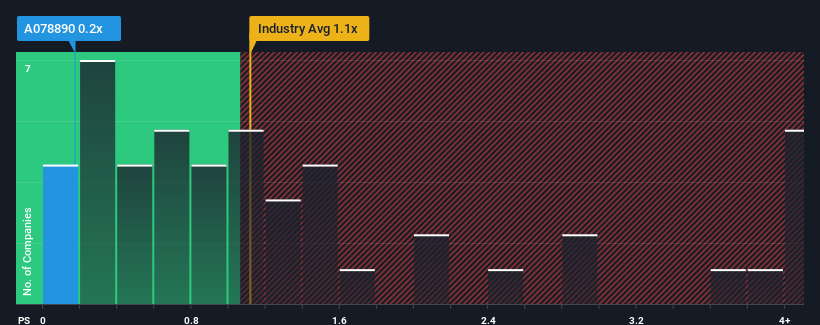

Since its price has dipped substantially, when close to half the companies operating in Korea's Communications industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider KAON Group as an enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for KAON Group

How Has KAON Group Performed Recently?

As an illustration, revenue has deteriorated at KAON Group over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on KAON Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for KAON Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is KAON Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as KAON Group's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. Regardless, revenue has managed to lift by a handy 11% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 36% shows it's noticeably less attractive.

In light of this, it's understandable that KAON Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Key Takeaway

The southerly movements of KAON Group's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

In line with expectations, KAON Group maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Before you settle on your opinion, we've discovered 4 warning signs for KAON Group (2 are a bit unpleasant!) that you should be aware of.

If you're unsure about the strength of KAON Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if KAON Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A078890

KAON Group

Manufactures, develops, and sells digital connectivity devices and services for Pay-TV and broadband industries worldwide.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives