- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A009470

South Korea's High Growth Tech Stocks To Watch

Reviewed by Simply Wall St

The South Korean market has seen a modest increase of 1.2% over the last week, although it remained flat over the past year, with earnings forecasted to grow by 29% annually. In this environment, identifying high-growth tech stocks that can capitalize on these favorable conditions is crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.66% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 49 stocks from our KRX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. develops and sells electronic materials across multiple regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.73 billion.

Operations: Daejoo Electronic Materials Co., Ltd. focuses on the development, production, and sale of electrical and electronic components, generating revenue of ₩206.32 billion from these activities. The company operates in various regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

Daejoo Electronic Materials, amidst a challenging market, has shown remarkable resilience and growth potential. Recently, the company reported a significant increase in net income to KRW 6,557.14 million from KRW 821.69 million year-over-year for Q2 2024, alongside an earnings surge per share from KRW 55 to KRW 443. This financial uplift is underpinned by an aggressive R&D strategy which aligns with its revenue growth forecast at an impressive rate of 42.2% annually—outpacing the broader South Korean market's average of just over 10%. Moreover, Daejoo's earnings are expected to grow by about 48.7% each year, indicating not only recovery but also a potential leadership stance in high-tech sectors within Korea. These figures reflect a strategic pivot towards innovative technologies and efficiency that could set new industry standards if sustained effectively.

Samwha ElectricLtd (KOSE:A009470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Samwha Electric Co., Ltd. operates in the electrolytic capacitor industry in South Korea and internationally, with a market cap of ₩363.10 billion.

Operations: Samwha Electric Co., Ltd. generates revenue primarily from the sale of electronic components and parts, amounting to ₩211.75 billion. The company operates both domestically in South Korea and internationally in the electrolytic capacitor industry.

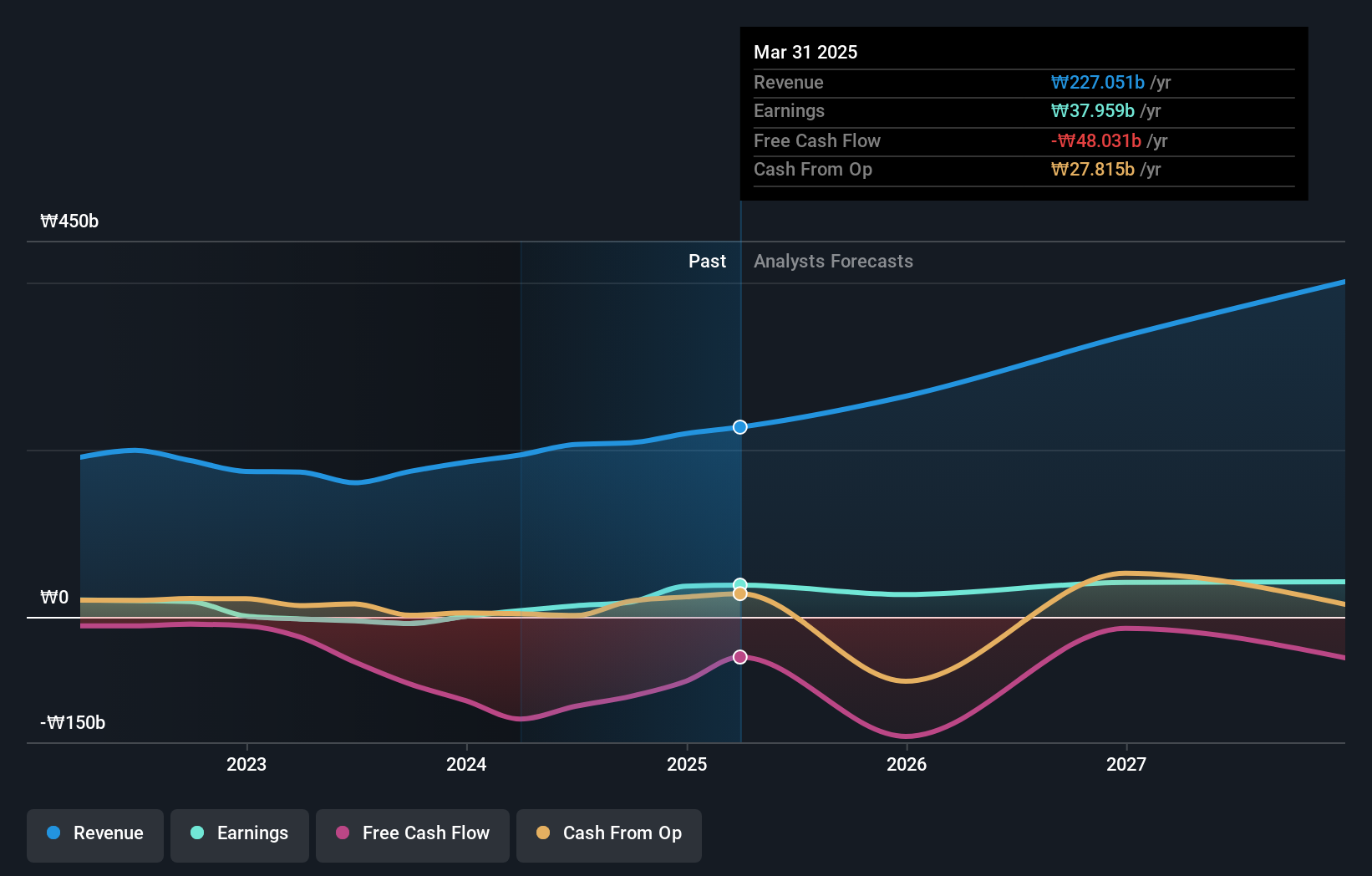

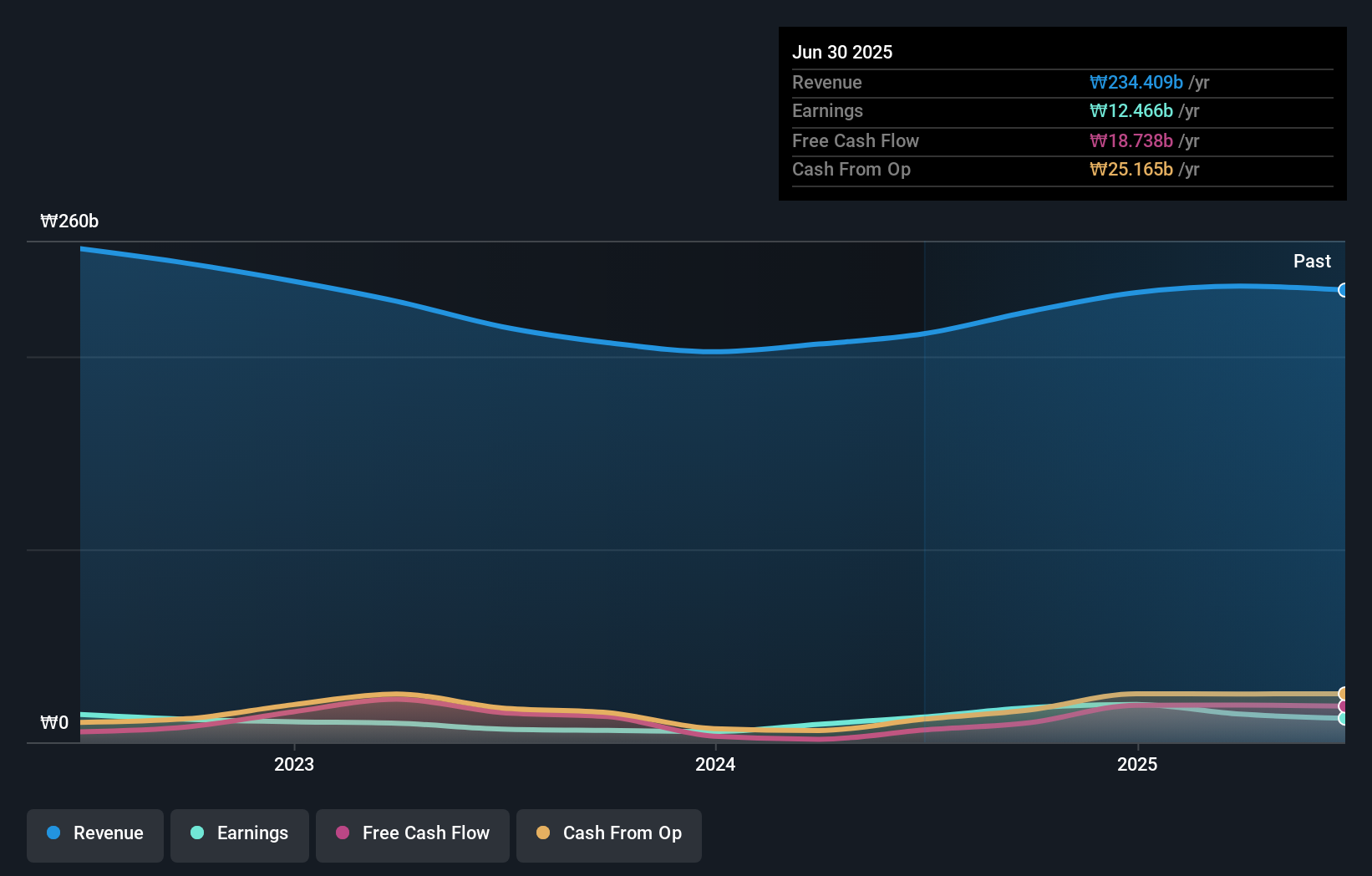

Samwha Electric Co.,Ltd. recently joined the S&P Global BMI Index, signaling a positive market acknowledgment as of September 23, 2024. This inclusion follows a robust financial performance in Q2 2024, where net income more than doubled to KRW 6.97 billion from KRW 3.23 billion year-over-year, alongside an earnings per share increase from KRW 488 to KRW 1,053. These results are underpinned by an aggressive R&D strategy with expenses aligning closely with revenue growth projections of 19.2% annually—slightly below the sector's top performers but still ahead of the broader South Korean market's average growth rate of about 10%. Moreover, Samwha's earnings are expected to surge by approximately 43.8% annually over the next three years, reflecting its potential to outperform in its sector and enhance shareholder value through strategic innovations and market expansion.

- Delve into the full analysis health report here for a deeper understanding of Samwha ElectricLtd.

Gain insights into Samwha ElectricLtd's past trends and performance with our Past report.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. engages in music production, publishing, and artist development and management businesses with a market cap of ₩7.08 trillion.

Operations: HYBE generates revenue primarily through music production, publishing, and artist management, with notable contributions from its Label (₩1.28 trillion) and Solution (₩1.24 trillion) segments. The company also leverages a Platform segment which adds ₩361.12 billion to its revenue stream.

HYBE has demonstrated a robust financial trajectory with its earnings growing by 21.6% over the past year, outpacing the Entertainment industry's average of 7.3%. This growth is anticipated to accelerate, with earnings expected to surge by 42.2% annually. Additionally, the company's commitment to innovation is evident from its strategic R&D investments which have been integral in supporting these projections. Recently, HYBE also completed a share repurchase program, buying back 150,000 shares for KRW 26.09 billion, underlining confidence in its financial health and future prospects. This move aligns with broader market strategies aimed at enhancing shareholder value and stabilizing stock prices within volatile markets.

- Unlock comprehensive insights into our analysis of HYBE stock in this health report.

Understand HYBE's track record by examining our Past report.

Key Takeaways

- Unlock our comprehensive list of 49 KRX High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009470

Samwha ElectricLtd

Operates in the electrolytic capacitor industry in South Korea and internationally.

Flawless balance sheet with high growth potential.