- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A076610

There Is A Reason Haesung Optics Co., Ltd.'s (KOSDAQ:076610) Price Is Undemanding

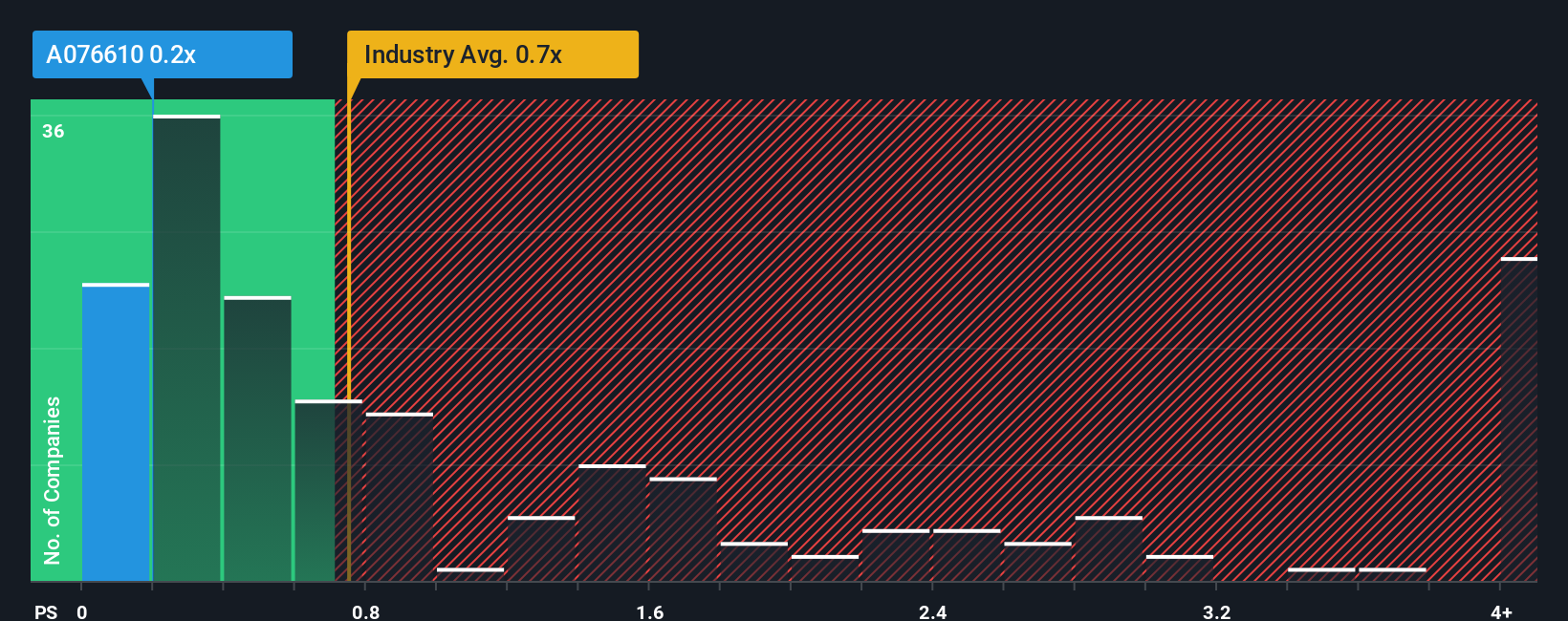

Haesung Optics Co., Ltd.'s (KOSDAQ:076610) price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Electronic industry in Korea, where around half of the companies have P/S ratios above 0.7x and even P/S above 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Haesung Optics

How Has Haesung Optics Performed Recently?

For instance, Haesung Optics' receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Haesung Optics, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Haesung Optics' Revenue Growth Trending?

Haesung Optics' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 8.7% decrease to the company's top line. As a result, revenue from three years ago have also fallen 25% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 19% shows it's an unpleasant look.

With this information, we are not surprised that Haesung Optics is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Haesung Optics' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Haesung Optics maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Haesung Optics (2 are concerning) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Haesung Optics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A076610

Haesung Optics

Produces and sells optical lens in South Korea, Vietnam, China, and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives