- South Korea

- /

- Communications

- /

- KOSDAQ:A073540

Did Business Growth Power FrtekLtd's (KOSDAQ:073540) Share Price Gain of 115%?

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Frtek Co.Ltd. (KOSDAQ:073540) share price has flown 115% in the last three years. That sort of return is as solid as granite. Meanwhile the share price is 4.9% higher than it was a week ago.

View our latest analysis for FrtekLtd

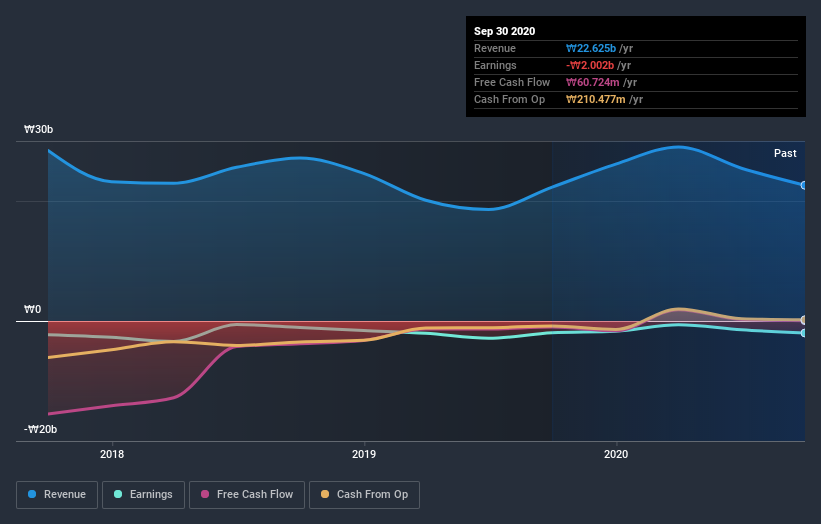

Given that FrtekLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

FrtekLtd actually saw its revenue drop by 1.2% per year over three years. So we wouldn't have expected the share price to gain 29% per year, but it has. It's fair to say shareholders are definitely counting on a bright future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

FrtekLtd provided a TSR of 26% over the last twelve months. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 14% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand FrtekLtd better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for FrtekLtd you should be aware of, and 1 of them doesn't sit too well with us.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade FrtekLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A073540

FrtekLtd

Provides mobile communication systems, LED lighting products, and information communication construction products in South Korea.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives