- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A032820

Did You Miss Woori Technology's (KOSDAQ:032820) 71% Share Price Gain?

It might be of some concern to shareholders to see the Woori Technology, Inc. (KOSDAQ:032820) share price down 11% in the last month. But over three years, the returns would have left most investors smiling In fact, the company's share price bested the return of its market index in that time, posting a gain of 71%.

View our latest analysis for Woori Technology

Given that Woori Technology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years Woori Technology has grown its revenue at 8.5% annually. That's a very respectable growth rate. The share price gain of 20% per year shows that the market is paying attention to this growth. Of course, valuation is quite sensitive to the rate of growth. Keep in mind that the strength of the balance sheet impacts the options open to the company.

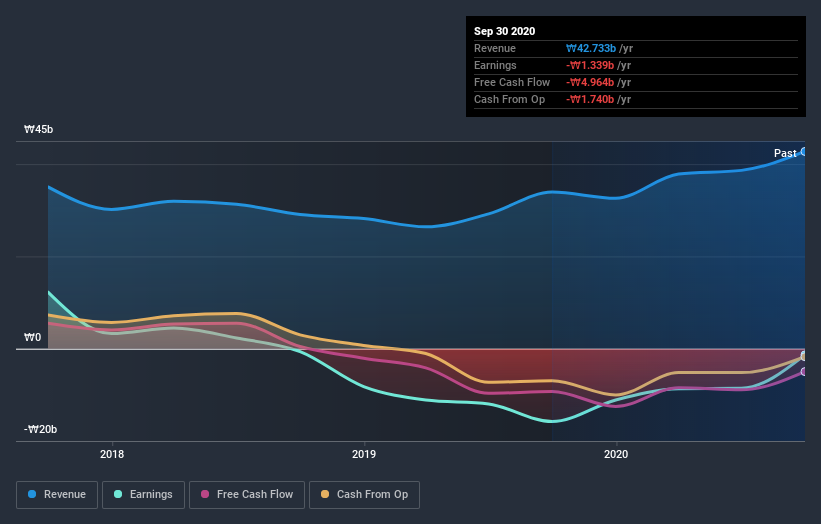

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Woori Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Woori Technology provided a TSR of 23% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 10% over half a decade This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Woori Technology better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Woori Technology you should be aware of, and 1 of them is a bit concerning.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Woori Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Woori Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A032820

Woori Technology

Manufactures and sells switchboard and electric control panels.

Proven track record with low risk.

Market Insights

Community Narratives