- South Korea

- /

- Software

- /

- KOSDAQ:A158430

Optimistic Investors Push ATON Inc. (KOSDAQ:158430) Shares Up 46% But Growth Is Lacking

ATON Inc. (KOSDAQ:158430) shares have continued their recent momentum with a 46% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 55% in the last year.

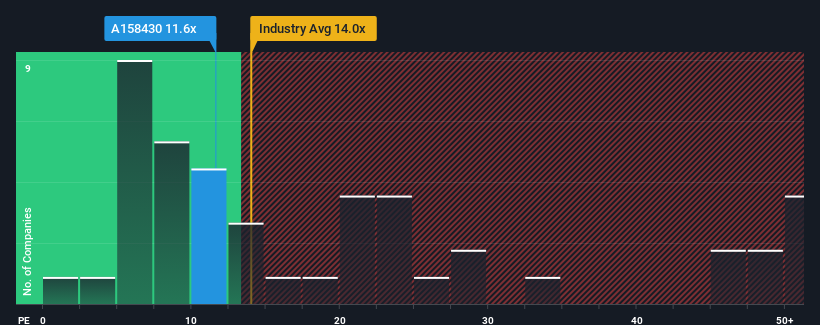

Although its price has surged higher, there still wouldn't be many who think ATON's price-to-earnings (or "P/E") ratio of 11.6x is worth a mention when the median P/E in Korea is similar at about 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, ATON's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for ATON

Is There Some Growth For ATON?

The only time you'd be comfortable seeing a P/E like ATON's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 36%. Still, the latest three year period has seen an excellent 247% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 3.1% per year over the next three years. That's shaping up to be materially lower than the 15% per annum growth forecast for the broader market.

With this information, we find it interesting that ATON is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On ATON's P/E

Its shares have lifted substantially and now ATON's P/E is also back up to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of ATON's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware ATON is showing 4 warning signs in our investment analysis, you should know about.

You might be able to find a better investment than ATON. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A158430

ATON

Engages in the provision and operation of mobile financial solutions, content, and financial services in South Korea.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives