- South Korea

- /

- Software

- /

- KOSDAQ:A030520

High Growth Tech Stocks In Asia For June 2025

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate and trade negotiations between the U.S. and China show signs of easing, global markets have been experiencing volatility, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 seeing notable declines. In this environment, high-growth tech stocks in Asia present intriguing opportunities for investors seeking resilience amid market fluctuations, as they often benefit from innovation-driven growth potential and regional economic developments.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Fositek | 26.94% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| PharmaResearch | 24.65% | 26.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Hancom (KOSDAQ:A030520)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hancom Inc. is a company that develops and sells office software products and solutions both in South Korea and internationally, with a market capitalization of approximately ₩830.52 billion.

Operations: The company's primary revenue stream comes from its Non-Financial - SW Division, generating ₩184.10 billion, followed by the Non-Financial - Manufacturing Sector at ₩97.78 billion. The software division contributes significantly to overall sales, while the manufacturing sector also plays a notable role in revenue generation.

Amidst the dynamic landscape of Asian high-growth tech, Hancom stands out with its robust forecasted earnings growth at 42.6% annually, surpassing Korea's market average of 20.9%. Despite a challenging past year where earnings growth (3.5%) lagged behind the software industry average (6.8%), Hancom's revenue projections remain promising with an expected increase of 13.4% per year, doubling the national market pace of 6.7%. This performance is shadowed by a significant one-off loss of ₩8 billion, underscoring the volatility and potential risks in its financial trajectory. As Hancom approaches its Q1 2025 results release on May 20, stakeholders are keenly watching how these projections align with actual performance, shaping perceptions and future prospects in this high-stakes sector.

- Take a closer look at Hancom's potential here in our health report.

Explore historical data to track Hancom's performance over time in our Past section.

Geovis TechnologyLtd (SHSE:688568)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Geovis Technology Co., Ltd focuses on the research, development, and industrialization of digital earth products for various sectors in China, with a market cap of CN¥27.16 billion.

Operations: Geovis Technology Co., Ltd specializes in creating digital earth products tailored for government, enterprise, and public sectors across China.

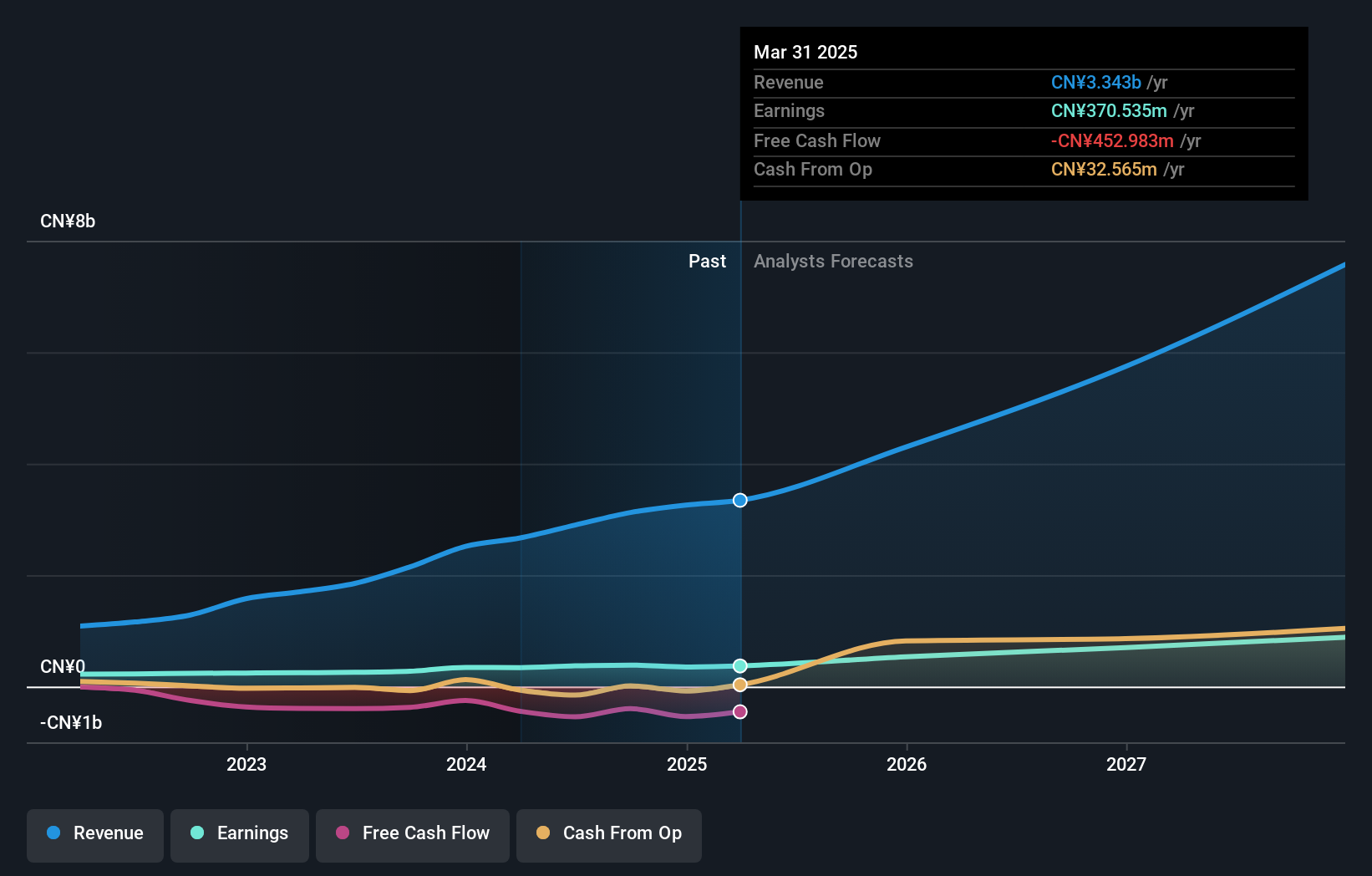

Geovis TechnologyLtd, a beacon in Asia's tech arena, recently showcased a strong Q1 performance with revenues soaring to CNY 504.33 million from CNY 418.6 million year-over-year and net income escalating to CNY 20.78 million from just CNY 1.94 million. This surge is underpinned by an aggressive R&D commitment, evident from their substantial share repurchase plan funded by over-raised IPO funds and internal resources, signaling confidence in ongoing innovation and market expansion strategies. With earnings growth outpacing the industry at 9.2% compared to the software sector’s downturn of -2%, Geovis not only demonstrates robust financial health but also aligns with high future growth projections in earnings (29.7% annually) and revenue (29.3% annually), significantly above China's market averages of 23.2% and 12.3%, respectively.

- Delve into the full analysis health report here for a deeper understanding of Geovis TechnologyLtd.

Evaluate Geovis TechnologyLtd's historical performance by accessing our past performance report.

ASROCK Incorporation (TWSE:3515)

Simply Wall St Growth Rating: ★★★★★☆

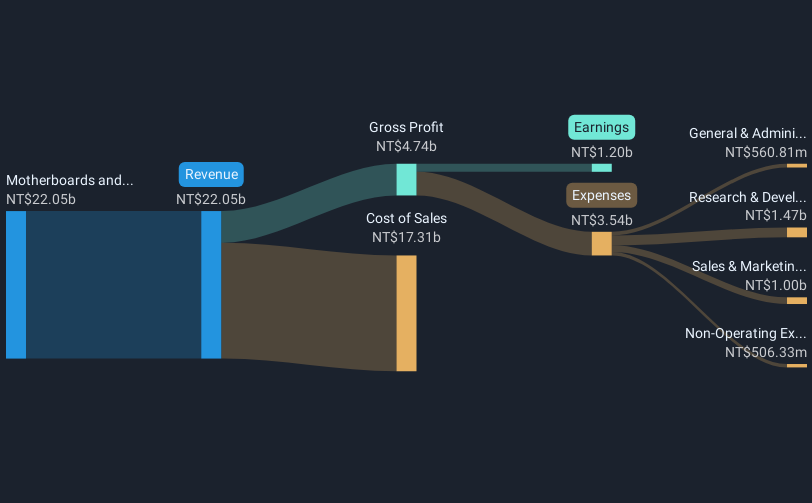

Overview: ASROCK Incorporation is a Taiwanese company that specializes in designing, developing, and selling motherboards, with a market cap of NT$30.15 billion.

Operations: The company primarily generates revenue through the sale of motherboards, contributing NT$31.16 billion to its financial performance.

ASROCK Incorporation, amid a dynamic tech landscape, reported a significant uptick in Q1 earnings with sales doubling to TWD 10.46 billion from TWD 4.95 billion year-over-year and net income rising to TWD 442.16 million from TWD 308.07 million. This growth trajectory is bolstered by strategic expansions such as the new manufacturing agreement with Optiemus Electronics Ltd., positioning ASROCK to capitalize on India's burgeoning electronics market. Their commitment to innovation is underscored by R&D expenses that align closely with revenue increases, ensuring sustained development in high-demand sectors like gaming and enterprise solutions, projecting an optimistic outlook for continual market penetration and revenue growth of 32.7% annually.

- Click here to discover the nuances of ASROCK Incorporation with our detailed analytical health report.

Assess ASROCK Incorporation's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Discover the full array of 488 Asian High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hancom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A030520

Hancom

Develops and sells office software products and solutions in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives