- South Korea

- /

- Semiconductors

- /

- KOSE:A281820

KCTech Co., Ltd. (KRX:281820) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

KCTech Co., Ltd. (KRX:281820) shares have had a horrible month, losing 27% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 59% in the last year.

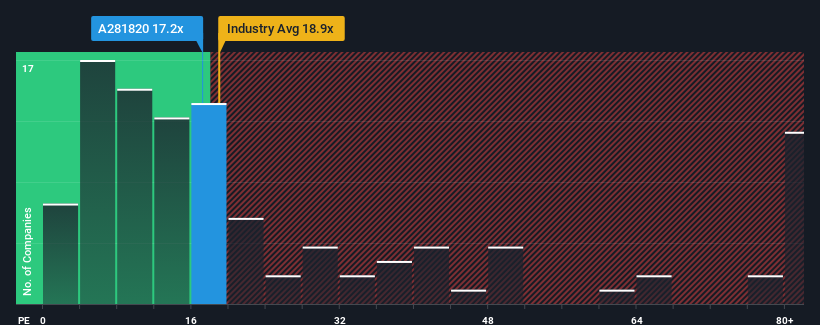

Even after such a large drop in price, KCTech's price-to-earnings (or "P/E") ratio of 17.2x might still make it look like a sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 11x and even P/E's below 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings that are retreating more than the market's of late, KCTech has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for KCTech

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as KCTech's is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 9.2%. This means it has also seen a slide in earnings over the longer-term as EPS is down 9.0% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 19% per annum during the coming three years according to the three analysts following the company. With the market predicted to deliver 20% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it interesting that KCTech is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

There's still some solid strength behind KCTech's P/E, if not its share price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that KCTech currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about this 1 warning sign we've spotted with KCTech.

You might be able to find a better investment than KCTech. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if KCTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A281820

KCTech

Engages in the manufacture and distribution of semiconductor systems, display systems, and electronic materials in South Korea.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026