Stock Analysis

- South Korea

- /

- Capital Markets

- /

- KOSE:A003470

Sang-A FrontecLtd And 2 Other Undiscovered Gems In South Korea

Reviewed by Simply Wall St

The South Korean market has shown robust growth, with a 7.2% increase over the past year and earnings expected to grow by 30% annually. In such a thriving environment, stocks like Sang-A Frontec Ltd that are not yet widely recognized may present unique opportunities for growth-oriented investors.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 0.40% | 27.17% | ★★★★★★ |

| NOROO PAINT & COATINGS | 17.16% | 5.11% | 6.31% | ★★★★★★ |

| ASIA Holdings | 34.13% | 8.28% | 15.67% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 59.19% | 3.54% | 5.92% | ★★★★★★ |

| Kyungdong Invest | 8.15% | 3.08% | 15.07% | ★★★★★★ |

| KG Chemical | 43.62% | 33.46% | 8.39% | ★★★★★☆ |

| Daewon Cable | 24.70% | 8.50% | 62.14% | ★★★★★☆ |

| Ubiquoss Holdings | 2.69% | 9.93% | 14.22% | ★★★★★☆ |

| EASY BIOInc | 188.46% | 15.71% | 55.75% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sang-A FrontecLtd (KOSDAQ:A089980)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sang-A Frontec Co., Ltd. is a company focused on the R&D, production, and sale of materials and parts derived from engineering plastics, operating both in South Korea and globally, with a market capitalization of approximately ₩414.71 billion.

Operations: Sang-A Frontec Ltd generates its revenue primarily through the sale of products and services, with a gross profit margin of 19.34% as of the latest reporting period in 2024. The company's operating expenses are significant, impacting its net income margin, which stood at approximately 6.09% in mid-2024.

Sang-A Frontec Ltd. stands out with its robust performance in the electronics sector, surpassing industry growth with a 40.5% earnings increase over the past year while the sector saw a 7.3% decline. With earnings projected to grow by 37.76% annually, and a net debt-to-equity ratio at a healthy 28.4%, the company demonstrates financial prudence and growth potential. Additionally, its high-quality earnings underscore operational efficiency, making it an intriguing prospect for investors exploring opportunities beyond mainstream picks in South Korea.

- Unlock comprehensive insights into our analysis of Sang-A FrontecLtd stock in this health report.

Examine Sang-A FrontecLtd's past performance report to understand how it has performed in the past.

Sang-A FrontecLtd (KOSDAQ:A089980)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sang-A Frontec Co., Ltd. is a company focused on the R&D, production, and sale of materials and parts derived from engineering plastics, operating both in South Korea and globally, with a market capitalization of approximately ₩414.71 billion.

Operations: Sang-A Frontec Ltd generates its revenue primarily through the sale of products and services, with a gross profit margin of 19.34% as of the latest reporting period in 2024. The company's operating expenses are significant, impacting its net income margin, which stood at approximately 6.09% in mid-2024.

Sang-A Frontec Ltd. stands out with its robust performance in the electronics sector, surpassing industry growth with a 40.5% earnings increase over the past year while the sector saw a 7.3% decline. With earnings projected to grow by 37.76% annually, and a net debt-to-equity ratio at a healthy 28.4%, the company demonstrates financial prudence and growth potential. Additionally, its high-quality earnings underscore operational efficiency, making it an intriguing prospect for investors exploring opportunities beyond mainstream picks in South Korea.

- Unlock comprehensive insights into our analysis of Sang-A FrontecLtd stock in this health report.

Examine Sang-A FrontecLtd's past performance report to understand how it has performed in the past.

ASICLAND (KOSDAQ:A445090)

Simply Wall St Value Rating: ★★★★☆☆

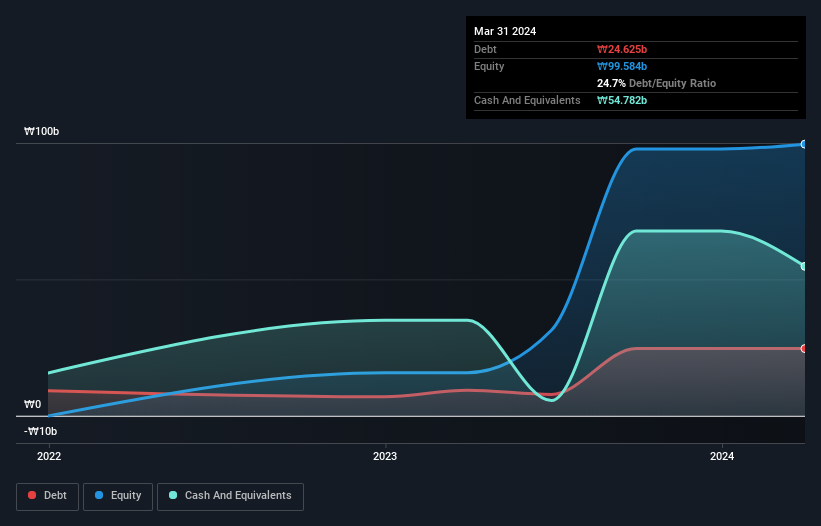

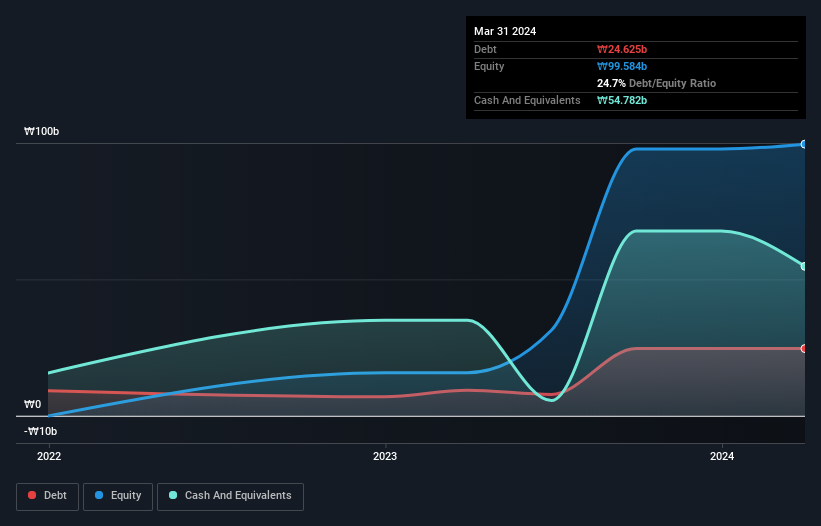

Overview: ASICLAND Co., Ltd. is a South Korean company specializing in the design of application-specific integrated circuits, with a market capitalization of ₩536.06 billion.

Operations: The company generates its revenue primarily from the semiconductor sector, with a notable increase in gross profit margin from 17.62% in 2021 to 22.42% by mid-2024, reflecting enhanced operational efficiency. This growth is supported by a consistent rise in annual revenues, reaching ₩75.95 billion by the first half of 2024.

ASICLAND, a lesser-known entity in South Korea's semiconductor sector, has demonstrated remarkable financial agility with a 14% earnings growth over the past year, significantly outpacing the industry's 25.9% contraction. With more cash than debt on its books and a highly volatile share price in recent months, ASICLAND appears poised for intriguing developments. Despite not generating positive free cash flow recently, its ability to cover interest payments suggests prudent financial management.

- Get an in-depth perspective on ASICLAND's performance by reading our health report here.

Understand ASICLAND's track record by examining our Past report.

ASICLAND (KOSDAQ:A445090)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ASICLAND Co., Ltd. is a South Korean company specializing in the design of application-specific integrated circuits, with a market capitalization of ₩536.06 billion.

Operations: The company generates its revenue primarily from the semiconductor sector, with a notable increase in gross profit margin from 17.62% in 2021 to 22.42% by mid-2024, reflecting enhanced operational efficiency. This growth is supported by a consistent rise in annual revenues, reaching ₩75.95 billion by the first half of 2024.

ASICLAND, a lesser-known entity in South Korea's semiconductor sector, has demonstrated remarkable financial agility with a 14% earnings growth over the past year, significantly outpacing the industry's 25.9% contraction. With more cash than debt on its books and a highly volatile share price in recent months, ASICLAND appears poised for intriguing developments. Despite not generating positive free cash flow recently, its ability to cover interest payments suggests prudent financial management.

- Get an in-depth perspective on ASICLAND's performance by reading our health report here.

Understand ASICLAND's track record by examining our Past report.

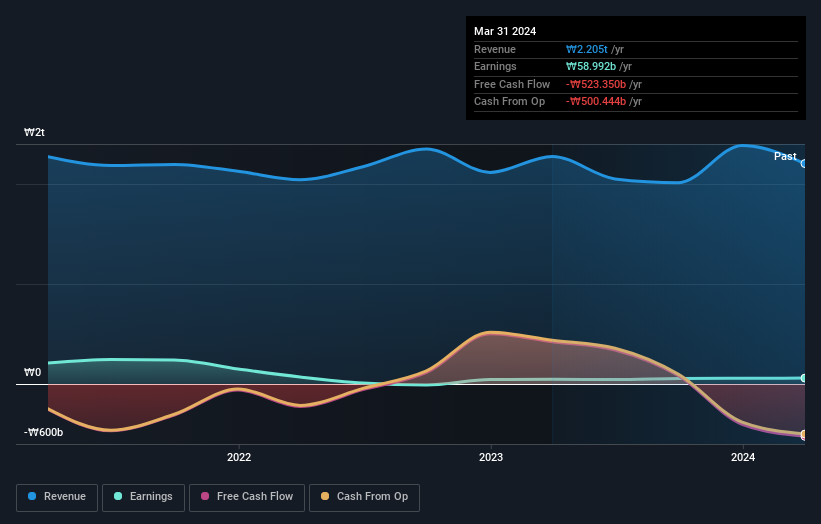

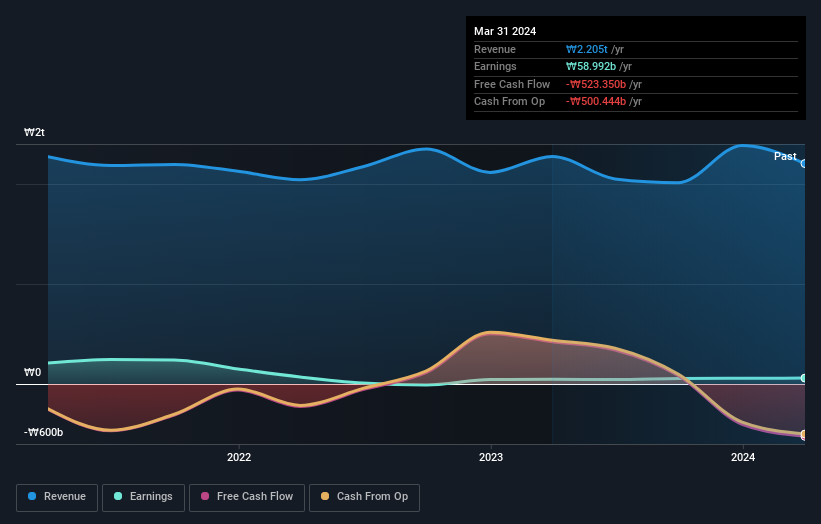

Yuanta Securities Korea (KOSE:A003470)

Simply Wall St Value Rating: ★★★★☆☆

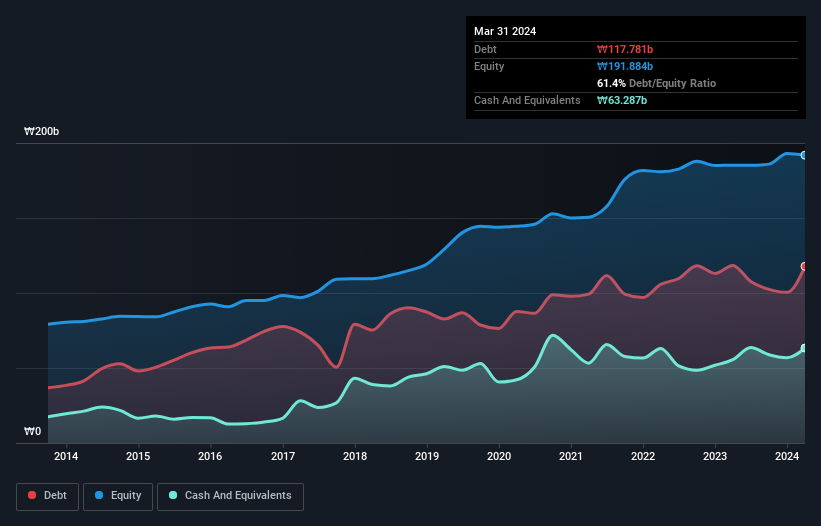

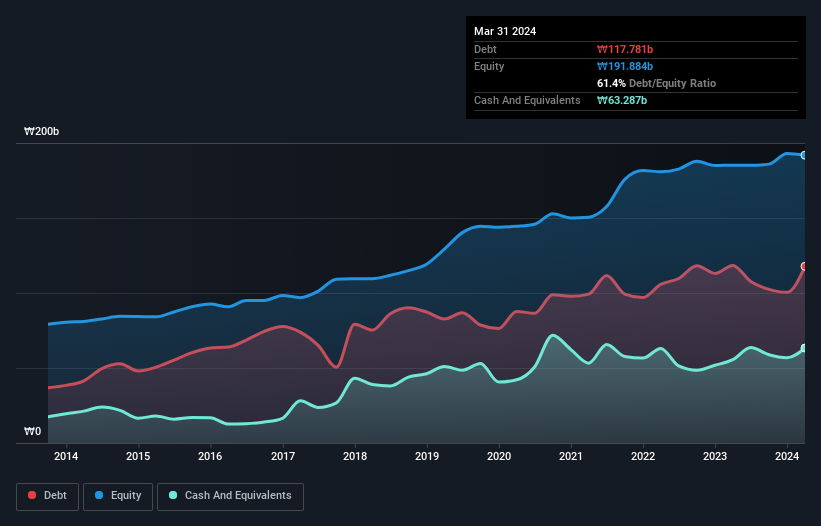

Overview: Yuanta Securities Korea Co., Ltd. operates as a financial services provider, offering a range of services both domestically in South Korea and internationally, with a market capitalization of approximately ₩633.11 billion.

Operations: Yuanta Securities Korea generates its revenue primarily from financial trading and related services, consistently exhibiting a high gross profit margin averaging around 97.5% over recent periods. The company's operational costs are dominated by general and administrative expenses, which form a significant portion of its operating expenses.

Yuanta Securities Korea, an often overlooked player in the capital markets sector, has demonstrated robust performance with a 24.2% earnings growth over the past year, surpassing the industry average of 0.8%. Despite a challenging five-year period where earnings declined by 11.7% annually, its debt-to-equity ratio improved from 487% to 482.3%. The firm's price-to-earnings ratio stands at an appealing 10.7x compared to the market's 12.7x, signaling potential undervaluation. Recently, Yuanta faced regulatory fines but promptly addressed these issues with a voluntary payment plan.

- Click to explore a detailed breakdown of our findings in Yuanta Securities Korea's health report.

Learn about Yuanta Securities Korea's historical performance.

Yuanta Securities Korea (KOSE:A003470)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yuanta Securities Korea Co., Ltd. operates as a financial services provider, offering a range of services both domestically in South Korea and internationally, with a market capitalization of approximately ₩633.11 billion.

Operations: Yuanta Securities Korea generates its revenue primarily from financial trading and related services, consistently exhibiting a high gross profit margin averaging around 97.5% over recent periods. The company's operational costs are dominated by general and administrative expenses, which form a significant portion of its operating expenses.

Yuanta Securities Korea, an often overlooked player in the capital markets sector, has demonstrated robust performance with a 24.2% earnings growth over the past year, surpassing the industry average of 0.8%. Despite a challenging five-year period where earnings declined by 11.7% annually, its debt-to-equity ratio improved from 487% to 482.3%. The firm's price-to-earnings ratio stands at an appealing 10.7x compared to the market's 12.7x, signaling potential undervaluation. Recently, Yuanta faced regulatory fines but promptly addressed these issues with a voluntary payment plan.

- Click to explore a detailed breakdown of our findings in Yuanta Securities Korea's health report.

Learn about Yuanta Securities Korea's historical performance.

Make It Happen

- Reveal the 210 hidden gems among our KRX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Yuanta Securities Korea is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003470

Yuanta Securities Korea

Provides various financial services in South Korea and internationally.

Adequate balance sheet with acceptable track record.