- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A348210

NEXTIN, Inc.'s (KOSDAQ:348210) P/E Is Still On The Mark Following 26% Share Price Bounce

NEXTIN, Inc. (KOSDAQ:348210) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

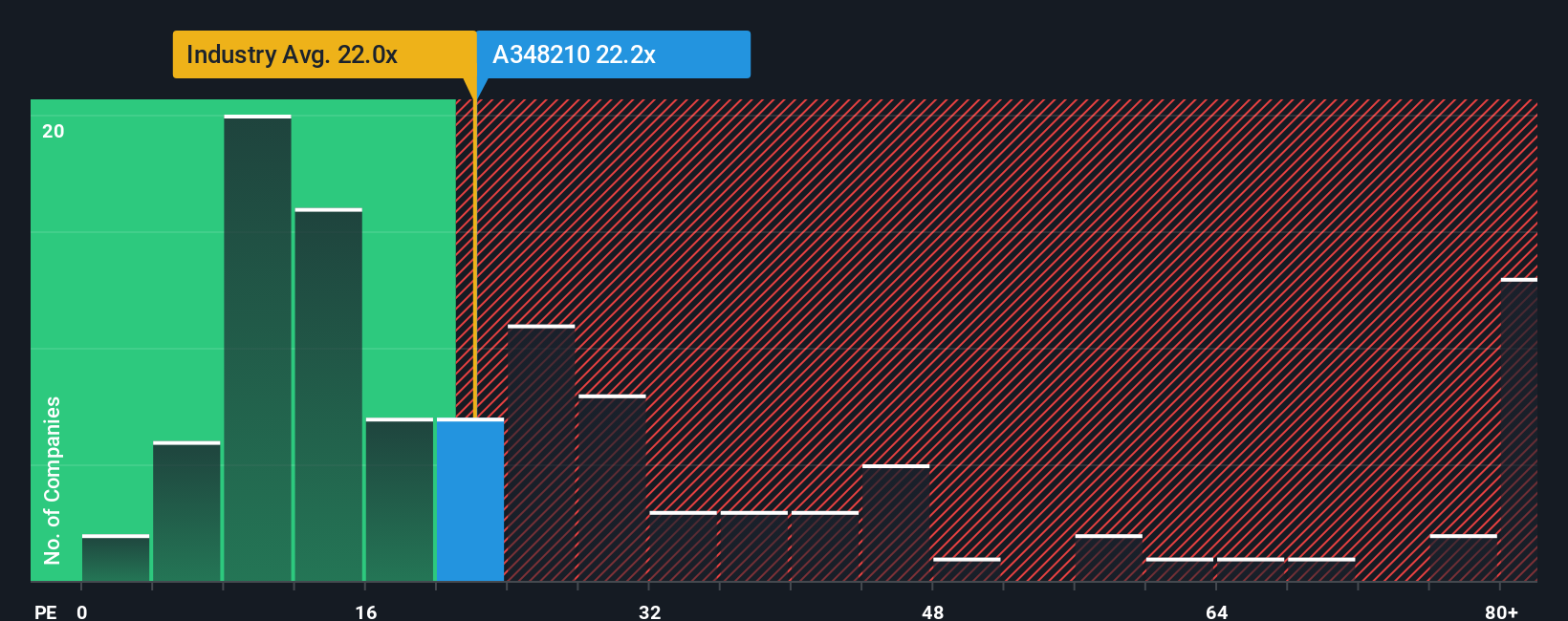

Following the firm bounce in price, NEXTIN may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 22.2x, since almost half of all companies in Korea have P/E ratios under 14x and even P/E's lower than 7x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, NEXTIN has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for NEXTIN

Is There Enough Growth For NEXTIN?

There's an inherent assumption that a company should outperform the market for P/E ratios like NEXTIN's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 8.5%. The last three years don't look nice either as the company has shrunk EPS by 25% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 33% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 18% per annum, which is noticeably less attractive.

With this information, we can see why NEXTIN is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From NEXTIN's P/E?

The large bounce in NEXTIN's shares has lifted the company's P/E to a fairly high level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of NEXTIN's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for NEXTIN with six simple checks on some of these key factors.

If you're unsure about the strength of NEXTIN's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NEXTIN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A348210

NEXTIN

Manufactures defect inspection and metrology systems for semiconductor and display industries in South Korea.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives