Stock Analysis

- South Korea

- /

- Pharma

- /

- KOSE:A009420

June 2024 Insight Into Three KRX Stocks Estimated Below Market Value

Reviewed by Simply Wall St

Over the past week, South Korea's stock market has shown stability with no significant changes, while it has experienced a growth of 6.8% over the last year. With earnings expected to grow by 29% annually, identifying stocks that are currently undervalued could present opportunities for investors looking to capitalize on potential future gains in this promising market environment.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Poongsan Holdings (KOSE:A005810) | ₩27300.00 | ₩49235.90 | 44.6% |

| Solum (KOSE:A248070) | ₩20850.00 | ₩39918.43 | 47.8% |

| Iljin ElectricLtd (KOSE:A103590) | ₩25900.00 | ₩50951.46 | 49.2% |

| Protec (KOSDAQ:A053610) | ₩28600.00 | ₩55029.72 | 48% |

| Caregen (KOSDAQ:A214370) | ₩22300.00 | ₩43428.59 | 48.7% |

| Anapass (KOSDAQ:A123860) | ₩27050.00 | ₩48447.25 | 44.2% |

| Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49502.89 | 49.7% |

| IMLtd (KOSDAQ:A101390) | ₩6880.00 | ₩13578.83 | 49.3% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩75700.00 | ₩137549.91 | 45% |

| NEXON Games (KOSDAQ:A225570) | ₩14480.00 | ₩25829.99 | 43.9% |

Here's a peek at a few of the choices from the screener

ISC (KOSDAQ:A095340)

Overview: ISC Co., Ltd. is a global company that develops, manufactures, and sells semiconductor test sockets with a market capitalization of approximately ₩1.30 billion.

Operations: The company generates its revenue from the development, manufacturing, and sale of semiconductor test sockets on a global scale.

Estimated Discount To Fair Value: 17.4%

ISC Co., Ltd. is currently trading at ₩63700, below the estimated fair value of ₩77115.76, indicating potential undervaluation based on discounted cash flow analysis. Despite this, its earnings are expected to grow by 45.1% annually, outpacing the South Korean market's 29.2%. However, recent financials show a significant dip in profit margins from 22.4% to 13.9%, and shareholder dilution over the past year raises concerns about equity value erosion despite high revenue growth forecasts of 23.3% per year.

- The analysis detailed in our ISC growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of ISC stock in this financial health report.

NEXTIN (KOSDAQ:A348210)

Overview: NEXTIN, Inc. is a South Korean company that specializes in producing defect inspection and metrology systems for the semiconductor and display industries, with a market capitalization of approximately ₩680.59 billion.

Operations: The company generates revenue primarily from its semiconductor equipment and services segment, totaling approximately ₩103.59 billion.

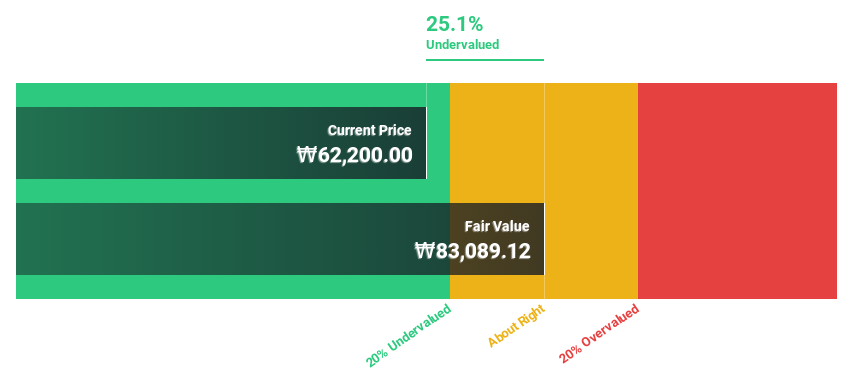

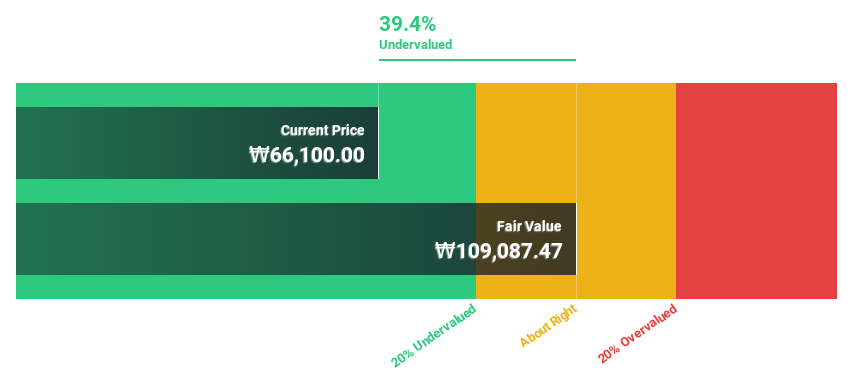

Estimated Discount To Fair Value: 34.6%

NEXTIN, trading at ₩66,300, is valued below its fair estimate of ₩101,324.60, suggesting significant undervaluation. Analysts predict a 44.3% potential price increase and forecast high revenue growth at 17.6% annually—outpacing the South Korean market's 10.5%. However, its earnings growth projection of 21.2% lags behind the market expectation of 29.2%. Recent acquisition by KCGI Co., Ltd., purchasing a 13% stake for ₩100.61 billion underscores strategic interest but raises considerations about future financial integration and performance impacts.

- Our growth report here indicates NEXTIN may be poised for an improving outlook.

- Take a closer look at NEXTIN's balance sheet health here in our report.

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a South Korean pharmaceutical company that produces and markets pharmaceutical products domestically and globally, with a market capitalization of approximately ₩1.56 trillion.

Operations: The company generates revenue through the production and sale of pharmaceutical products both in South Korea and internationally.

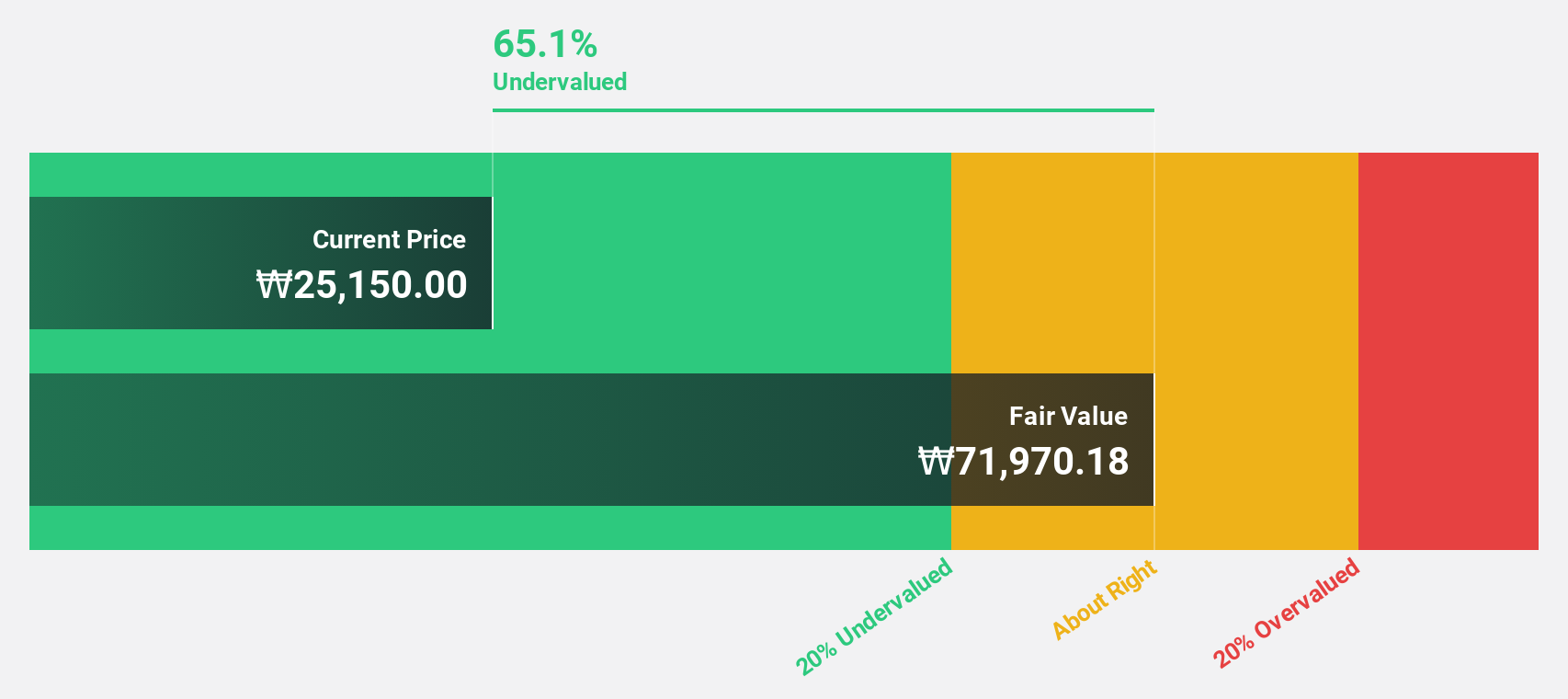

Estimated Discount To Fair Value: 15.1%

Hanall Biopharma, priced at ₩30,750, trades below its calculated fair value of ₩36,218.25, indicating a mild undervaluation based on discounted cash flows. Despite this, the company's share price has shown high volatility recently. Financially, Hanall has turned profitable this year with expectations of robust earnings growth at 69.6% annually over the next three years—surpassing the broader Korean market's forecast growth rate. Revenue is also expected to increase by 14.9% annually, outperforming the market prediction of 10.5%.

- The growth report we've compiled suggests that Hanall Biopharma's future prospects could be on the up.

- Navigate through the intricacies of Hanall Biopharma with our comprehensive financial health report here.

Seize The Opportunity

- Dive into all 35 of the Undervalued KRX Stocks Based On Cash Flows we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Hanall Biopharma is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009420

Hanall Biopharma

A pharmaceutical company, manufactures and sells pharmaceutical products in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.