- South Korea

- /

- Consumer Durables

- /

- KOSE:A192400

Discovering South Korea's Undiscovered Gems In August 2024

Reviewed by Simply Wall St

The South Korea stock market has experienced notable volatility recently, with the KOSPI index experiencing a significant drop and mixed performances across various sectors. As investors navigate these turbulent times, identifying resilient companies with strong growth potential becomes crucial. In this article, we will explore three lesser-known South Korean stocks that exhibit promising attributes despite the current market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.98% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Woori Technology Investment | NA | 22.60% | -1.67% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.38% | ★★★★★☆ |

| PaperCorea | 53.09% | 1.31% | 77.27% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. develops, manufactures, and sells PCB automation equipment in South Korea and internationally with a market cap of ₩552.56 billion.

Operations: Taesung generates revenue primarily from manufacturing and selling PCB automation equipment, amounting to ₩45.68 billion.

Taesung Ltd. has shown impressive earnings growth of 1482% over the past year, significantly outpacing the semiconductor industry’s -10.8%. The company’s net debt to equity ratio stands at a satisfactory 4.2%, indicating prudent financial management. EBIT covers interest payments 17.5 times, reflecting strong profitability and high-quality earnings. However, shareholders experienced dilution in the past year, and its share price has been highly volatile over the last three months.

- Click here and access our complete health analysis report to understand the dynamics of TaesungLtd.

Gain insights into TaesungLtd's historical performance by reviewing our past performance report.

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. manufactures and sells storage batteries with a market cap of ₩1.64 trillion.

Operations: Hankook's primary revenue stream is derived from the sale of storage batteries. The company has a market cap of ₩1.64 trillion.

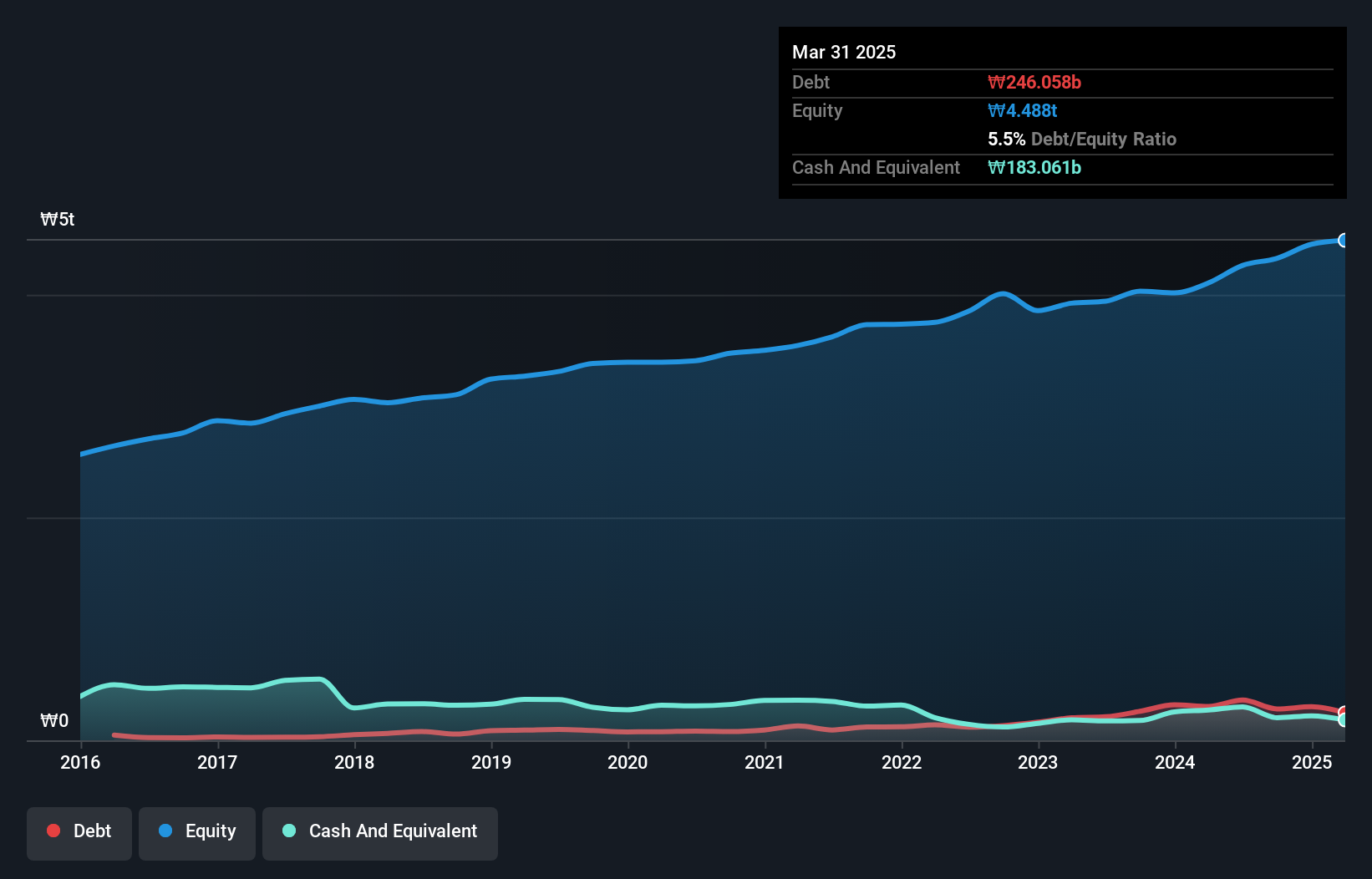

Hankook's impressive earnings growth of 267% over the past year highlights its potential in the auto components sector, outpacing the industry's 16.6%. The company reported second-quarter sales of KRW 4.81 million and net income of KRW 108,476.33 million, a significant jump from KRW 36,322.83 million a year ago. Trading at a P/E ratio of 4.8x compared to the market's 11.7x suggests undervaluation while maintaining a satisfactory net debt to equity ratio at 1.4%.

- Navigate through the intricacies of Hankook with our comprehensive health report here.

Examine Hankook's past performance report to understand how it has performed in the past.

Cuckoo Holdings (KOSE:A192400)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cuckoo Holdings Co., Ltd., along with its subsidiaries, manufactures and sells electric heaters and daily necessities in South Korea and internationally, with a market cap of ₩742.77 billion.

Operations: Cuckoo Holdings generates revenue from the manufacturing and sale of electric heaters and daily necessities, both domestically and internationally. The company has a market cap of ₩742.77 billion.

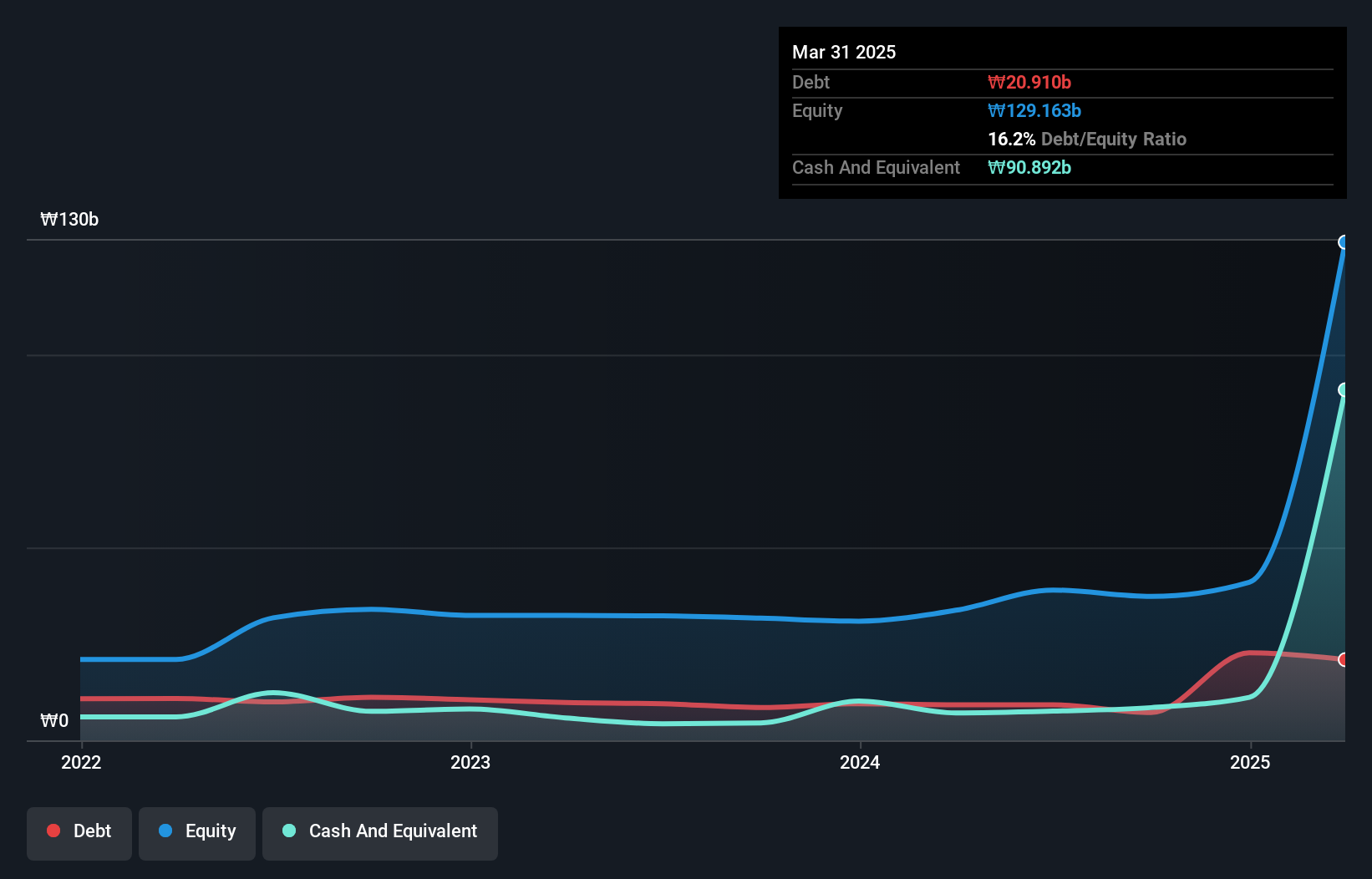

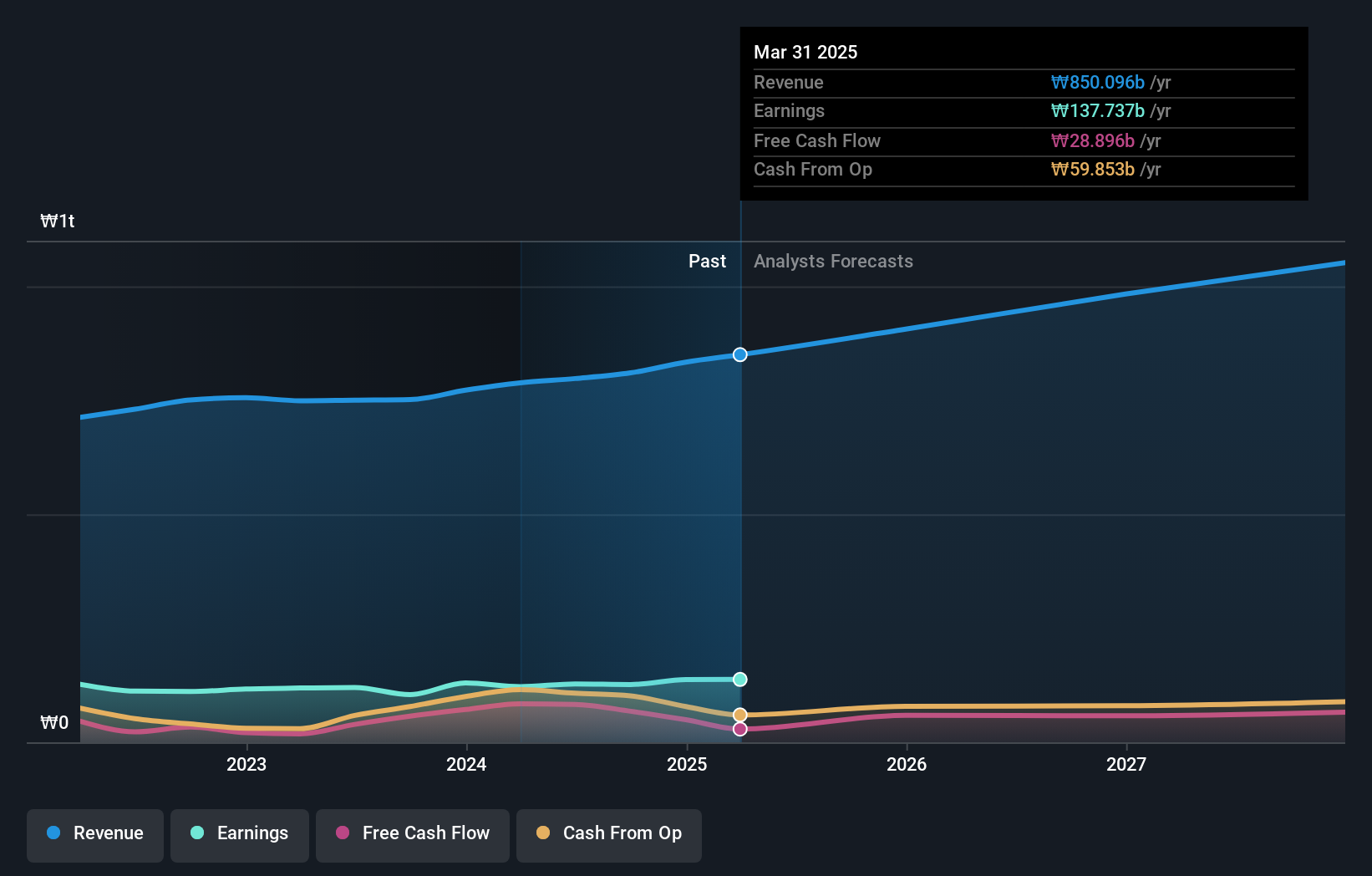

Cuckoo Holdings, a notable player in South Korea's consumer durables sector, has seen earnings grow 8.8% annually over the past five years. Despite a debt-to-equity ratio increase from 0% to 0.04%, its cash exceeds total debt. The company repurchased shares in 2024, indicating confidence in its valuation, currently trading at nearly 80% below fair value estimates. While it earns more interest than it pays and remains profitable, recent earnings growth of 6.5% lags behind the industry average of 16.1%.

- Get an in-depth perspective on Cuckoo Holdings' performance by reading our health report here.

Assess Cuckoo Holdings' past performance with our detailed historical performance reports.

Make It Happen

- Embark on your investment journey to our 195 KRX Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A192400

Cuckoo Holdings

Manufactures and sells electric heaters and daily necessities in South Korea and internationally.

Excellent balance sheet average dividend payer.