- South Korea

- /

- Entertainment

- /

- KOSE:A352820

KRX Growth Companies With High Insider Ownership August 2024

Reviewed by Simply Wall St

The South Korea stock market has recently experienced volatility, with the KOSPI index showing mixed performances amid broader global economic uncertainties and key inflation data releases. Despite this turbulence, identifying growth companies with high insider ownership can provide valuable insights into potential investment opportunities, as these firms often benefit from strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 97.6% |

| Global Tax Free (KOSDAQ:A204620) | 20.9% | 78.5% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 106.2% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Let's dive into some prime choices out of the screener.

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JUSUNG ENGINEERING Co.,Ltd. manufactures and sells semiconductor, display, solar, and lighting equipment in South Korea and internationally, with a market cap of ₩1.27 billion.

Operations: The company's revenue primarily comes from semiconductor equipment and services, amounting to ₩272.61 billion.

Insider Ownership: 37.1%

JUSUNG ENGINEERING Ltd. exemplifies a growth company with high insider ownership in South Korea, benefiting from strong earnings and revenue forecasts. Analysts predict annual earnings growth of 35.7% and revenue growth of 25.9%, both outpacing the broader market. Despite lower profit margins this year (14.6%) compared to last year (23%), the stock trades at 46.3% below its estimated fair value, suggesting potential for significant price appreciation based on analyst consensus.

- Unlock comprehensive insights into our analysis of JUSUNG ENGINEERINGLtd stock in this growth report.

- In light of our recent valuation report, it seems possible that JUSUNG ENGINEERINGLtd is trading behind its estimated value.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., a biotechnology company, specializes in creating long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩16.76 trillion.

Operations: The company's revenue is primarily derived from its biotechnology segment, which generated ₩90.79 billion.

Insider Ownership: 26.6%

ALTEOGEN is forecast to become profitable within 3 years, with revenue expected to grow at 64.2% annually, significantly outpacing the market. The recent MFDS approval of Tergase® underscores its innovative edge and commercial potential. Despite high share price volatility and past shareholder dilution, its Return on Equity is projected to be very high in 3 years (66.3%). Trading at 75.6% below fair value suggests potential for substantial upside based on analyst estimates.

- Click here to discover the nuances of ALTEOGEN with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that ALTEOGEN is trading beyond its estimated value.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

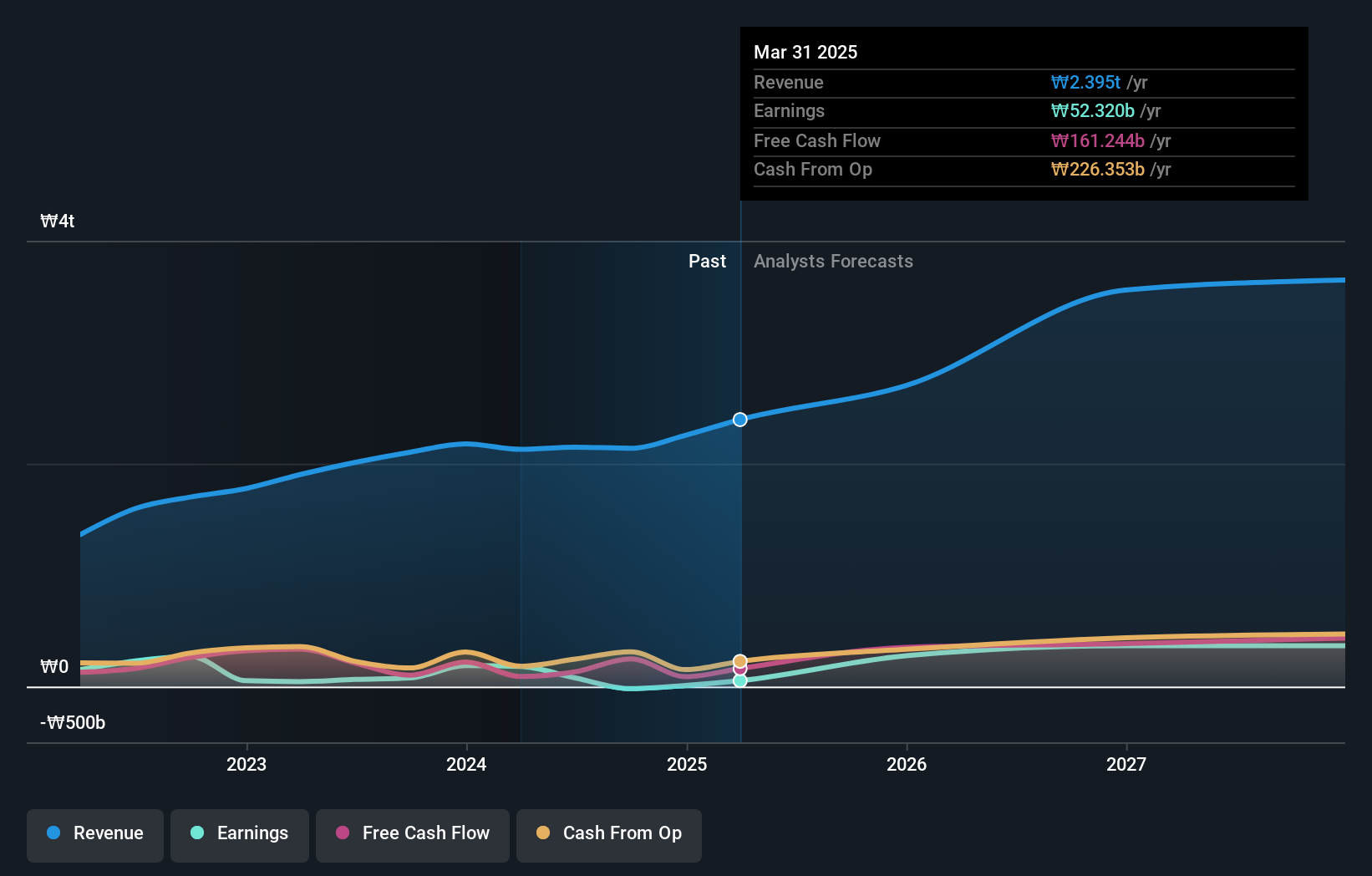

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management with a market cap of ₩7.81 trillion.

Operations: HYBE generates revenue from three primary segments: Label (₩1.28 trillion), Platform (₩361.12 billion), and Solution (₩1.24 trillion).

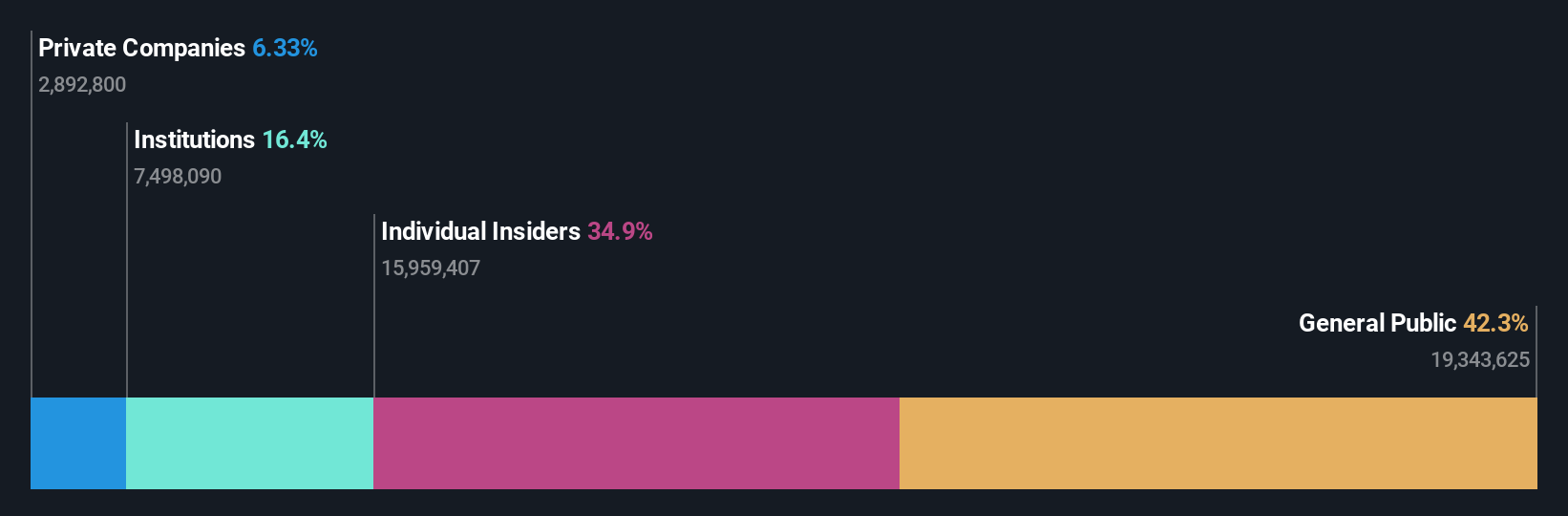

Insider Ownership: 32.5%

HYBE Co., Ltd. is a growth company with high insider ownership, recently announcing a share repurchase program aimed at stabilizing its stock price. Despite a significant drop in net income for the second quarter of 2024 compared to the previous year, analysts forecast earnings to grow significantly over the next three years. Trading at 18.1% below fair value and expected to outpace market revenue growth, HYBE remains a strong contender in South Korea's market landscape.

- Get an in-depth perspective on HYBE's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that HYBE's share price might be on the expensive side.

Where To Now?

- Unlock more gems! Our Fast Growing KRX Companies With High Insider Ownership screener has unearthed 85 more companies for you to explore.Click here to unveil our expertly curated list of 88 Fast Growing KRX Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

Excellent balance sheet with reasonable growth potential.