- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A306620

Neontech's (KOSDAQ:306620) Returns On Capital Not Reflecting Well On The Business

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at Neontech (KOSDAQ:306620) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Neontech, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.039 = ₩1.4b ÷ (₩62b - ₩25b) (Based on the trailing twelve months to December 2020).

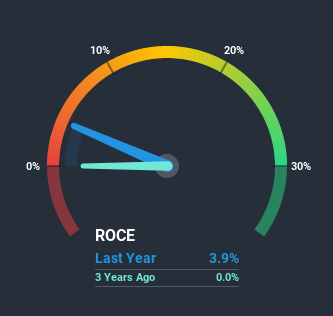

So, Neontech has an ROCE of 3.9%. Ultimately, that's a low return and it under-performs the Semiconductor industry average of 8.8%.

View our latest analysis for Neontech

Historical performance is a great place to start when researching a stock so above you can see the gauge for Neontech's ROCE against it's prior returns. If you're interested in investigating Neontech's past further, check out this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

The trend of ROCE doesn't look fantastic because it's fallen from 5.3% one year ago, while the business's capital employed increased by 29%. Usually this isn't ideal, but given Neontech conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. The funds raised likely haven't been put to work yet so it's worth watching what happens in the future with Neontech's earnings and if they change as a result from the capital raise. Additionally, we found that Neontech's most recent EBIT figure is around the same as the prior year, so we'd attribute the drop in ROCE mostly to the capital raise.

On a separate but related note, it's important to know that Neontech has a current liabilities to total assets ratio of 41%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line

While returns have fallen for Neontech in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. And long term investors must be optimistic going forward because the stock has returned a huge 147% to shareholders in the last year. So while investors seem to be recognizing these promising trends, we would look further into this stock to make sure the other metrics justify the positive view.

One more thing, we've spotted 2 warning signs facing Neontech that you might find interesting.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

When trading Neontech or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NeontechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A306620

NeontechLtd

Manufactures and sells mechanical dicing and system automation equipment in South Korea and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success