- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A297890

Slammed 43% HB SOLUTION Co., Ltd. (KOSDAQ:297890) Screens Well Here But There Might Be A Catch

HB SOLUTION Co., Ltd. (KOSDAQ:297890) shares have had a horrible month, losing 43% after a relatively good period beforehand. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 24%.

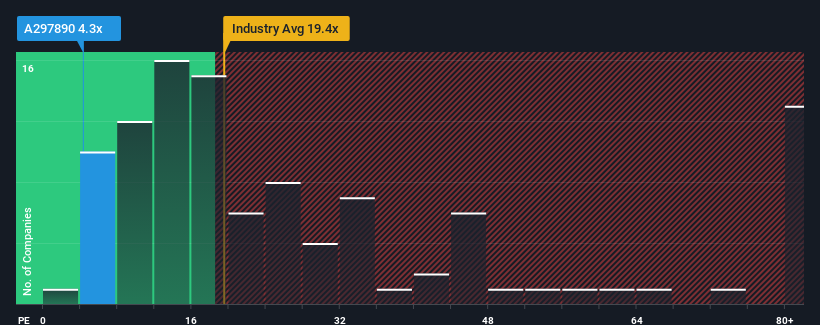

In spite of the heavy fall in price, HB SOLUTION may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.3x, since almost half of all companies in Korea have P/E ratios greater than 15x and even P/E's higher than 31x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For instance, HB SOLUTION's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for HB SOLUTION

What Are Growth Metrics Telling Us About The Low P/E?

HB SOLUTION's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 48%. Still, the latest three year period has seen an excellent 6,700% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 37% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that HB SOLUTION is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Having almost fallen off a cliff, HB SOLUTION's share price has pulled its P/E way down as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of HB SOLUTION revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for HB SOLUTION that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if HB SOLUTION might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A297890

HB SOLUTION

Manufactures and sells module process display manufacturing equipment and automation system for display industry in South Korea and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives