- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A238490

HIMS Co.,Ltd.'s (KOSDAQ:238490) Revenues Are Not Doing Enough For Some Investors

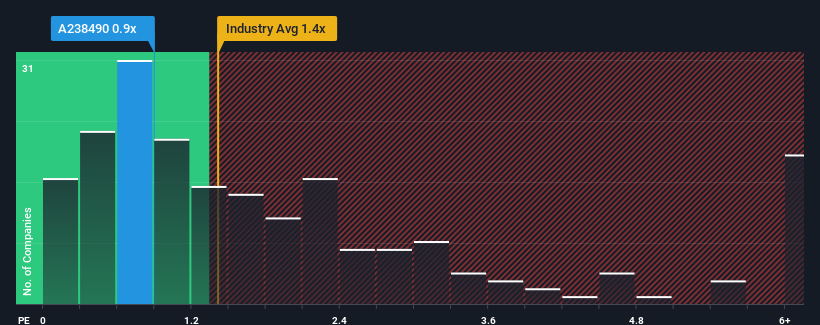

When you see that almost half of the companies in the Semiconductor industry in Korea have price-to-sales ratios (or "P/S") above 1.4x, HIMS Co.,Ltd. (KOSDAQ:238490) looks to be giving off some buy signals with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for HIMSLtd

What Does HIMSLtd's Recent Performance Look Like?

Recent times have been quite advantageous for HIMSLtd as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on HIMSLtd will help you shine a light on its historical performance.How Is HIMSLtd's Revenue Growth Trending?

In order to justify its P/S ratio, HIMSLtd would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 54%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 13% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 67% shows it's an unpleasant look.

With this information, we are not surprised that HIMSLtd is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On HIMSLtd's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of HIMSLtd confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for HIMSLtd (1 makes us a bit uncomfortable!) that you need to be mindful of.

If these risks are making you reconsider your opinion on HIMSLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HIMSLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A238490

HIMSLtd

Manufactures and sells machine vision module equipment related to displays, semiconductors, and general industrial automation in South Korea.

Medium-low risk with excellent balance sheet.

Market Insights

Community Narratives