- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A222800

SIMMTECH Co., Ltd.'s (KOSDAQ:222800) Shares Climb 25% But Its Business Is Yet to Catch Up

Despite an already strong run, SIMMTECH Co., Ltd. (KOSDAQ:222800) shares have been powering on, with a gain of 25% in the last thirty days. The last month tops off a massive increase of 290% in the last year.

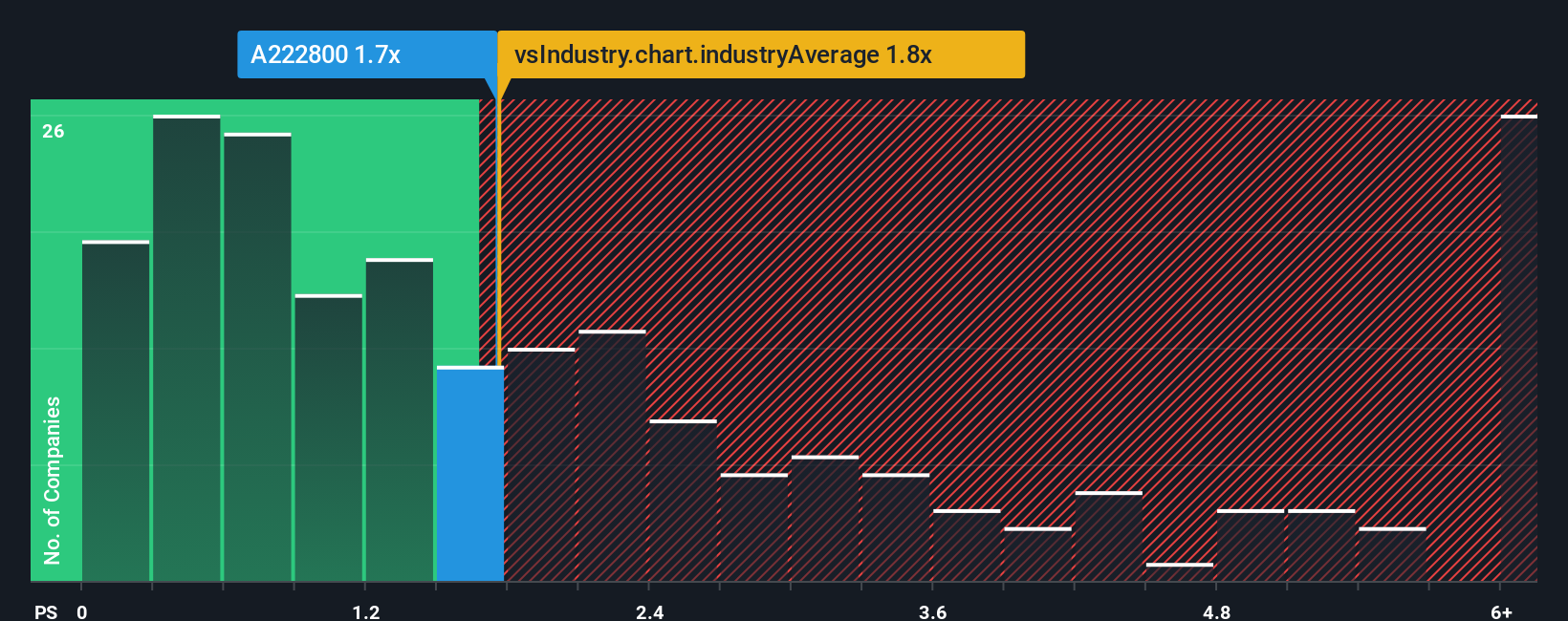

In spite of the firm bounce in price, there still wouldn't be many who think SIMMTECH's price-to-sales (or "P/S") ratio of 1.7x is worth a mention when the median P/S in Korea's Semiconductor industry is similar at about 1.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for SIMMTECH

How SIMMTECH Has Been Performing

SIMMTECH could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SIMMTECH.Do Revenue Forecasts Match The P/S Ratio?

SIMMTECH's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 6.8% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 23% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 41%, which is noticeably more attractive.

With this information, we find it interesting that SIMMTECH is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does SIMMTECH's P/S Mean For Investors?

SIMMTECH's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that SIMMTECH's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you settle on your opinion, we've discovered 2 warning signs for SIMMTECH that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A222800

SIMMTECH

Engages in the developing and manufacturing of high-layer printed circuit boards (PCBs) for semiconductors worldwide.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives