- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A196490

The Market Doesn't Like What It Sees From DA Technology Co.,Ltd.'s (KOSDAQ:196490) Revenues Yet

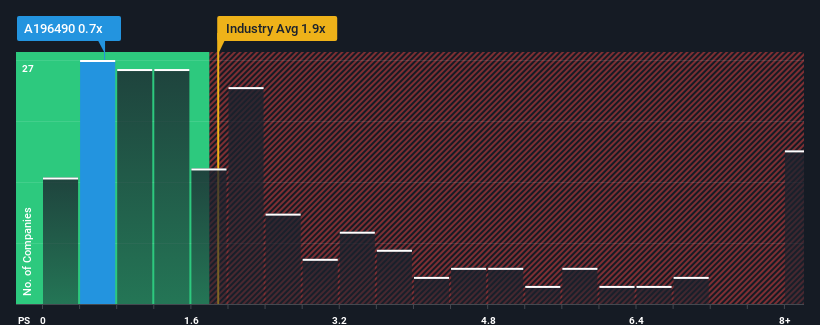

DA Technology Co.,Ltd.'s (KOSDAQ:196490) price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Semiconductor industry in Korea, where around half of the companies have P/S ratios above 1.9x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for DA TechnologyLtd

What Does DA TechnologyLtd's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, DA TechnologyLtd has been doing very well. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on DA TechnologyLtd will help you shine a light on its historical performance.How Is DA TechnologyLtd's Revenue Growth Trending?

DA TechnologyLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 144%. The latest three year period has also seen an excellent 41% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 66% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why DA TechnologyLtd's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does DA TechnologyLtd's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of DA TechnologyLtd confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 4 warning signs for DA TechnologyLtd (1 makes us a bit uncomfortable!) that you need to take into consideration.

If you're unsure about the strength of DA TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A196490

DA TechnologyLtd

Provides manufacturing solutions for automated assembly of rechargeable batteries in South Korea and internationally.

Medium with adequate balance sheet.

Market Insights

Community Narratives