In a landscape marked by tariff uncertainties and cooling job growth, the global markets have experienced mixed performances, with major U.S. indices like the S&P 500 seeing slight declines while European stocks showed resilience. As investors navigate these fluctuating conditions, identifying promising small-cap stocks that can thrive amid economic shifts becomes crucial; these undiscovered gems often exhibit strong fundamentals and unique market positions that can potentially offer resilience in volatile times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

KoMiCo (KOSDAQ:A183300)

Simply Wall St Value Rating: ★★★★★★

Overview: KoMiCo Ltd. specializes in semiconductor equipment cleaning and coating products, operating across South Korea, the United States, China, Taiwan, and Singapore with a market cap of approximately ₩446.69 billion.

Operations: KoMiCo Ltd. generates revenue primarily from its semiconductor equipment and services segment, amounting to approximately ₩469.30 billion.

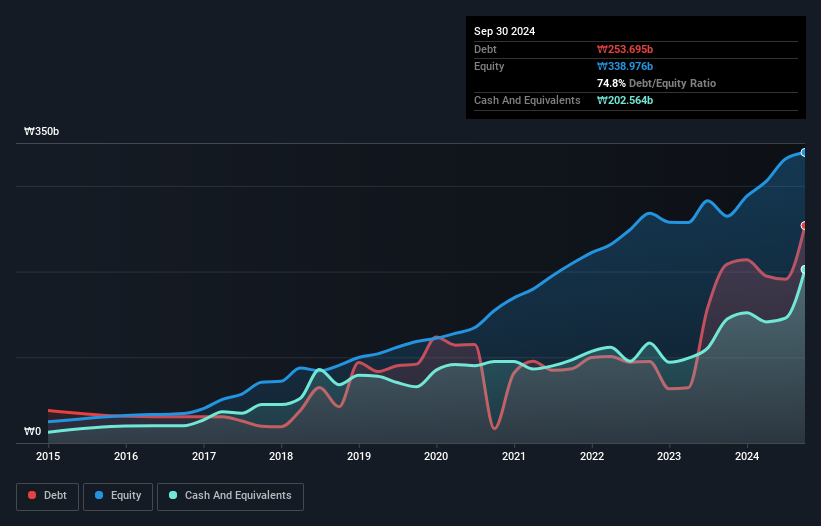

KoMiCo, a small player in the semiconductor space, has shown remarkable earnings growth of 100.5% over the past year, outpacing the industry average of 7.4%. The company is trading at a substantial discount, 72.8% below estimated fair value, suggesting potential undervaluation compared to peers. With its EBIT covering interest payments 24.8 times over and a net debt to equity ratio at a satisfactory 15.1%, financial stability seems robust. Recent buybacks included repurchasing shares worth KRW 4,999 million, reflecting strategic capital allocation amidst high-quality earnings and promising future growth prospects forecasted at 42.42% annually.

- Unlock comprehensive insights into our analysis of KoMiCo stock in this health report.

Examine KoMiCo's past performance report to understand how it has performed in the past.

Shandong Cvicse MiddlewareLtd (SHSE:688695)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Cvicse Middleware Co., Ltd. specializes in providing basic software middleware products in China and has a market capitalization of CN¥2.87 billion.

Operations: Shandong Cvicse Middleware Co., Ltd. generates revenue primarily from its software tools segment, amounting to CN¥202.69 million.

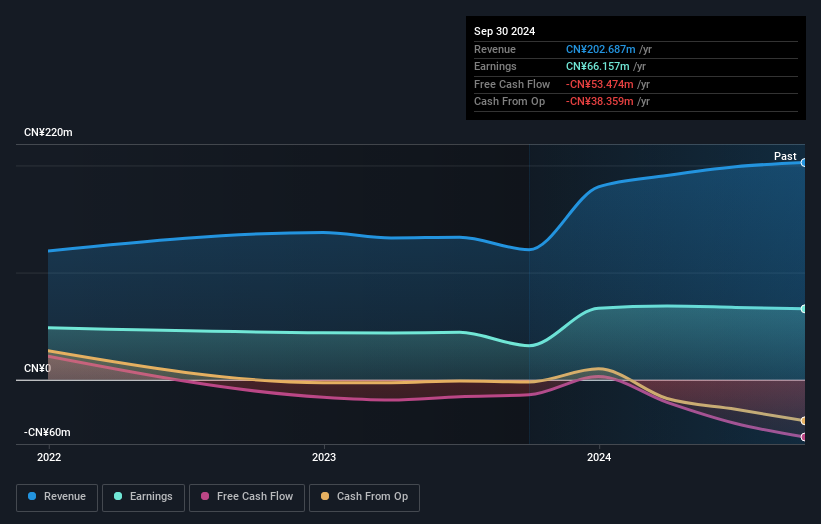

Shandong Cvicse Middleware, a small player in the software industry, has shown impressive earnings growth of 108% over the past year, outpacing its industry peers who saw an 11% decrease. With no debt on its books now compared to a debt-to-equity ratio of 1.4 five years ago, it navigates financial waters with ease. Despite this progress, free cash flow remains negative at US$53 million as of September 2024. Its price-to-earnings ratio stands attractively at 43x against an industry average of 94x. Recent events include a shareholders meeting scheduled for December and an earnings call last November.

- Dive into the specifics of Shandong Cvicse MiddlewareLtd here with our thorough health report.

Gain insights into Shandong Cvicse MiddlewareLtd's past trends and performance with our Past report.

Shanghai Kaibao PharmaceuticalLtd (SZSE:300039)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Kaibao Pharmaceutical Co., Ltd focuses on the research, development, production, and sale of modern Chinese medicines primarily in China, with a market capitalization of CN¥6.74 billion.

Operations: Shanghai Kaibao Pharmaceutical Co., Ltd generates revenue primarily from its industry segment, amounting to CN¥1.56 billion. The company's financial performance is influenced by various factors, including a segment adjustment of CN¥3.03 million.

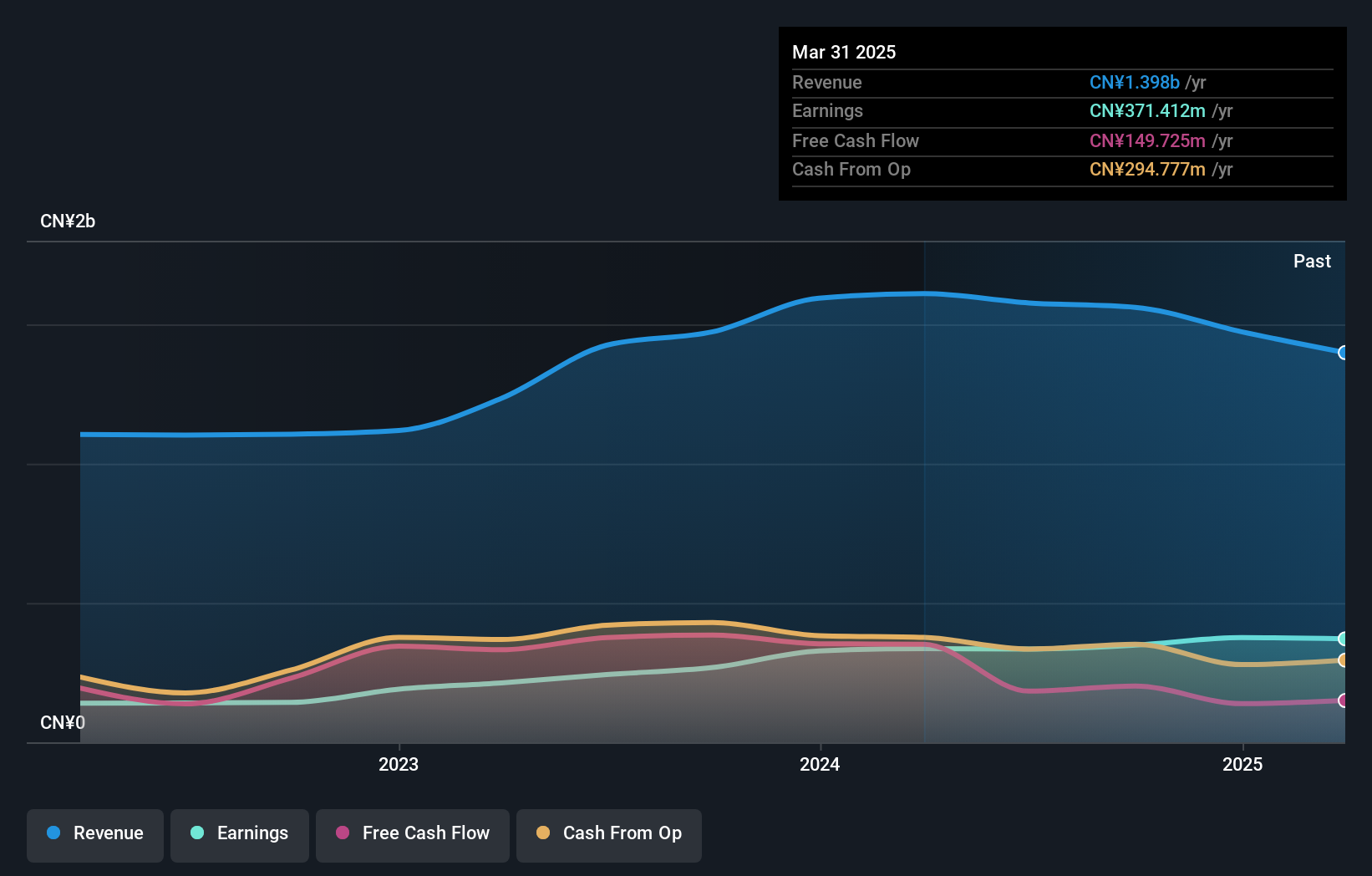

Shanghai Kaibao Pharmaceutical showcases a promising profile with its earnings growth of 30% over the past year, outpacing the broader Pharmaceuticals industry. The company is in a solid financial position, having more cash than total debt and maintaining high-quality earnings. Its price-to-earnings ratio of 19.3x offers an attractive valuation compared to the CN market's average of 36.3x, suggesting potential undervaluation. With free cash flow remaining positive and interest payments well covered by profits, Shanghai Kaibao seems positioned for stability within its sector despite a slight increase in debt to equity from 0% to 0.08% over five years.

Turning Ideas Into Actions

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4706 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688695

Shandong Cvicse MiddlewareLtd

Provides basic software middleware products in China.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives