- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A183300

Earnings Tell The Story For KoMiCo Ltd. (KOSDAQ:183300) As Its Stock Soars 30%

KoMiCo Ltd. (KOSDAQ:183300) shareholders have had their patience rewarded with a 30% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

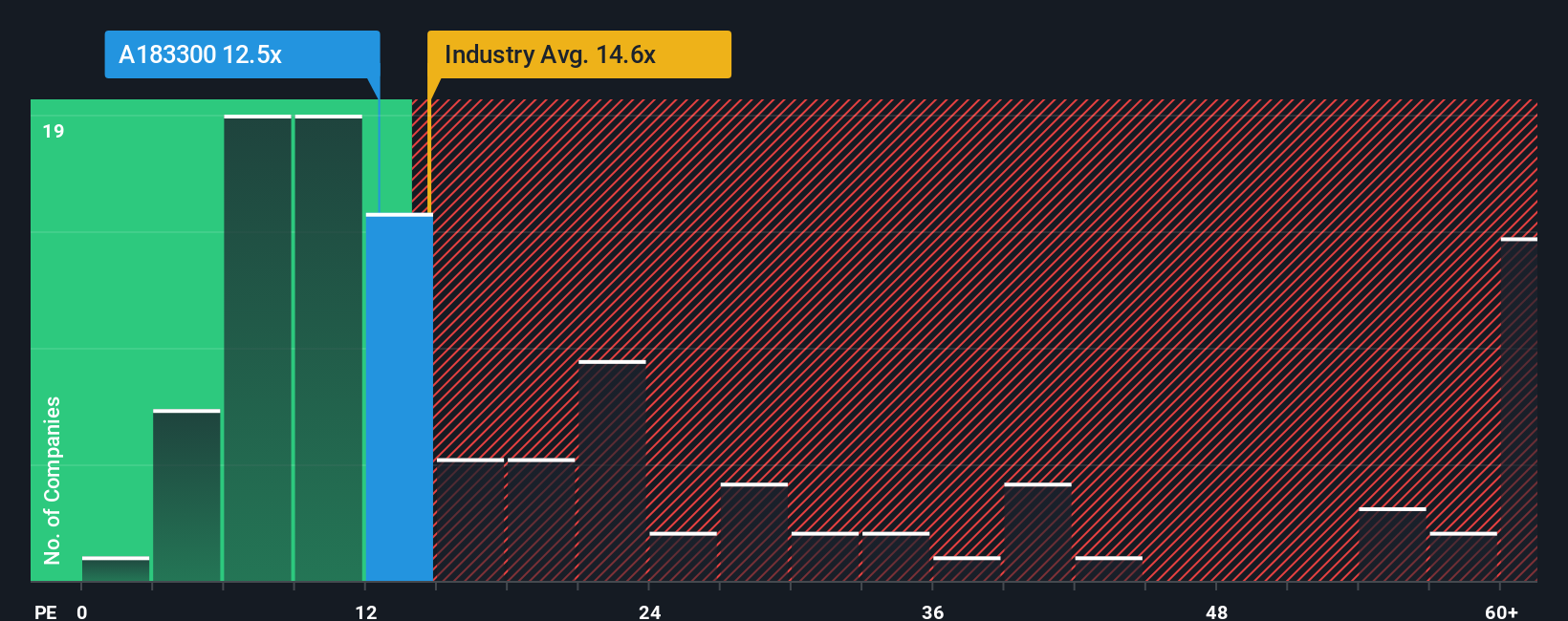

Although its price has surged higher, it's still not a stretch to say that KoMiCo's price-to-earnings (or "P/E") ratio of 12.5x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

KoMiCo certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for KoMiCo

How Is KoMiCo's Growth Trending?

In order to justify its P/E ratio, KoMiCo would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 51%. The latest three year period has also seen a 14% overall rise in EPS, aided extensively by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to climb by 18% per annum during the coming three years according to the four analysts following the company. With the market predicted to deliver 17% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that KoMiCo's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On KoMiCo's P/E

KoMiCo's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that KoMiCo maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Having said that, be aware KoMiCo is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If you're unsure about the strength of KoMiCo's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if KoMiCo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A183300

KoMiCo

Provides semiconductor equipment cleaning and coating products in South Korea, the United States, China, Taiwan, and Singapore.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives