- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A171090

SUNIC SYSTEM Co., Ltd. (KOSDAQ:171090) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

The SUNIC SYSTEM Co., Ltd. (KOSDAQ:171090) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 77%, which is great even in a bull market.

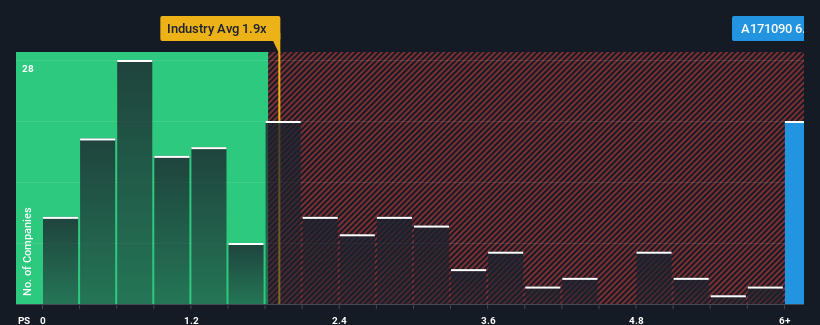

In spite of the heavy fall in price, given around half the companies in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider SUNIC SYSTEM as a stock to avoid entirely with its 6.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for SUNIC SYSTEM

How SUNIC SYSTEM Has Been Performing

SUNIC SYSTEM hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SUNIC SYSTEM.How Is SUNIC SYSTEM's Revenue Growth Trending?

In order to justify its P/S ratio, SUNIC SYSTEM would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 94% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 89% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that SUNIC SYSTEM's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

A significant share price dive has done very little to deflate SUNIC SYSTEM's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that SUNIC SYSTEM currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for SUNIC SYSTEM that you need to be mindful of.

If you're unsure about the strength of SUNIC SYSTEM's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A171090

SUNIC SYSTEM

Manufactures and sells OLED deposition equipment and semiconductor vacuum equipment in Korea.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives