- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A159010

Positive Sentiment Still Eludes ASFLOW Co., LTD. (KOSDAQ:159010) Following 30% Share Price Slump

Unfortunately for some shareholders, the ASFLOW Co., LTD. (KOSDAQ:159010) share price has dived 30% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 48% in that time.

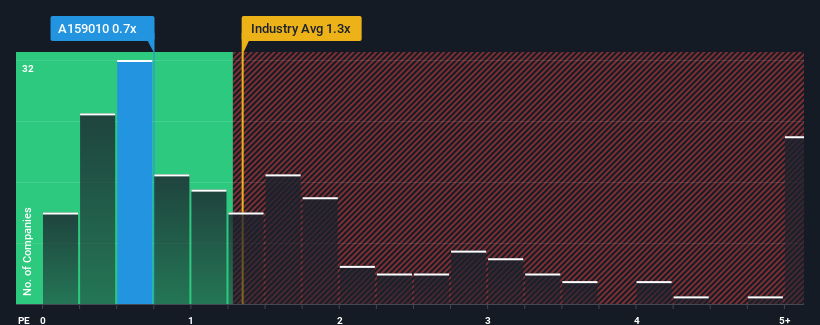

Even after such a large drop in price, given about half the companies operating in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider ASFLOW as an attractive investment with its 0.7x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for ASFLOW

What Does ASFLOW's P/S Mean For Shareholders?

ASFLOW could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ASFLOW.How Is ASFLOW's Revenue Growth Trending?

ASFLOW's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 67% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 67% as estimated by the only analyst watching the company. With the industry predicted to deliver 62% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that ASFLOW's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From ASFLOW's P/S?

ASFLOW's recently weak share price has pulled its P/S back below other Semiconductor companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for ASFLOW remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You need to take note of risks, for example - ASFLOW has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A159010

ASFLOW

Provides filters, piping module, and semiconductor equipment in South Korea.

Good value with mediocre balance sheet.

Market Insights

Community Narratives