- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A089030

Market Participants Recognise Techwing, Inc.'s (KOSDAQ:089030) Revenues Pushing Shares 25% Higher

Techwing, Inc. (KOSDAQ:089030) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last 30 days were the cherry on top of the stock's 314% gain in the last year, which is nothing short of spectacular.

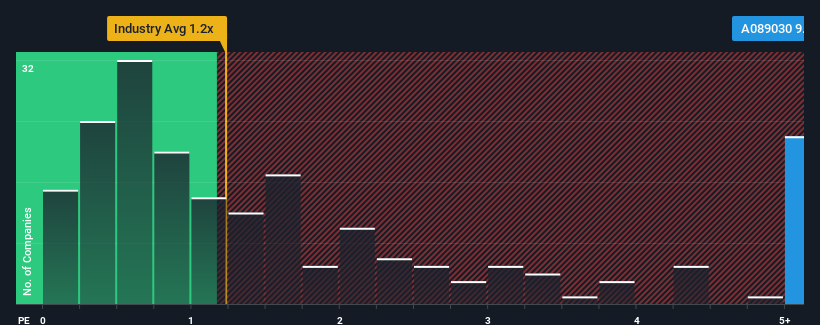

Since its price has surged higher, given around half the companies in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Techwing as a stock to avoid entirely with its 9.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Techwing

What Does Techwing's Recent Performance Look Like?

Techwing could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Techwing.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Techwing would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 25% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 162% as estimated by the two analysts watching the company. With the industry only predicted to deliver 45%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Techwing's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Techwing's P/S Mean For Investors?

Techwing's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Techwing maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Techwing (1 is a bit unpleasant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Techwing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A089030

Techwing

Develops, manufactures, sells, and services semiconductor inspection equipment in South Korea and internationally.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives