- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A067310

HANA Micron Inc. (KOSDAQ:067310) Looks Inexpensive After Falling 28% But Perhaps Not Attractive Enough

HANA Micron Inc. (KOSDAQ:067310) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

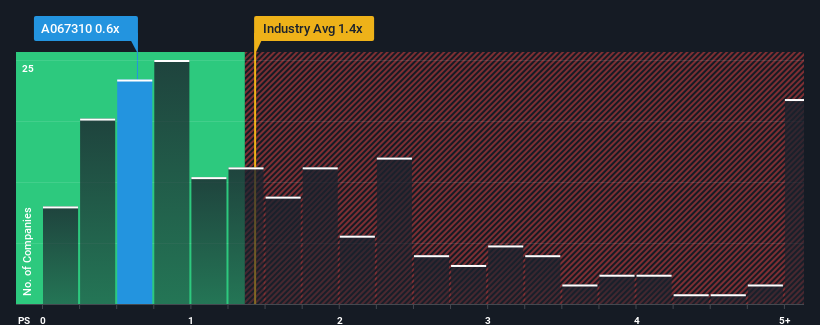

Following the heavy fall in price, considering around half the companies operating in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider HANA Micron as an solid investment opportunity with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for HANA Micron

How Has HANA Micron Performed Recently?

HANA Micron could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HANA Micron.How Is HANA Micron's Revenue Growth Trending?

HANA Micron's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. This was backed up an excellent period prior to see revenue up by 75% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 44% as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 70% growth forecast for the broader industry.

With this in consideration, its clear as to why HANA Micron's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

HANA Micron's recently weak share price has pulled its P/S back below other Semiconductor companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of HANA Micron's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for HANA Micron that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HANA Micron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A067310

HANA Micron

Provides semiconductor back-end process packaging solutions in South Korea.

Undervalued with high growth potential.

Market Insights

Community Narratives