- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A064760

Tokai Carbon Korea Co., Ltd.'s (KOSDAQ:064760) Shares Climb 38% But Its Business Is Yet to Catch Up

Tokai Carbon Korea Co., Ltd. (KOSDAQ:064760) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 24% is also fairly reasonable.

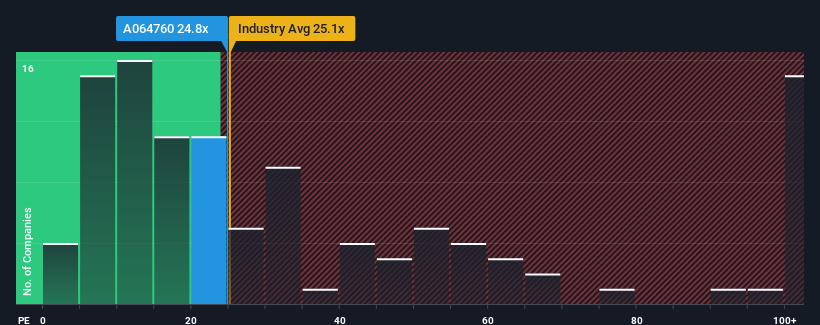

Since its price has surged higher, Tokai Carbon Korea's price-to-earnings (or "P/E") ratio of 24.8x might make it look like a strong sell right now compared to the market in Korea, where around half of the companies have P/E ratios below 13x and even P/E's below 7x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Tokai Carbon Korea has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Tokai Carbon Korea

How Is Tokai Carbon Korea's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Tokai Carbon Korea's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 35%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 19% over the next year. With the market predicted to deliver 31% growth , the company is positioned for a weaker earnings result.

In light of this, it's alarming that Tokai Carbon Korea's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

The strong share price surge has got Tokai Carbon Korea's P/E rushing to great heights as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Tokai Carbon Korea currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 1 warning sign for Tokai Carbon Korea that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tokai Carbon Korea might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A064760

Tokai Carbon Korea

Produces and sells various parts and components for the semiconductor, light emitting diode (LED), and solar industries in South Korea.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success