- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A053610

With A 25% Price Drop For Protec Co., Ltd. (KOSDAQ:053610) You'll Still Get What You Pay For

Protec Co., Ltd. (KOSDAQ:053610) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 56% in the last year.

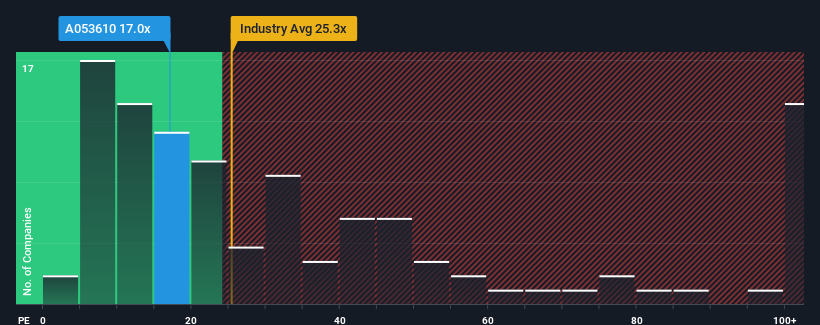

Although its price has dipped substantially, given around half the companies in Korea have price-to-earnings ratios (or "P/E's") below 13x, you may still consider Protec as a stock to potentially avoid with its 17x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Protec has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Protec

How Is Protec's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Protec's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 49% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 98% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 51% as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 29%, which is noticeably less attractive.

With this information, we can see why Protec is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Protec's P/E?

Protec's P/E hasn't come down all the way after its stock plunged. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Protec's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Protec that you need to be mindful of.

If you're unsure about the strength of Protec's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A053610

Protec

Manufactures and sells semiconductor packaging equipment and automated pneumatic parts in South Korea.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives