- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A052900

Update: KMH Hitech (KOSDAQ:052900) Stock Gained 64% In The Last Three Years

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, the KMH Hitech Co., Ltd. (KOSDAQ:052900) share price is up 64% in the last three years, clearly besting the market return of around 26% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 39% in the last year.

Check out our latest analysis for KMH Hitech

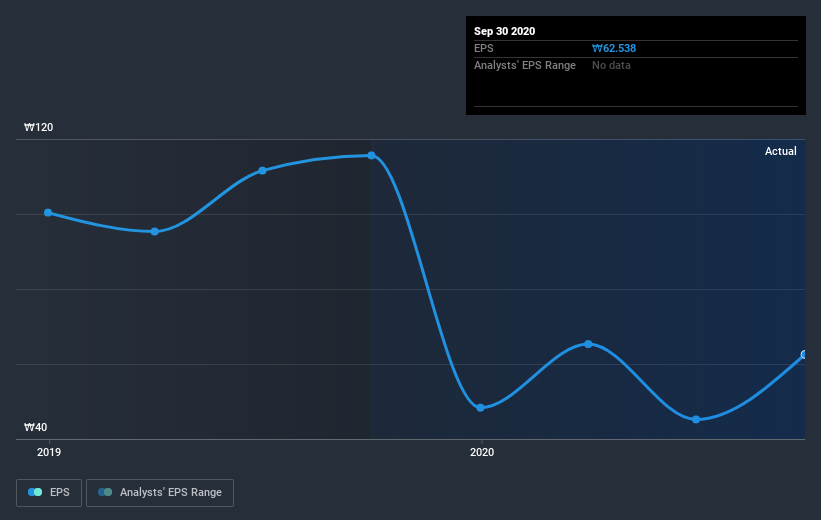

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, KMH Hitech achieved compound earnings per share growth of 14% per year. This EPS growth is lower than the 18% average annual increase in the share price. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. That's not necessarily surprising considering the three-year track record of earnings growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on KMH Hitech's earnings, revenue and cash flow.

A Different Perspective

While the market return was 43% in the last year, KMH Hitech returned 39% to shareholders. That's not at all bad, but the cherry on top is that it's an improvement on prior returns (since shareholders only made 18% yearly over the last three years). We're certainly happy to see the uptick and we hope the underlying business goes on to justify the improved valuation. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for KMH Hitech that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading KMH Hitech or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kx Hitech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A052900

Kx Hitech

Kx Hitech Co., Ltd. manufacture and sell semiconductor process materials.

Good value with adequate balance sheet.

Market Insights

Community Narratives