Stock Analysis

- South Korea

- /

- Personal Products

- /

- KOSE:A278470

EO Technics And 2 Other KRX Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The South Korean market has shown promising growth, climbing 1.7% in the last week and 4.5% over the past year, with earnings expected to grow by 29% annually. In such a buoyant environment, stocks like EO Technics that boast high insider ownership can be particularly compelling, as this often reflects a strong belief by those closest to the company in its future prospects.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| SamyoungLtd (KOSE:A003720) | 25% | 30.4% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.9% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's take a closer look at a couple of our picks from the screened companies.

EO Technics (KOSDAQ:A039030)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EO Technics Co., Ltd. is a global manufacturer and supplier of laser processing equipment, with a market capitalization of approximately ₩2.37 billion.

Operations: The firm operates primarily in the laser processing equipment sector, generating revenue globally.

Insider Ownership: 30.7%

Earnings Growth Forecast: 47% p.a.

EO Technics, a South Korean company, demonstrates strong growth potential with expected earnings to increase by 46.98% annually. Despite its highly volatile stock price and lower profit margins compared to last year (11% down from 16.4%), the firm's revenue growth at 19.9% per year outpaces the national market average (10.5%). However, its forecasted Return on Equity in three years is relatively low at 15.8%, and large one-off items have affected financial results, indicating some concerns about earnings quality.

- Click here and access our complete growth analysis report to understand the dynamics of EO Technics.

- According our valuation report, there's an indication that EO Technics' share price might be on the expensive side.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across various regions including South Korea, the United States, Asia, the Middle East, and Europe with a market cap of approximately ₩3.41 trillion.

Operations: The company generates revenue through its involvement in heavy industry, machinery manufacturing, and apartment construction across various global markets.

Insider Ownership: 34.3%

Earnings Growth Forecast: 72.9% p.a.

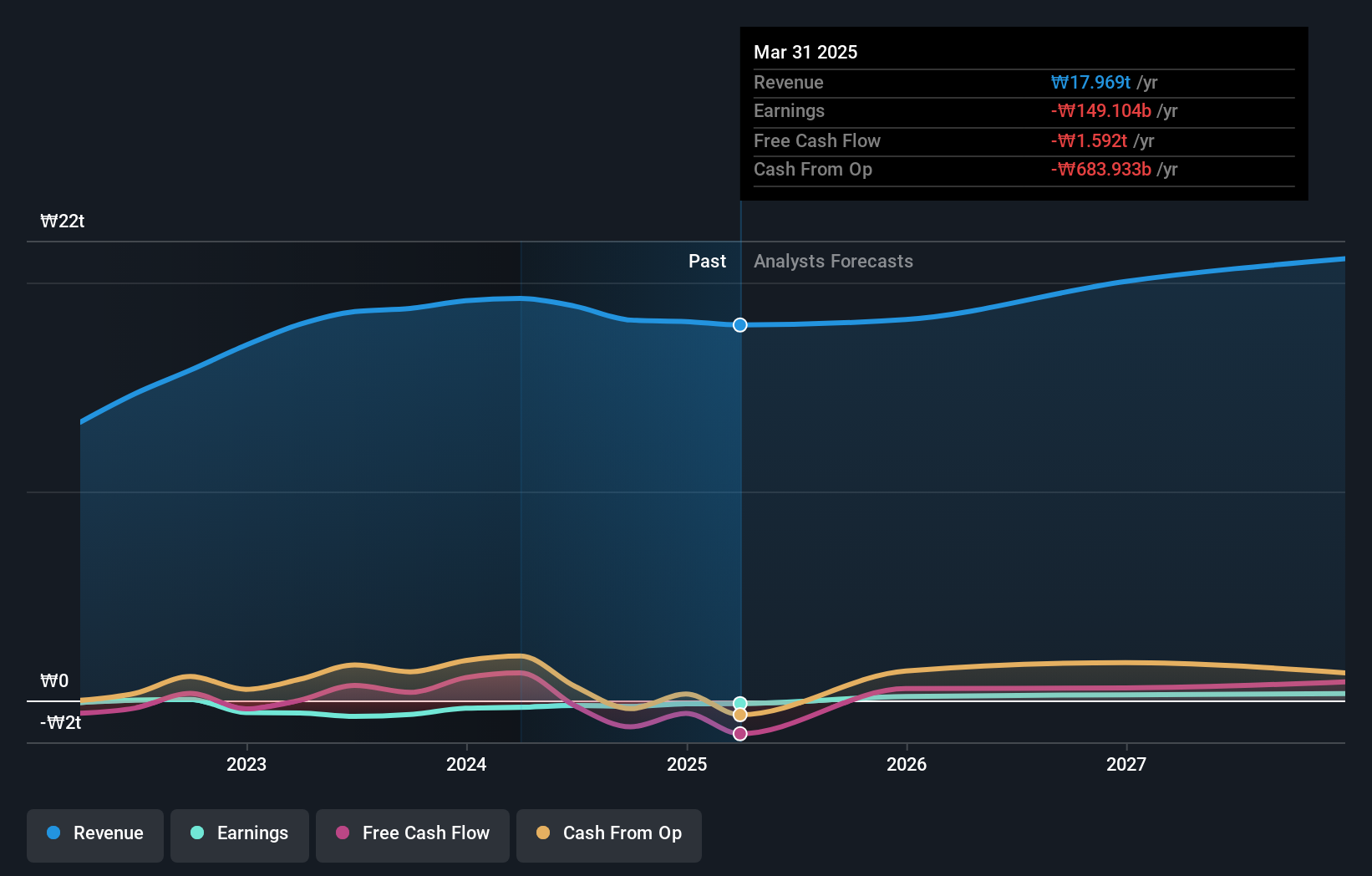

Doosan Corporation has shown a significant turnaround, moving from a net loss to posting KRW 4.98 billion in net income as of Q1 2024. Despite this recovery, its annual revenue growth rate of 3.6% lags behind the South Korean market average of 10.5%. Looking ahead, Doosan is expected to become profitable within three years with a notably high forecasted Return on Equity of 22.2%. However, there has been no substantial insider trading activity reported in the past three months.

- Unlock comprehensive insights into our analysis of Doosan stock in this growth report.

- Our comprehensive valuation report raises the possibility that Doosan is priced lower than what may be justified by its financials.

APR (KOSE:A278470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd, operating under the ticker KOSE:A278470, is a company that manufactures and sells cosmetic products for both men and women, with a market capitalization of approximately ₩2.97 billion.

Operations: The firm generates its revenue from the sale of cosmetic products tailored for both male and female consumers.

Insider Ownership: 34.2%

Earnings Growth Forecast: 26.2% p.a.

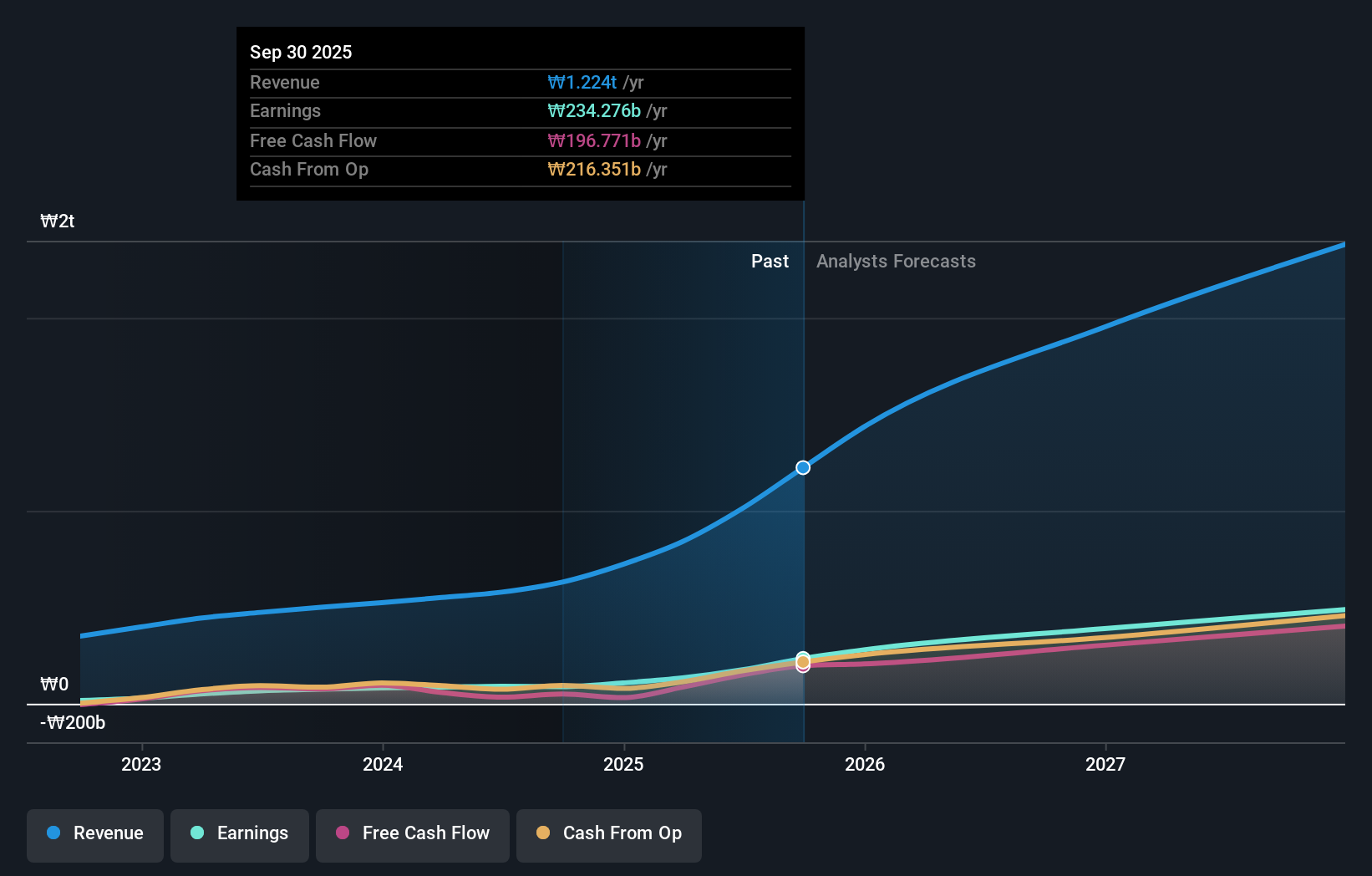

APR Co., Ltd. has demonstrated robust growth, with earnings increasing by 70.2% over the past year and forecasted revenue growth of 23.1% per year, surpassing the South Korean market average of 10.5%. Despite its earnings growth projection of 26.2% per year being slightly below the market rate of 28.9%, APR maintains a strong forecast Return on Equity at 34.8%. The company also benefits from high-quality non-cash earnings, indicating solid financial health without substantial insider selling recently reported.

- Click to explore a detailed breakdown of our findings in APR's earnings growth report.

- Our valuation report here indicates APR may be overvalued.

Where To Now?

- Access the full spectrum of 81 Fast Growing KRX Companies With High Insider Ownership by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether APR is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A278470

APR

APR Co.,Ltd manufactures and sells cosmetic products for men and women.

Flawless balance sheet with high growth potential.