- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A038880

What iA, Inc.'s (KOSDAQ:038880) 40% Share Price Gain Is Not Telling You

iA, Inc. (KOSDAQ:038880) shares have continued their recent momentum with a 40% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

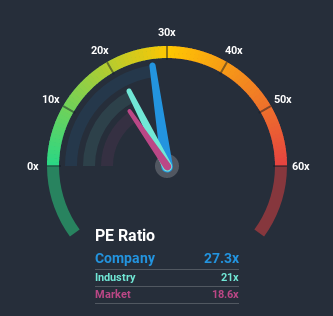

Since its price has surged higher, iA may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 27.3x, since almost half of all companies in Korea have P/E ratios under 18x and even P/E's lower than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been quite advantageous for iA as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for iA

How Is iA's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like iA's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 176% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that iA is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

iA's P/E is getting right up there since its shares have risen strongly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that iA currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - iA has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

When trading iA or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if iA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A038880

iA

Provides automotive semiconductor chips, modules, and solutions in Korea.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives