- South Korea

- /

- Entertainment

- /

- KOSDAQ:A035900

Top 3 KRX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In the last week, the South Korean market has stayed flat while the Materials sector gained 4.5%. With earnings forecasted to grow by 30% annually and a flat market over the past year, identifying growth companies with high insider ownership can offer unique investment opportunities.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.1% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| Park Systems (KOSDAQ:A140860) | 33% | 35.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

Let's uncover some gems from our specialized screener.

JYP Entertainment (KOSDAQ:A035900)

Simply Wall St Growth Rating: ★★★★☆☆

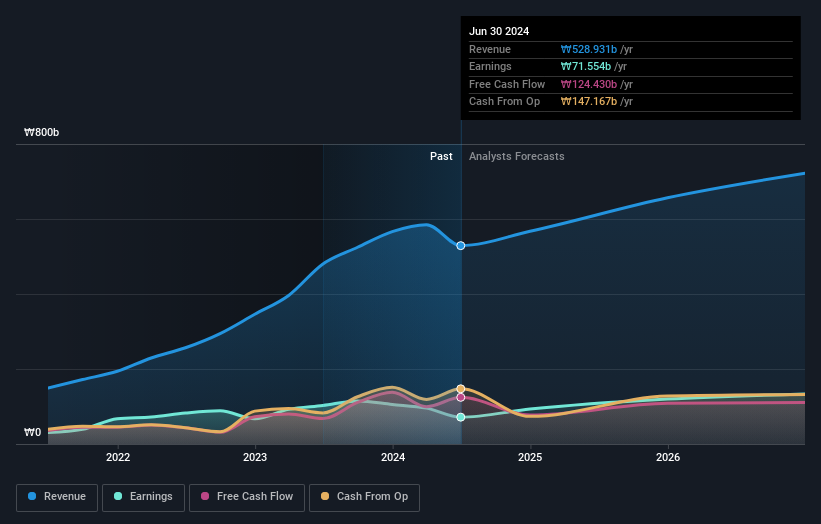

Overview: JYP Entertainment Corporation operates as an entertainment company in South Korea and internationally, with a market cap of approximately ₩1.67 trillion.

Operations: The company's revenue segments include Entertainment (₩456.35 billion), Music Publishing (₩12.07 billion), and Distribution and Sales (₩60.51 billion).

Insider Ownership: 17%

JYP Entertainment, a growth company with high insider ownership in South Korea, has its revenue forecasted to grow at 11.4% per year, which is faster than the market average of 10.5%. However, earnings are expected to grow at 21.9% per year, slower than the Korean market's average of 29.7%. The stock trades at a significant discount (55.9%) below its estimated fair value and analysts predict a potential price increase of 40.4%.

- Delve into the full analysis future growth report here for a deeper understanding of JYP Entertainment.

- Insights from our recent valuation report point to the potential undervaluation of JYP Entertainment shares in the market.

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Simply Wall St Growth Rating: ★★★★☆☆

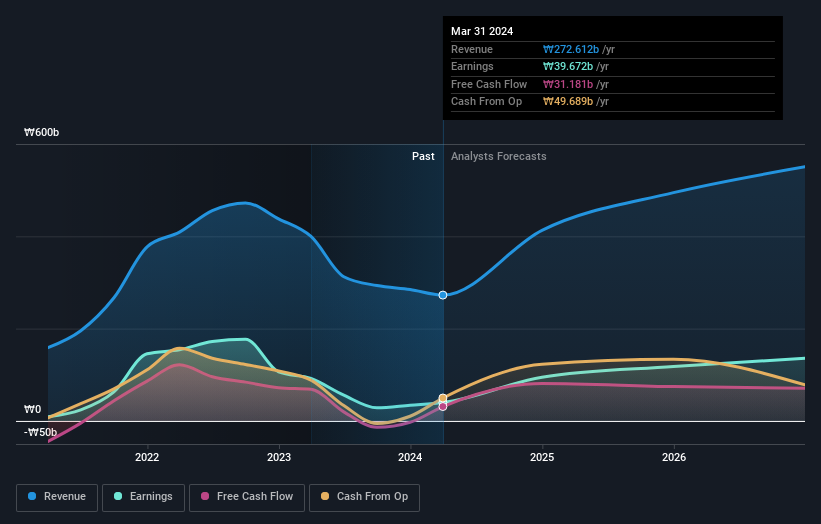

Overview: JUSUNG ENGINEERING Co.,Ltd. manufactures and sells semiconductor, display, solar, and lighting equipment in South Korea and internationally, with a market cap of ₩1.27 trillion.

Operations: The company's revenue segments include semiconductor equipment and services, generating ₩338.28 billion.

Insider Ownership: 36.9%

JUSUNG ENGINEERING Ltd. is trading 34.7% below its estimated fair value, suggesting potential undervaluation. Despite earnings forecasted to grow at 21.05% per year, which is slower than the Korean market's average of 29.7%, the company's revenue growth rate of 21.7% per year outpaces the market average of 10.5%. Although no significant insider trading activity has been reported in the last three months, past year earnings grew by a notable 43.5%.

- Dive into the specifics of JUSUNG ENGINEERINGLtd here with our thorough growth forecast report.

- The valuation report we've compiled suggests that JUSUNG ENGINEERINGLtd's current price could be quite moderate.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

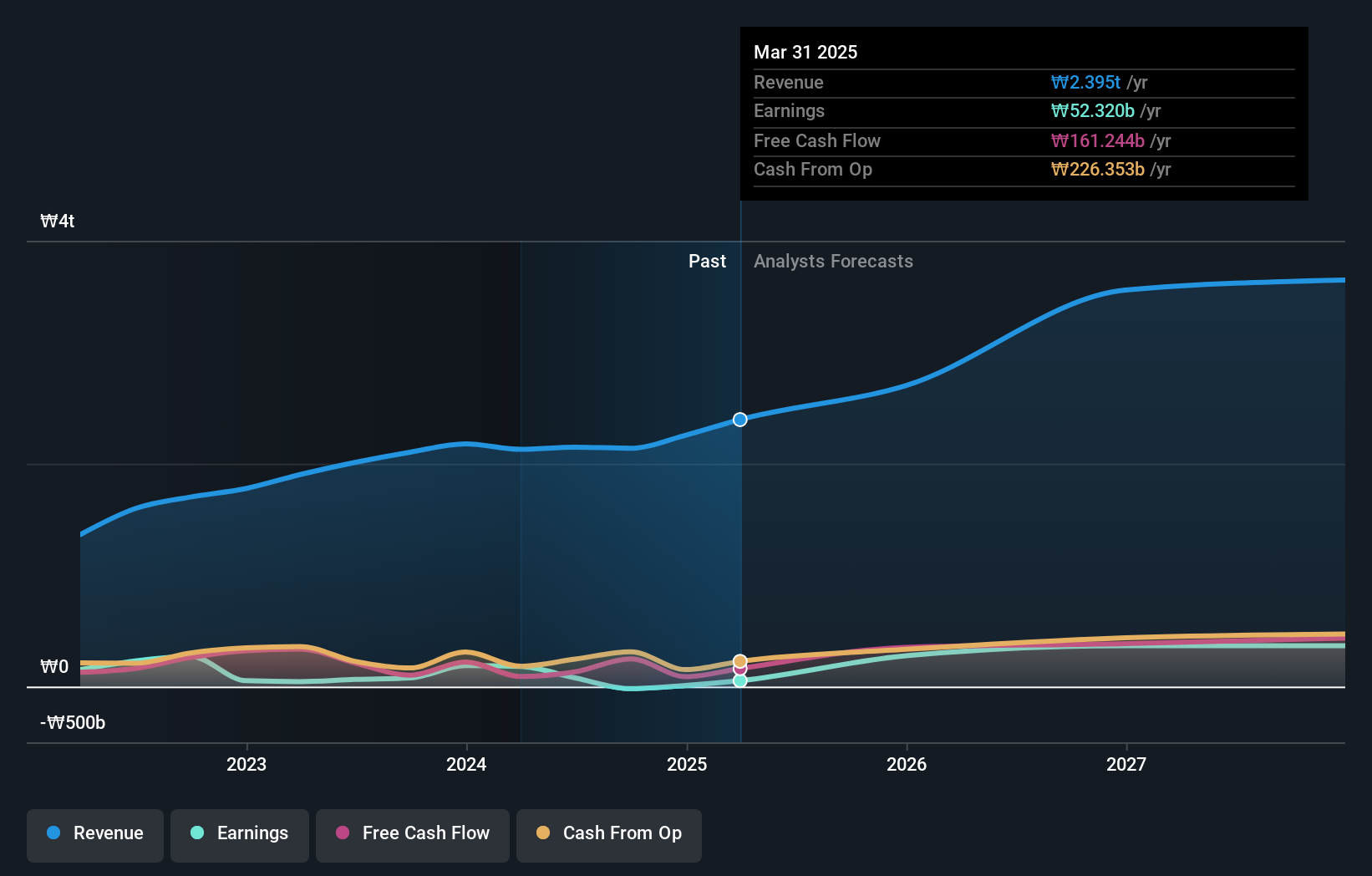

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management with a market cap of ₩7.03 trillion.

Operations: HYBE generates revenue from three main segments: Label (₩1.28 trillion), Platform (₩361.12 billion), and Solution (₩1.24 trillion).

Insider Ownership: 32.5%

HYBE's earnings are forecast to grow significantly at 42.23% annually, outpacing the Korean market average. Despite a lower revenue growth rate of 14%, it still exceeds the market's 10.5%. The stock trades at a 27.8% discount to its estimated fair value, and analysts predict a 51.9% price increase. Recent buybacks totaling KRW 26,092.38 million indicate confidence in future performance despite recent earnings declines due to large one-off items impacting results.

- Unlock comprehensive insights into our analysis of HYBE stock in this growth report.

- Our valuation report here indicates HYBE may be undervalued.

Taking Advantage

- Unlock our comprehensive list of 87 Fast Growing KRX Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A035900

JYP Entertainment

Operates as an entertainment company in South Korea and internationally.

Flawless balance sheet and good value.