- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A033160

Why Investors Shouldn't Be Surprised By MK Electron Co., Ltd.'s (KOSDAQ:033160) 25% Share Price Plunge

The MK Electron Co., Ltd. (KOSDAQ:033160) share price has fared very poorly over the last month, falling by a substantial 25%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 50% share price drop.

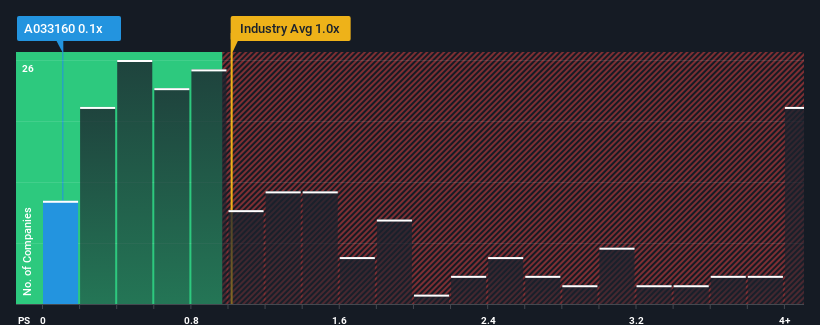

Following the heavy fall in price, considering around half the companies operating in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") above 1x, you may consider MK Electron as an solid investment opportunity with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for MK Electron

How Has MK Electron Performed Recently?

Revenue has risen firmly for MK Electron recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on MK Electron will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For MK Electron?

In order to justify its P/S ratio, MK Electron would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. Revenue has also lifted 24% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 47% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that MK Electron's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On MK Electron's P/S

MK Electron's recently weak share price has pulled its P/S back below other Semiconductor companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of MK Electron revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

You need to take note of risks, for example - MK Electron has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A033160

MK Electron

Develops, manufactures, and markets semiconductor materials in Korea, Taiwan, China, and Southeast Asia.

Slightly overvalued unattractive dividend payer.

Market Insights

Community Narratives