Stock Analysis

- South Korea

- /

- Biotech

- /

- KOSDAQ:A228760

KRX Stocks Estimated To Be Trading Below Intrinsic Values In June 2024

Reviewed by Simply Wall St

The South Korean market has shown robust growth, with a 5.2% increase over the past year and the Utilities sector alone gaining 3.0%. In this environment of promising earnings growth, estimated at 29% per annum, stocks trading below their intrinsic values present potentially attractive opportunities for investors seeking value in an appreciating market.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Poongsan Holdings (KOSE:A005810) | ₩27950.00 | ₩49329.24 | 43.3% |

| Solum (KOSE:A248070) | ₩20800.00 | ₩39870.77 | 47.8% |

| Protec (KOSDAQ:A053610) | ₩29050.00 | ₩55289.53 | 47.5% |

| Caregen (KOSDAQ:A214370) | ₩22650.00 | ₩43428.59 | 47.8% |

| Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49635.61 | 49.8% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩57600.00 | ₩107926.62 | 46.6% |

| IMLtd (KOSDAQ:A101390) | ₩7000.00 | ₩13599.72 | 48.5% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩78800.00 | ₩137549.91 | 42.7% |

| NEXON Games (KOSDAQ:A225570) | ₩14710.00 | ₩25839.20 | 43.1% |

Let's review some notable picks from our screened stocks

Genomictree (KOSDAQ:A228760)

Overview: Genomictree Inc. is a South Korean biomarker-based molecular diagnostics company that focuses on developing and commercializing products for detecting cancer and various infectious diseases, with a market capitalization of approximately ₩521.61 billion.

Operations: The company generates revenue primarily through its Cancer Molecular Diagnosis segment, which brought in ₩1.86 billion, and its Genomic Analysis segment, contributing ₩0.68 billion.

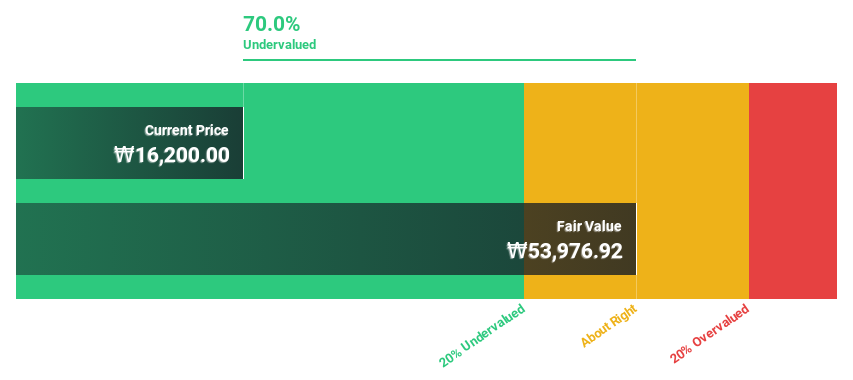

Estimated Discount To Fair Value: 38.1%

Genomictree is currently trading at ₩21,750, significantly below the estimated fair value of ₩35,165.43, marking it as undervalued by over 20%. Despite a highly volatile share price recently, its earnings are expected to grow by 98.46% annually. Revenue growth is also strong at an expected rate of 81% per year. However, challenges include a low forecasted return on equity at 3.7% and recent shareholder dilution. The company's revenue stands at ₩3 billion and is projected to become profitable within three years.

- Our expertly prepared growth report on Genomictree implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Genomictree stock in this financial health report.

Hotel ShillaLtd (KOSE:A008770)

Overview: Hotel Shilla Co., Ltd operates as a hospitality company in South Korea and internationally, with a market capitalization of approximately ₩2.07 trillion.

Operations: The company generates its revenue from hospitality services both domestically and internationally.

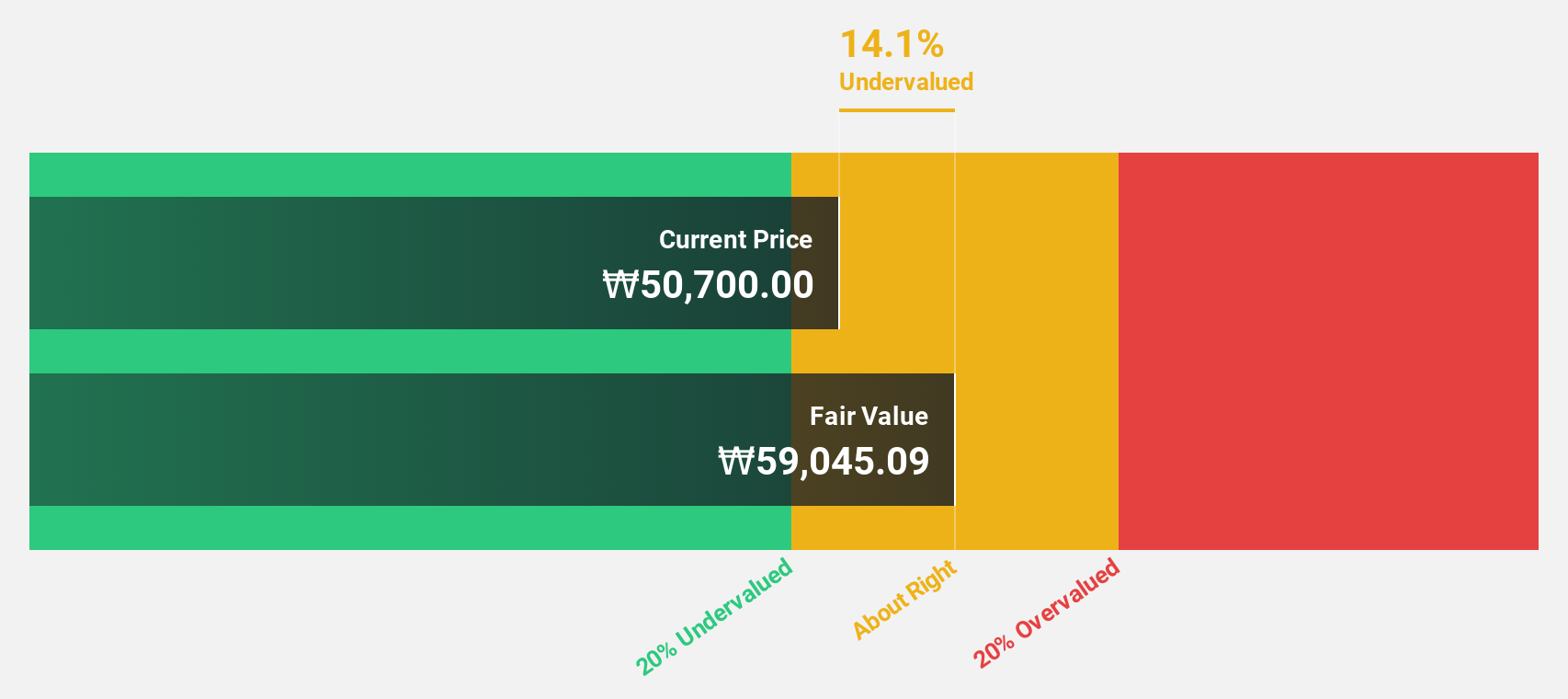

Estimated Discount To Fair Value: 20.5%

Hotel Shilla Co., Ltd is identified as undervalued based on discounted cash flow analysis, trading at ₩55,000 against a fair value of ₩69,198.47. Its earnings are expected to grow by 47.71% annually over the next three years, outpacing the South Korean market's growth. Despite this strong growth projection and a significant undervaluation, concerns arise from its financial position where interest payments are poorly covered by earnings and one-off items significantly impacting results. Additionally, its return on equity is predicted to remain low at 19.8% in three years.

- Our growth report here indicates Hotel ShillaLtd may be poised for an improving outlook.

- Navigate through the intricacies of Hotel ShillaLtd with our comprehensive financial health report here.

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on the development of drugs for central nervous system disorders, with a market capitalization of approximately ₩6.17 billion.

Operations: The company generates revenue primarily through the development and sale of pharmaceuticals targeting central nervous system disorders.

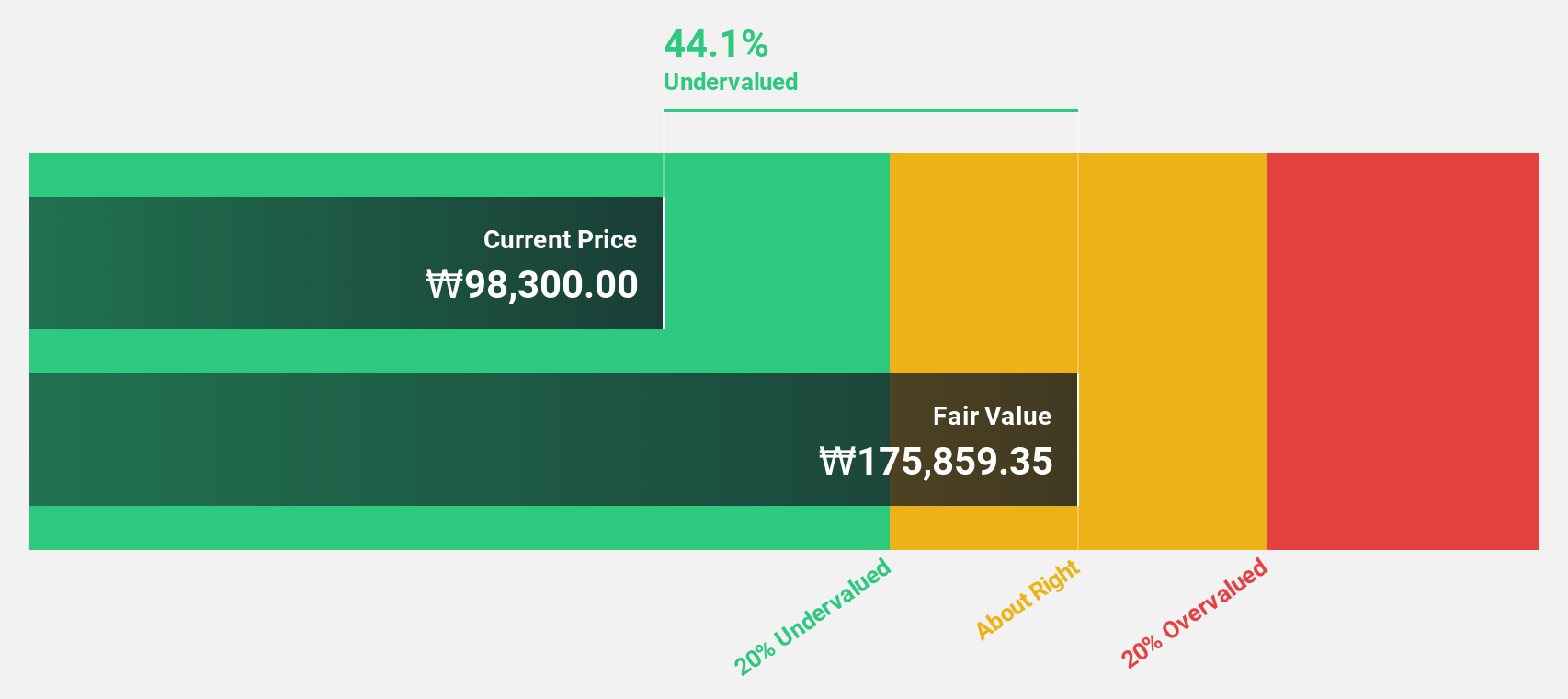

Estimated Discount To Fair Value: 42.7%

SK Biopharmaceuticals Co., Ltd. is significantly undervalued, with its current price at ₩78,800 well below the fair value estimate of ₩137,549.91. The company's revenue growth is robust at 22.2% per year, outstripping the South Korean market forecast of 10.5%. Expected to turn profitable within three years, its earnings are projected to surge by 85.33% annually. However, it's important to note that while return on equity is anticipated to be high at 33.6%, this financial metric will only materialize over a similar timeframe.

- In light of our recent growth report, it seems possible that SK Biopharmaceuticals' financial performance will exceed current levels.

- Take a closer look at SK Biopharmaceuticals' balance sheet health here in our report.

Next Steps

- Take a closer look at our Undervalued KRX Stocks Based On Cash Flows list of 34 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Genomictree is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A228760

Genomictree

A biomarker-based molecular diagnostics company, develops and commercializes molecular diagnostic products for the detection of cancer and various infectious diseases.

High growth potential with excellent balance sheet.