- South Korea

- /

- Semiconductors

- /

- KOSE:A000660

KRX Value Stocks Trading Below Estimated Worth In August 2024

Reviewed by Simply Wall St

The South Korean market has remained flat over the last week, with the Financials sector gaining 4.1%, and is up 3.4% over the past year, while earnings are forecast to grow by 29% annually. In this context, identifying undervalued stocks—those trading below their estimated worth—can offer significant opportunities for investors looking to capitalize on potential growth in a stable market environment.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| C&C International (KOSDAQ:A352480) | ₩114400.00 | ₩201579.29 | 43.2% |

| Samwha ElectricLtd (KOSE:A009470) | ₩50000.00 | ₩92050.06 | 45.7% |

| Samyang Foods (KOSE:A003230) | ₩617000.00 | ₩1086674.02 | 43.2% |

| Tonymoly (KOSE:A214420) | ₩9880.00 | ₩19080.88 | 48.2% |

| Jeisys Medical (KOSDAQ:A287410) | ₩12920.00 | ₩23814.37 | 45.7% |

| TSE (KOSDAQ:A131290) | ₩49900.00 | ₩94070.36 | 47% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩55400.00 | ₩109525.00 | 49.4% |

| CS Wind (KOSE:A112610) | ₩47650.00 | ₩87809.03 | 45.7% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩87100.00 | ₩170336.89 | 48.9% |

We'll examine a selection from our screener results.

iFamilySC (KOSDAQ:A114840)

Overview: iFamilySC Co., Ltd. is an interactive branding company that connects content and products both online and offline in South Korea and internationally, with a market cap of ₩571.96 billion.

Operations: The company's revenue segments include the Cosmetics Business Division, generating ₩168.68 billion, and the Wedding Business Sector, Etc., contributing ₩4.57 billion.

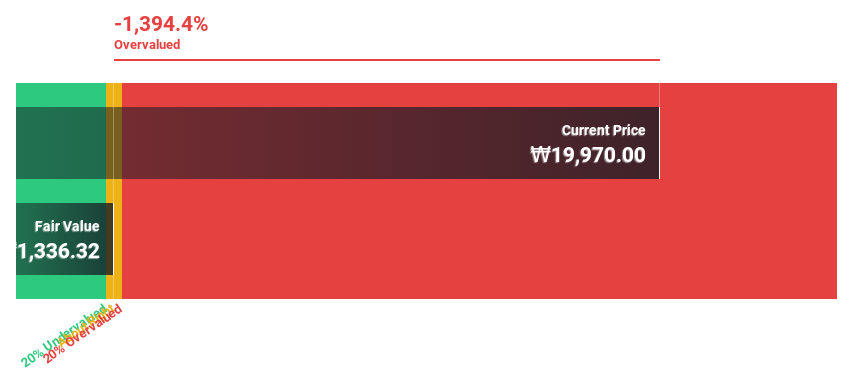

Estimated Discount To Fair Value: 14.9%

iFamilySC is trading at ₩33,250, below its estimated fair value of ₩39,079.54. The company's earnings grew by 160.4% over the past year and are forecast to grow significantly at 26.83% annually over the next three years. Despite high share price volatility recently, iFamilySC has announced a KRW 3 billion share repurchase program to enhance shareholder value, indicating management's confidence in its undervaluation based on cash flows.

- According our earnings growth report, there's an indication that iFamilySC might be ready to expand.

- Dive into the specifics of iFamilySC here with our thorough financial health report.

SK hynix (KOSE:A000660)

Overview: SK hynix Inc., with a market cap of ₩133.91 trillion, manufactures, distributes, and sells semiconductor products across Korea, China, the rest of Asia, the United States, and Europe.

Operations: Revenue segments for SK hynix Inc. include ₩22.41 trillion from DRAM, ₩6.08 trillion from NAND Flash, and ₩1.15 trillion from others such as MCP (Multi-Chip Package) and CIS (CMOS Image Sensor).

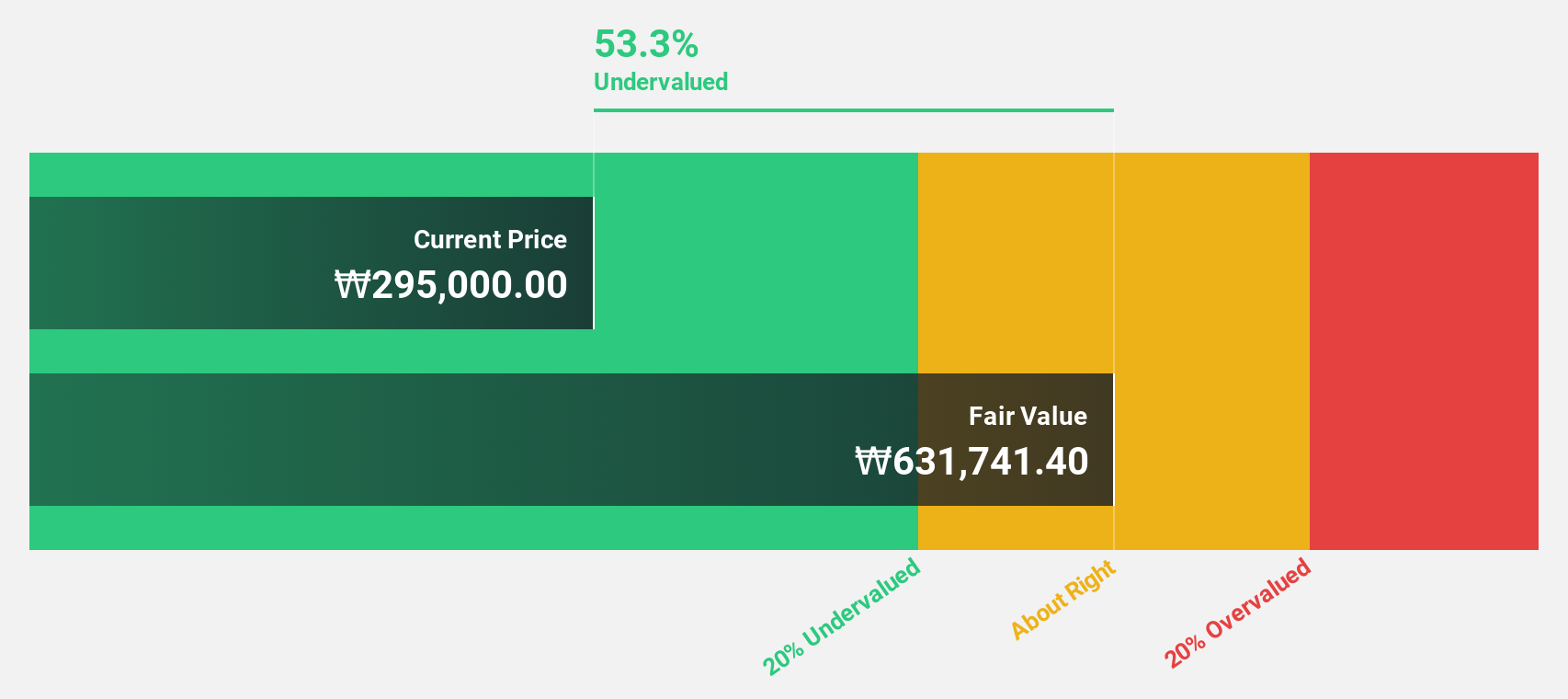

Estimated Discount To Fair Value: 22.4%

SK hynix is trading at ₩194,600, significantly below its estimated fair value of ₩250,904.96. Recent product advancements like the GDDR7 graphics memory and PCB01 SSD for AI PCs highlight the company's innovative edge. Analysts forecast a 25.4% annual revenue growth and expect profitability within three years, outpacing market averages. Despite high share price volatility, SK hynix's strong cash flows and upcoming product launches position it as an undervalued stock with substantial growth potential in South Korea's tech sector.

- The growth report we've compiled suggests that SK hynix's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of SK hynix.

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a pharmaceutical company that manufactures and sells pharmaceutical products in South Korea and internationally, with a market cap of ₩1.79 billion.

Operations: The company's revenue segments include the manufacture and sale of pharmaceutical products both domestically and internationally.

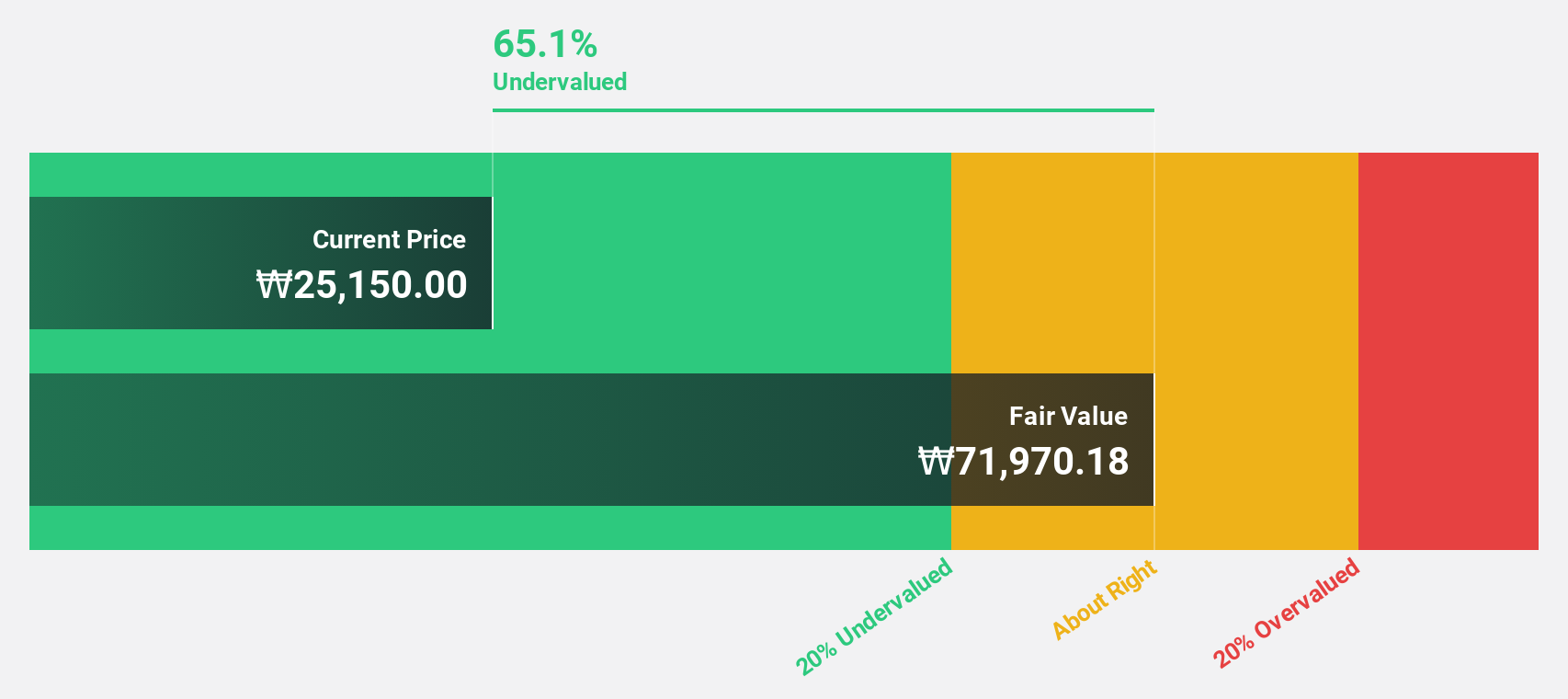

Estimated Discount To Fair Value: 19.1%

Hanall Biopharma is trading at ₩35,400, below its estimated fair value of ₩43,781.27. The company recently appointed Christopher W. Slavinsky as Chief Business Development and Legal Officer to enhance strategic growth. Despite a net loss reduction from KRW 1,253.56 million to KRW 323.32 million year-over-year in Q1 2024, Hanall's ongoing Phase III VELOS-4 study for tanfanercept in dry eye treatment underscores its potential for future revenue growth and market positioning improvements based on cash flows.

- Our earnings growth report unveils the potential for significant increases in Hanall Biopharma's future results.

- Click to explore a detailed breakdown of our findings in Hanall Biopharma's balance sheet health report.

Where To Now?

- Investigate our full lineup of 34 Undervalued KRX Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000660

SK hynix

Engages in the manufacture, distribution, and sale of semiconductor products in Korea, China, rest of Asia, the United States, and Europe.

Exceptional growth potential and undervalued.