- South Korea

- /

- Specialty Stores

- /

- KOSDAQ:A069920

ISE Commerce (KOSDAQ:069920) Share Prices Have Dropped 51% In The Last Five Years

Generally speaking long term investing is the way to go. But no-one is immune from buying too high. To wit, the ISE Commerce Company Limited (KOSDAQ:069920) share price managed to fall 51% over five long years. That is extremely sub-optimal, to say the least. On the other hand the share price has bounced 6.7% over the last week.

Check out our latest analysis for ISE Commerce

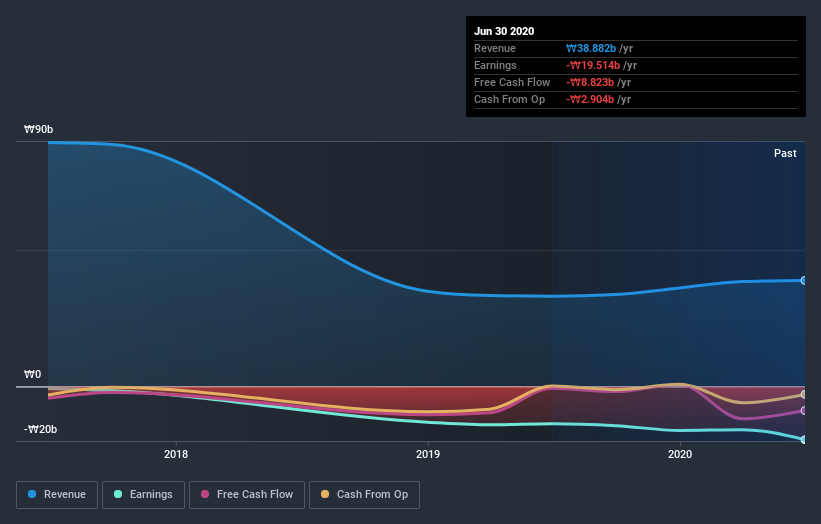

Given that ISE Commerce didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years ISE Commerce saw its revenue shrink by 12% per year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 9% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on ISE Commerce's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 27% in the last year, ISE Commerce shareholders lost 5.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 9% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand ISE Commerce better, we need to consider many other factors. Even so, be aware that ISE Commerce is showing 3 warning signs in our investment analysis , and 2 of those are a bit concerning...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading ISE Commerce or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Exion Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A069920

Exion Group

Operates in the fashion business in South Korea, China, the United States, Japan, and internationally.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives