- South Korea

- /

- Biotech

- /

- KOSE:A006280

GC Biopharma Corp.'s (KRX:006280) Business And Shares Still Trailing The Industry

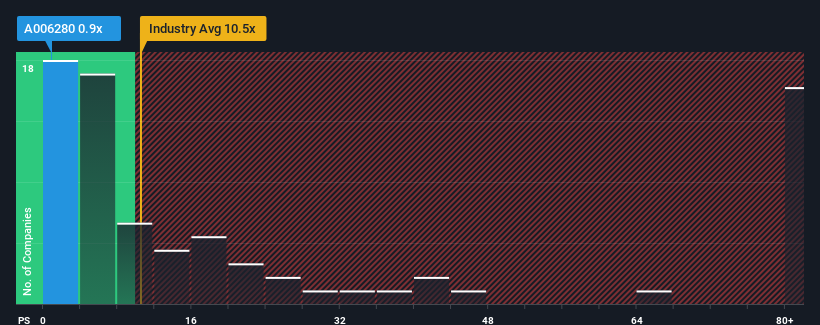

You may think that with a price-to-sales (or "P/S") ratio of 0.9x GC Biopharma Corp. (KRX:006280) is definitely a stock worth checking out, seeing as almost half of all the Biotechs companies in Korea have P/S ratios greater than 10.5x and even P/S above 40x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for GC Biopharma

What Does GC Biopharma's P/S Mean For Shareholders?

GC Biopharma hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on GC Biopharma will help you uncover what's on the horizon.How Is GC Biopharma's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as GC Biopharma's is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.1%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 5.4% over the next year. That's shaping up to be materially lower than the 39% growth forecast for the broader industry.

In light of this, it's understandable that GC Biopharma's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On GC Biopharma's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of GC Biopharma's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for GC Biopharma (1 is potentially serious!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A006280

GC Biopharma

A biopharmaceutical company, develops and sells pharmaceutical drugs in South Korea and internationally.

Fair value with questionable track record.

Similar Companies

Market Insights

Community Narratives