- South Korea

- /

- Auto Components

- /

- KOSE:A000240

Hankook And Two More Undiscovered Gems In South Korea

Reviewed by Simply Wall St

The South Korean stock market has recently experienced a positive trajectory, with the KOSPI index climbing significantly in consecutive sessions. Amidst this upward movement and global economic cues, investors might find potential in lesser-known stocks that could benefit from current market dynamics and broader economic activities. In such a vibrant market environment, identifying stocks with solid fundamentals yet lower visibility could offer interesting opportunities. These "undiscovered gems" may stand to gain as they capitalize on prevailing financial trends and sectoral growth within South Korea.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CYMECHS | 10.99% | 11.45% | 3.52% | ★★★★★★ |

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 0.40% | 27.17% | ★★★★★★ |

| Woori Technology Investment | NA | 22.60% | -1.67% | ★★★★★★ |

| Kyung Dong Navien | 26.97% | 11.54% | 19.49% | ★★★★★★ |

| Kyungdong Invest | 8.15% | 3.08% | 15.07% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 59.19% | 3.54% | 5.92% | ★★★★★★ |

| Hansae Yes24 Holdings | 97.82% | 2.74% | 18.89% | ★★★★★☆ |

| Daewon Cable | 24.70% | 8.50% | 62.14% | ★★★★★☆ |

| Ubiquoss Holdings | 2.69% | 9.93% | 14.22% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Hankook (KOSE:A000240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hankook & Company Co., Ltd. is a South Korean company engaged in the manufacturing and selling of storage batteries, with a market capitalization of approximately ₩1.50 trillion.

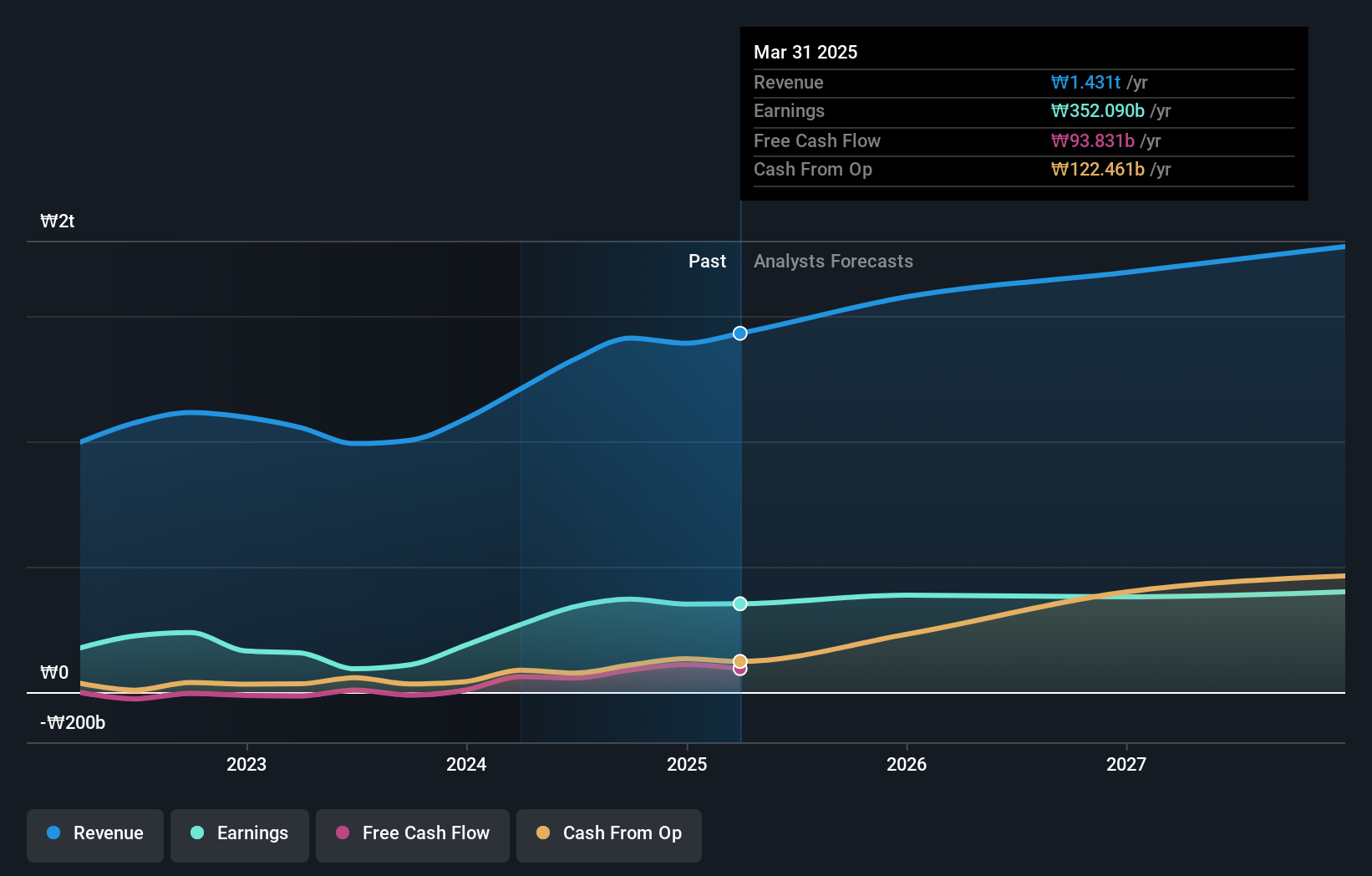

Operations: The company generates significant revenue from its Storage Battery Division, contributing ₩859.55 billion, and its Investment Business Division, which adds another ₩349.37 billion. Its business model showcases a robust gross profit margin trend, peaking at 37.59% in recent periods, indicative of efficient cost management relative to sales revenue.

Hankook & Company Co., Ltd. has demonstrated a robust financial performance with a 72% earnings growth over the past year, outpacing the Auto Components industry's 21.4%. The company's debt to equity ratio rose from 2.8% to 7.4% over five years, yet its net debt to equity ratio remains low at 0.8%, indicating sound financial health. Impressively, Hankook trades at a significant discount—76.7% below estimated fair value—highlighting its potential as an undervalued gem in South Korea's market landscape.

- Dive into the specifics of Hankook here with our thorough health report.

Explore historical data to track Hankook's performance over time in our Past section.

Daewoong (KOSE:A003090)

Simply Wall St Value Rating: ★★★★★★

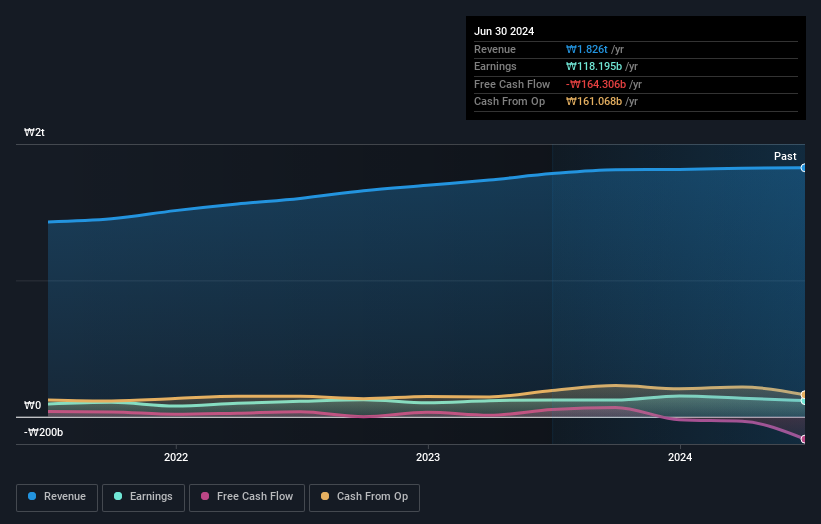

Overview: Daewoong Co., Ltd. is a South Korean pharmaceutical company involved in the manufacturing and sale of various pharmaceutical products, with a market capitalization of approximately ₩922.09 billion.

Operations: Daewoong operates primarily in pharmaceutical manufacturing and sales, generating ₩1.98 billion in revenue from this segment, which is its main business focus. The company also engages in service provision and real estate rental, contributing ₩120.70 million and ₩11.88 million respectively to its revenue streams.

Amidst South Korea's bustling market, Daewoong emerges as a compelling yet under-the-radar entity. With its earnings having surged by 23.6% annually over the past five years, the company stands out for its robust financial health. Despite a recent dip in net income to KRW 21.1 billion from last year's KRW 38.4 billion, Daewoong trades at a striking 77.8% below its estimated fair value, hinting at significant undervaluation. Additionally, the firm has successfully reduced its debt-to-equity ratio from 39.7% to 32.2%, enhancing its fiscal stability amidst fluctuating markets.

- Unlock comprehensive insights into our analysis of Daewoong stock in this health report.

Evaluate Daewoong's historical performance by accessing our past performance report.

STX Heavy Industries (KOSE:A071970)

Simply Wall St Value Rating: ★★★★★☆

Overview: STX Heavy Industries Co., Ltd. is a South Korean company engaged in the manufacturing and selling of marine engines, industrial facilities, and plants both domestically and globally, with a market capitalization of approximately ₩665.28 billion.

Operations: STX Heavy Industries specializes in manufacturing, with a significant portion of its revenue derived from the cost of goods sold (COGS), which consistently accounts for a high percentage of its total revenue. The company has experienced fluctuations in net income, reflecting varying gross profit margins over the years, notably improving to 17.45% by the end of 2024 from earlier negative values.

STX Heavy Industries, a lesser-known but robust player in the machinery sector, has demonstrated impressive financial agility. With earnings skyrocketing by 149% last year, the company outpaced its industry's average decline of 2%. This growth is supported by a solid debt reduction from 107% to 38% over five years and an EBIT coverage ratio of 6.6 times for interest payments. Trading at a striking 79% below its fair value estimate, STX offers potential as an undervalued gem with high-quality earnings and satisfactory net debt levels at just 9%.

- Click to explore a detailed breakdown of our findings in STX Heavy Industries' health report.

Assess STX Heavy Industries' past performance with our detailed historical performance reports.

Next Steps

- Delve into our full catalog of 206 KRX Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hankook might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000240

Undervalued with solid track record.