- South Korea

- /

- Biotech

- /

- KOSDAQ:A196170

KRX Growth Companies With High Insider Ownership In July 2024

Reviewed by Simply Wall St

The South Korea stock market has moved higher in back-to-back sessions, advancing more than 55 points or 2 percent in that span. The KOSPI now sits just above the 2,765-point plateau and it's likely to hold steady in that neighborhood on Tuesday. In such a dynamic environment, growth companies with high insider ownership can offer unique investment opportunities due to their potential for robust performance and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 36.4% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 29.8% | 58.7% |

| Park Systems (KOSDAQ:A140860) | 33% | 36.6% |

| Vuno (KOSDAQ:A338220) | 19.5% | 105% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 20% | 97.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's dive into some prime choices out of the screener.

ZeusLtd (KOSDAQ:A079370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zeus Co., Ltd. offers semiconductor, robot, and display total solutions both in South Korea and internationally, with a market cap of ₩432.69 billion.

Operations: The company's revenue segments are comprised of ₩22.95 billion from Valve and ₩436.69 billion from the Equipment Division.

Insider Ownership: 33.3%

Zeus Ltd. reported strong first-quarter earnings with net income rising to KRW 4.95 billion from KRW 244.14 million a year ago, despite a drop in sales to KRW 7.65 billion from KRW 10.27 billion. Earnings per share improved significantly, reaching KRW 160 from KRW 24 last year. Although profit margins decreased to 3.7%, the company's annual earnings are forecasted to grow at an impressive rate of approximately 47.73% per year, outpacing the market's growth rate of around 29%.

- Click here to discover the nuances of ZeusLtd with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, ZeusLtd's share price might be too optimistic.

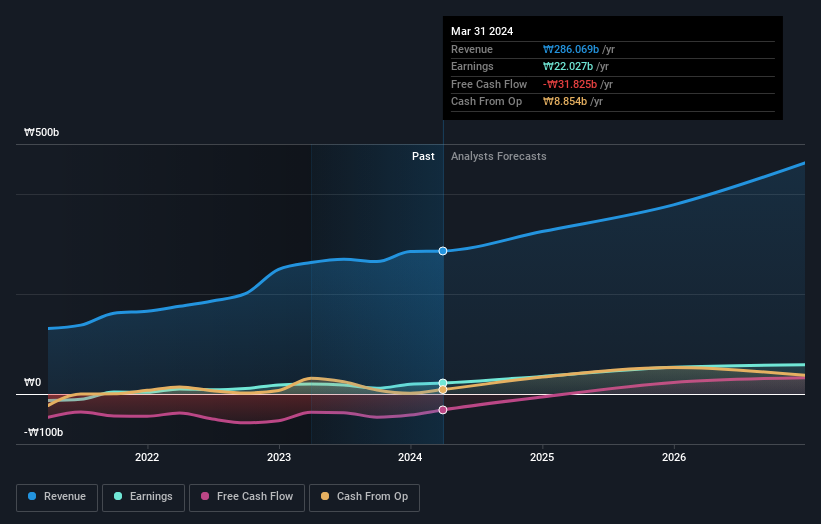

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., a bio company with a market cap of ₩15.86 trillion, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Operations: ALTEOGEN's revenue segments include long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Insider Ownership: 26.6%

ALTEOGEN Inc. has recently received MFDS approval for its new drug Tergase®, marking a significant milestone as it transitions to a commercial-stage company. The company's earnings are forecasted to grow at 73.1% annually, significantly outpacing the market's 29.4%. Despite high share price volatility, ALTEOGEN is trading at 69.9% below its estimated fair value and has substantial insider ownership, enhancing investor confidence in its growth potential and strategic direction.

- Unlock comprehensive insights into our analysis of ALTEOGEN stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of ALTEOGEN shares in the market.

ST PharmLtd (KOSDAQ:A237690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ST Pharm Co., Ltd. provides custom manufacturing services for active pharmaceutical ingredients and intermediates in South Korea and internationally, with a market cap of ₩1.84 trillion.

Operations: ST Pharm Co., Ltd. generates revenue from raw drug manufacturing (₩251.86 billion) and clinical trial site consignment research institute services (₩34.40 billion).

Insider Ownership: 12.8%

ST Pharm Ltd. is expected to see its earnings grow at 33.6% annually, outpacing the South Korean market's 29.4%. Despite a highly volatile share price and significant shareholder dilution over the past year, it trades at 60.3% below its estimated fair value. Recent events include an extraordinary shareholders meeting and upcoming Q2 earnings release on July 25, 2024, which may provide further insight into its performance trajectory and strategic initiatives.

- Take a closer look at ST PharmLtd's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that ST PharmLtd is priced lower than what may be justified by its financials.

Summing It All Up

- Discover the full array of 80 Fast Growing KRX Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A196170

ALTEOGEN

A bio company, focuses on developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars.

Exceptional growth potential with flawless balance sheet.