- South Korea

- /

- Biotech

- /

- KOSDAQ:A420570

A Piece Of The Puzzle Missing From J2KBIO Co., Ltd.'s (KOSDAQ:420570) 28% Share Price Climb

J2KBIO Co., Ltd. (KOSDAQ:420570) shareholders have had their patience rewarded with a 28% share price jump in the last month. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

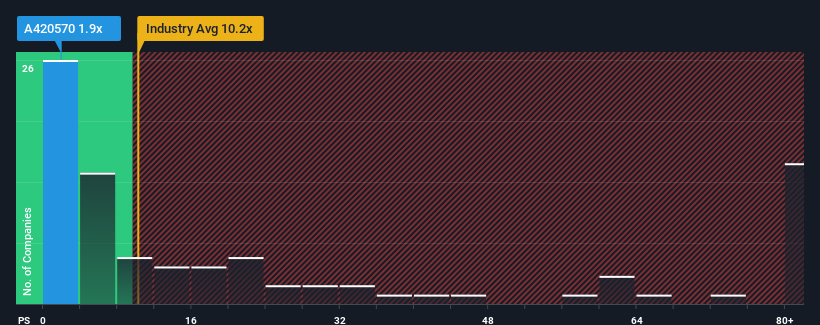

Even after such a large jump in price, J2KBIO's price-to-sales (or "P/S") ratio of 1.9x might still make it look like a strong buy right now compared to the wider Biotechs industry in Korea, where around half of the companies have P/S ratios above 10.2x and even P/S above 43x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for J2KBIO

What Does J2KBIO's Recent Performance Look Like?

Recent times have been advantageous for J2KBIO as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think J2KBIO's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, J2KBIO would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 42% gain to the company's top line. Pleasingly, revenue has also lifted 144% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 65% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 51%, which is noticeably less attractive.

With this information, we find it odd that J2KBIO is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From J2KBIO's P/S?

Shares in J2KBIO have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at J2KBIO's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 3 warning signs for J2KBIO (1 is a bit unpleasant!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A420570

J2KBIO

A bio venture company, provides active ingredients for cosmetics, functional food, and household products from natural materials and microbial fermentation.

Excellent balance sheet moderate.

Market Insights

Community Narratives