- South Korea

- /

- Biotech

- /

- KOSE:A068270

High Growth Tech Stocks in South Korea for October 2024

Reviewed by Simply Wall St

The South Korean market has remained flat over the last week but has seen a 3.8% rise over the past 12 months, with earnings forecasted to grow by 30% annually. In this environment, identifying high growth tech stocks involves focusing on companies that are well-positioned to capitalize on technological advancements and robust earnings potential.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.51 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 billion. It focuses on developing innovative biopharmaceutical products, including long-acting biobetters and antibody-drug conjugates.

ALTEOGEN is navigating the competitive landscape of South Korea's high-tech sector with a strategic focus on R&D, investing significantly to fuel its growth trajectory. With an impressive forecasted revenue growth rate of 64.2% annually, the company outpaces the broader KR market's 10.4% expansion rate, positioning itself as a formidable player in biotech innovation. Despite current unprofitability and market volatility, ALTEOGEN's aggressive investment in research (99.5% increase in R&D expenses) underscores its commitment to pioneering advancements in biotechnology. The firm’s projected shift to profitability within three years and a stellar anticipated return on equity of 66.3% reflect potential for substantial economic contributions and industry leadership, promising an exciting horizon for both the company and its stakeholders.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ABL Bio Inc. is a biotech research company specializing in the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩1.95 trillion.

Operations: ABL Bio Inc. generates revenue primarily from its biotechnology segment, with a focus on startups, amounting to ₩32.95 billion. The company is engaged in developing therapeutic drugs targeting immuno-oncology and neurodegenerative diseases.

ABL Bio, a contender in South Korea's high-tech sector, is making notable strides with a projected revenue growth of 24.7% annually, significantly outpacing the broader market's 10.4%. This growth is underpinned by substantial investments in R&D, which have surged by 48.2%, reflecting the company's commitment to innovation and development within biotechnology fields. Despite its current lack of profitability, ABL Bio’s aggressive financial strategy towards research expenditure—highlighting an increase to billions in R&D costs—positions it for potential leadership in emerging biotech markets. The firm’s strategic client relationships and anticipated shift towards profitability suggest promising prospects for future performance and industry impact.

- Navigate through the intricacies of ABL Bio with our comprehensive health report here.

Evaluate ABL Bio's historical performance by accessing our past performance report.

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

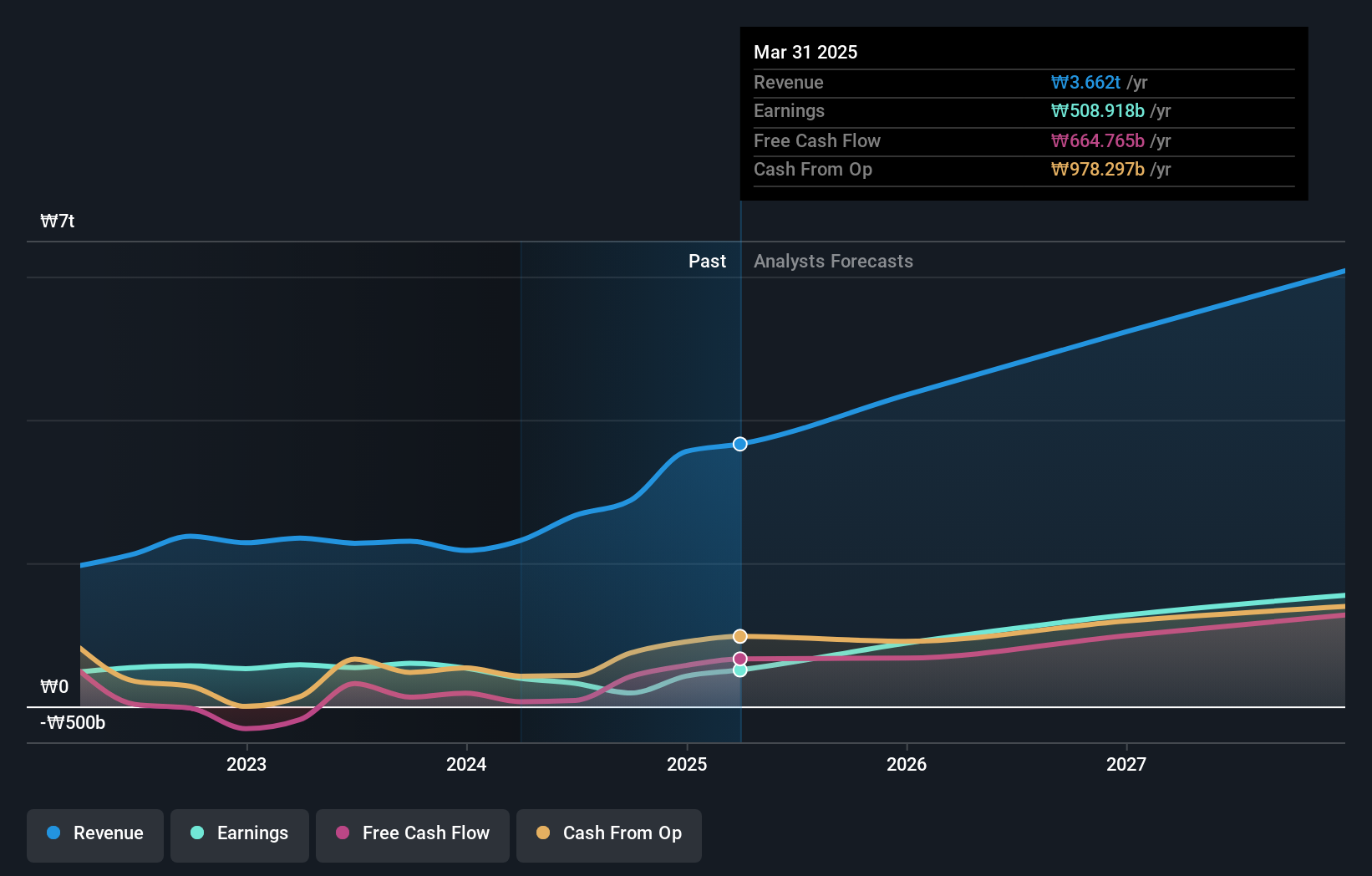

Overview: Celltrion, Inc., along with its subsidiaries, focuses on developing and producing protein-based drugs for oncology treatment in South Korea, with a market capitalization of ₩40.71 trillion.

Operations: Celltrion, Inc. generates revenue primarily from its Bio Medical Supply segment, which accounts for ₩3.54 trillion, and Chemical Drugs segment contributing ₩507 billion. The company's focus on protein-based oncology drugs positions it prominently in the South Korean pharmaceutical market.

Celltrion is carving a niche in South Korea's tech landscape, notably with its recent FDA approval of ZYMFENTRA for ulcerative colitis and Crohn's disease, enhancing its competitive edge in biologics. The company's R&D dedication is evident with a significant 25.6% forecasted annual revenue growth, outpacing the broader market's 10.4%. Moreover, Celltrion has strategically repurchased shares worth KRW 75.89 billion this year, underscoring confidence in its future trajectory amidst a challenging fiscal period marked by a net income drop to KRW 78 billion from KRW 147.5 billion last year. This blend of innovative healthcare solutions and robust financial maneuvers positions Celltrion distinctively within the high-tech domain.

- Take a closer look at Celltrion's potential here in our health report.

Gain insights into Celltrion's past trends and performance with our Past report.

Turning Ideas Into Actions

- Delve into our full catalog of 48 KRX High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A068270

Celltrion

Develops and produces drugs based on proteins for the treatment of oncology in South Korea.

Flawless balance sheet with high growth potential.