- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A245620

If You Had Bought Eone Diagnomics Genome Center (KOSDAQ:245620) Shares A Year Ago You'd Have Earned 54% Returns

Eone Diagnomics Genome Center Co., Ltd. (KOSDAQ:245620) shareholders might be concerned after seeing the share price drop 27% in the last quarter. But that fact in itself shouldn't obscure what are quite decent returns over the last year. Indeed the stock is up 54% over twelve months, compared to a market return of about 51%.

View our latest analysis for Eone Diagnomics Genome Center

Eone Diagnomics Genome Center wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Eone Diagnomics Genome Center saw its revenue grow by 46%. That's well above most other pre-profit companies. While the share price gain of 54% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at Eone Diagnomics Genome Center. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

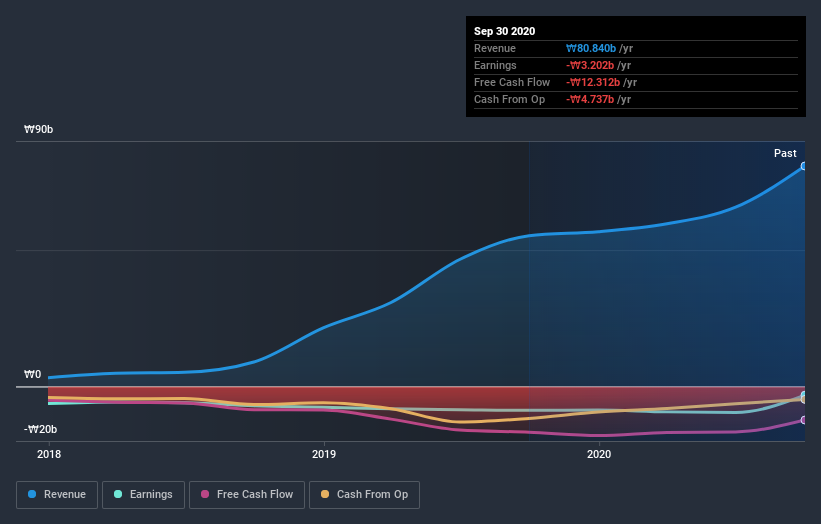

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Eone Diagnomics Genome Center's financial health with this free report on its balance sheet.

A Different Perspective

With a TSR of 54% over the last year, Eone Diagnomics Genome Center shareholders would be reasonably content, given that's not far from the broader market return of 51%. However, the share price has actually dropped 27% over the last three months. It may simply be that the share price got ahead of itself, although you might want to check for any weak results. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Eone Diagnomics Genome Center (including 2 which are significant) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Eone Diagnomics Genome Center, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eone Diagnomics Genome Center might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A245620

Eone Diagnomics Genome Center

Provides genetic information analysis services in South Korea.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives