Stock Analysis

- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A192650

KRX Growth Leaders With High Insider Stakes And Up To 48% Revenue Increase

Reviewed by Simply Wall St

The South Korean market has experienced a modest climb of 3.3% in the past week, maintaining stability over the last year with earnings projected to grow by 29% annually. In this context, stocks like those of growth companies with high insider ownership can be particularly noteworthy, as they often signal strong confidence from those most familiar with the company's potential and operations.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| SamyoungLtd (KOSE:A003720) | 25% | 30.4% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

We're going to check out a few of the best picks from our screener tool.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biopharmaceutical company engaged in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of approximately ₩14.29 billion.

Operations: The company generates revenue primarily from the development of enhanced biologics, targeted cancer therapies, and similar versions of existing antibodies.

Insider Ownership: 26.6%

Revenue Growth Forecast: 48.3% p.a.

ALTEOGEN, a South Korean biotech firm, showcases strong growth potential with its earnings and revenue forecasted to outpace the market significantly. Earnings are expected to surge by 73.06% annually, while revenue could increase by 48.3% per year. Despite high volatility in its share price recently and some shareholder dilution over the past year, the company's return on equity is predicted to be very high at 45.2%. Additionally, ALTEOGEN became profitable this year and trades at a substantial discount to estimated fair value, enhancing its appeal as a growth-oriented investment with substantial insider ownership.

- Navigate through the intricacies of ALTEOGEN with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of ALTEOGEN shares in the market.

ST PharmLtd (KOSDAQ:A237690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ST Pharm Co., Ltd. specializes in custom manufacturing services for active pharmaceutical ingredients and intermediates, operating both in South Korea and internationally, with a market capitalization of approximately ₩2.12 billion.

Operations: The company generates revenue through custom manufacturing services for active pharmaceutical ingredients and intermediates.

Insider Ownership: 13.2%

Revenue Growth Forecast: 16.3% p.a.

ST Pharm Co., Ltd. is positioned for notable growth, with earnings expected to grow by 35.18% annually and revenue projected to increase by 16.3% per year, outpacing the South Korean market's average. Despite a highly volatile share price recently and shareholder dilution over the past year, the company trades at 33.3% below its estimated fair value, presenting a potential opportunity for investors focused on growth companies with high insider ownership in South Korea. Recent activities include presentations at the Macquarie Asia Conference and an earnings call in May 2024.

- Delve into the full analysis future growth report here for a deeper understanding of ST PharmLtd.

- In light of our recent valuation report, it seems possible that ST PharmLtd is trading beyond its estimated value.

DREAMTECH (KOSE:A192650)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DREAMTECH Co., Ltd. specializes in designing, developing, and manufacturing modules, operating both in South Korea and internationally, with a market capitalization of approximately ₩632.82 billion.

Operations: The firm operates primarily in the module design, development, and manufacturing sector across domestic and international markets.

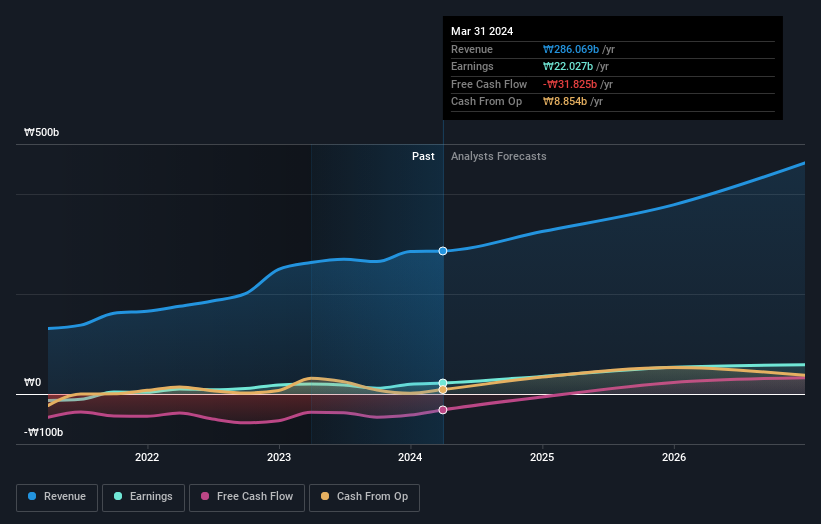

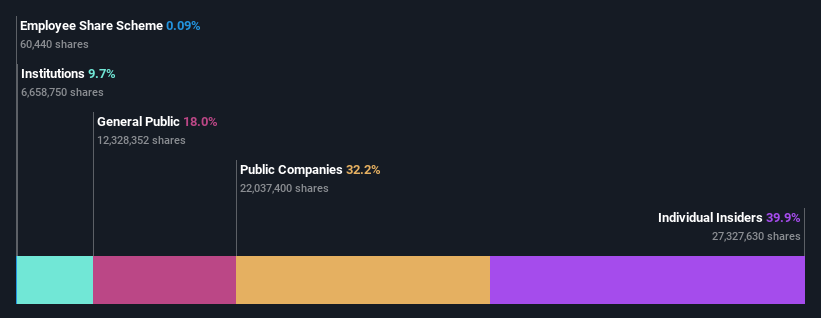

Insider Ownership: 39.9%

Revenue Growth Forecast: 19.3% p.a.

DREAMTECH is forecasted to experience substantial earnings growth at 74.1% annually, significantly outpacing the South Korean market's average of 29%. While its revenue growth is expected at 19.3% per year, slightly below the 20% high-growth benchmark, it remains well above the national market rate of 10.4%. However, profit margins have declined from last year and shareholder dilution has occurred. Recently, DREAMTECH has actively engaged in share buybacks spending KRW 5 billion to enhance shareholder value and stabilize its stock price.

- Click here and access our complete growth analysis report to understand the dynamics of DREAMTECH.

- In light of our recent valuation report, it seems possible that DREAMTECH is trading behind its estimated value.

Summing It All Up

- Delve into our full catalog of 81 Fast Growing KRX Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether DREAMTECH is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A192650

DREAMTECH

Engages in the design, development, and manufacture of modules in South Korea and internationally.

Flawless balance sheet and good value.