- South Korea

- /

- Biotech

- /

- KOSDAQ:A226950

Shareholders in OliX Pharmaceuticals (KOSDAQ:226950) have lost 56%, as stock drops 16% this past week

It is doubtless a positive to see that the OliX Pharmaceuticals, Inc (KOSDAQ:226950) share price has gained some 82% in the last three months. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 56% in the last three years. So the improvement may be a real relief to some. After all, could be that the fall was overdone.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for OliX Pharmaceuticals

Because OliX Pharmaceuticals made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, OliX Pharmaceuticals saw its revenue grow by 50% per year, compound. That's well above most other pre-profit companies. In contrast, the share price is down 16% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

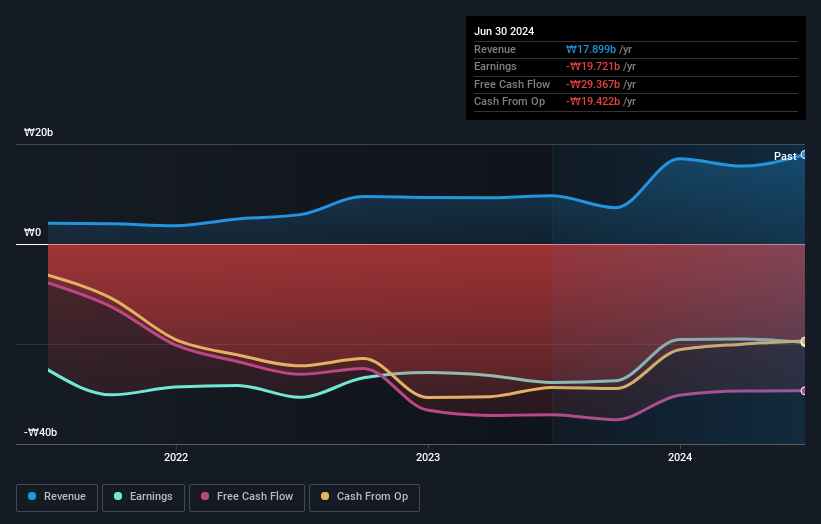

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at OliX Pharmaceuticals' financial health with this free report on its balance sheet.

A Different Perspective

OliX Pharmaceuticals shareholders gained a total return of 4.2% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 2% per year, over five years. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with OliX Pharmaceuticals (including 3 which are significant) .

Of course OliX Pharmaceuticals may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A226950

OliX Pharmaceuticals

Focuses on developing RNA interference (RNAi) therapeutics for dermal, ophthalmic, and pulmonary diseases.

Slight and overvalued.