David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies WOOJUNG BIO, Inc. (KOSDAQ:215380) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for WOOJUNG BIO

What Is WOOJUNG BIO's Net Debt?

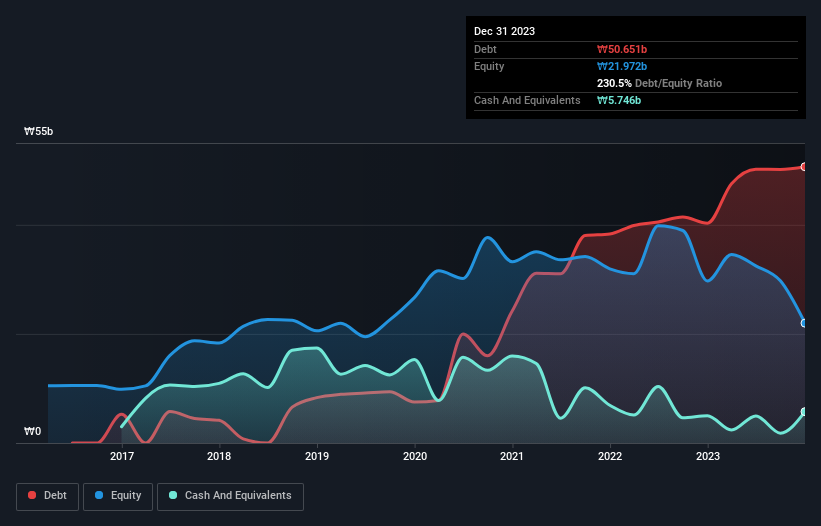

The image below, which you can click on for greater detail, shows that at December 2023 WOOJUNG BIO had debt of ₩50.7b, up from ₩40.3b in one year. However, because it has a cash reserve of ₩5.75b, its net debt is less, at about ₩44.9b.

How Strong Is WOOJUNG BIO's Balance Sheet?

We can see from the most recent balance sheet that WOOJUNG BIO had liabilities of ₩45.7b falling due within a year, and liabilities of ₩30.7b due beyond that. On the other hand, it had cash of ₩5.75b and ₩6.97b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩63.6b.

The deficiency here weighs heavily on the ₩19.9b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, WOOJUNG BIO would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since WOOJUNG BIO will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year WOOJUNG BIO had a loss before interest and tax, and actually shrunk its revenue by 18%, to ₩39b. That's not what we would hope to see.

Caveat Emptor

Not only did WOOJUNG BIO's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable ₩4.0b at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. Of course, it may be able to improve its situation with a bit of luck and good execution. But we think that is unlikely, given it is low on liquid assets, and burned through ₩4.1b in the last year. So we consider this a high risk stock and we wouldn't be at all surprised if the company asks shareholders for money before long. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for WOOJUNG BIO (2 make us uncomfortable) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if WOOJUNG BIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A215380

Slightly overvalued with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.